Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the treasurer of an investment company. Recently, you are asked to manage a $10 million fund for securities investment in Hong Kong.

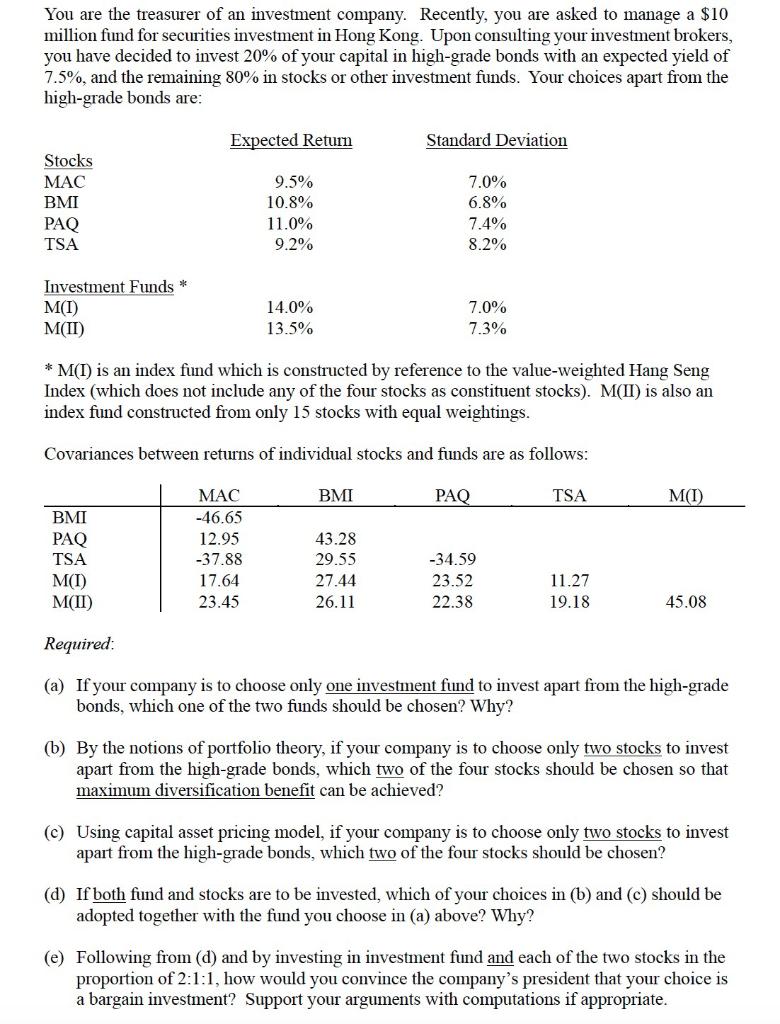

You are the treasurer of an investment company. Recently, you are asked to manage a $10 million fund for securities investment in Hong Kong. Upon consulting your investment brokers, you have decided to invest 20% of your capital in high-grade bonds with an expected yield of 7.5%, and the remaining 80% in stocks or other investment funds. Your choices apart from the high-grade bonds are: Stocks MAC BMI PAQ TSA Investment Funds * M(I) M(II) Expected Return BMI PAQ TSA 9.5% 10.8% 11.0% 9.2% MAC -46.65 12.95 -37.88 17.64 23.45 14.0% 13.5% * M(I) is an index fund which is constructed by reference to the value-weighted Hang Seng Index (which does not include any of the four stocks as constituent stocks). M(II) is also an index fund constructed from only 15 stocks with equal weightings. Covariances between returns of individual stocks and funds are as follows: BMI Standard Deviation 43.28 29.55 27.44 26.11 7.0% 6.8% 7.4% 8.2% 7.0% 7.3% PAQ -34.59 23.52 22.38 TSA 11.27 19.18 M(I) M(I) M(II) Required: (a) If your company is to choose only one investment fund to invest apart from the high-grade bonds, which one of the two funds should be chosen? Why? 45.08 (b) By the notions of portfolio theory, if your company is to choose only two stocks to invest apart from the high-grade bonds, which two of the four stocks should be chosen so that maximum diversification benefit can be achieved? (c) Using capital asset pricing model, if your company is to choose only two stocks to invest apart from the high-grade bonds, which two of the four stocks should be chosen? (d) If both fund and stocks are to be invested, which of your choices in (b) and (c) should be adopted together with the fund you choose in (a) above? Why? (e) Following from (d) and by investing in investment fund and each of the two stocks in the proportion of 2:1:1, how would you convince the company's president that your choice is a bargain investment? Support your arguments with computations if appropriate.

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a If your company is to choose only one investment fund to invest apart from the highgrade bonds which one of the two funds should be chosen Why To determine which investment fund to choose we can con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started