Question

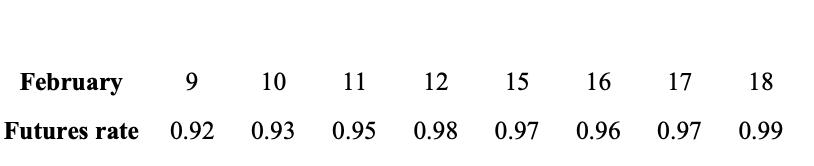

3. (a) On February 8, you sold five futures contracts for 5,000 EUR each at a futures rate of GBP/EUR 0.91. The subsequent settlemet prices

3. (a) On February 8, you sold five futures contracts for 5,000 EUR each at a futures rate of GBP/EUR 0.91. The subsequent settlemet prices are shown in the table below:

i. What are the daily cash flows from marking to market? 5 marks ii. What is the total cash flow from marking to market (ignoring discounting)? 5 marks (b) A German exporter is expected to pay GBP 1,500,000 on April 15th, three months from now. In order to hedge this transaction, she wishes to purchase an option conract. i. What would be the cost for an April maturity contract for hedging this transaction? Assume that the strike price is EUR/GBP 0.72, and the option premia (per 100 GBP) are EUR 1.7 for calls and EUR 2.4 for puts. 5 marks ii. What would be the maximum cost (in euros) for this exporter in April? Assume the EUR effective rate of return is 5%. 5 marks (c) A forex trader observes that the JPY/EUR synthetic forward rate is above the current JPY/EUR market forward rate. Explain how this constitutes a violation of the put-call parity and how this information is useful for profit making.

February 9 10 11 12 15 16 17 18 Futures rate 0.92 0.93 0.95 0.98 0.97 0.96 0.97 0.99

Step by Step Solution

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

3 a Marking to Market Cash Flows i Daily Cash Flows To calculate the daily cash flows from marking to market you need to compare the settlement price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started