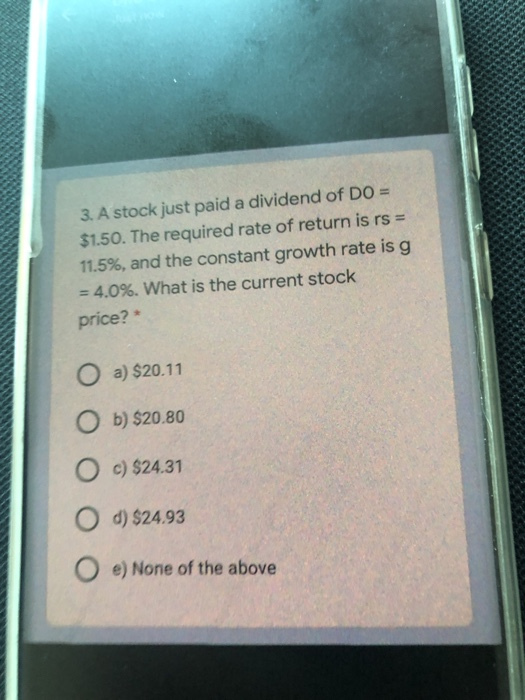

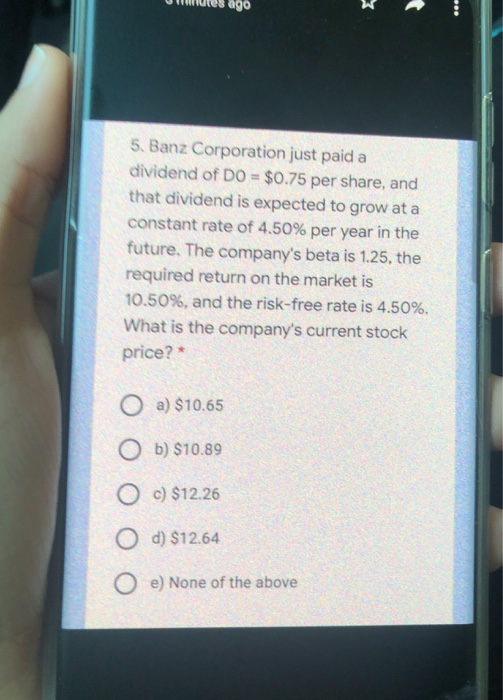

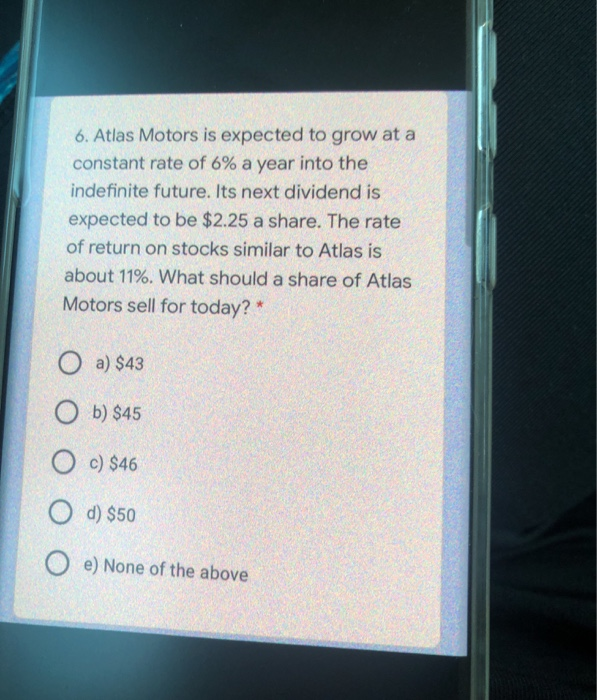

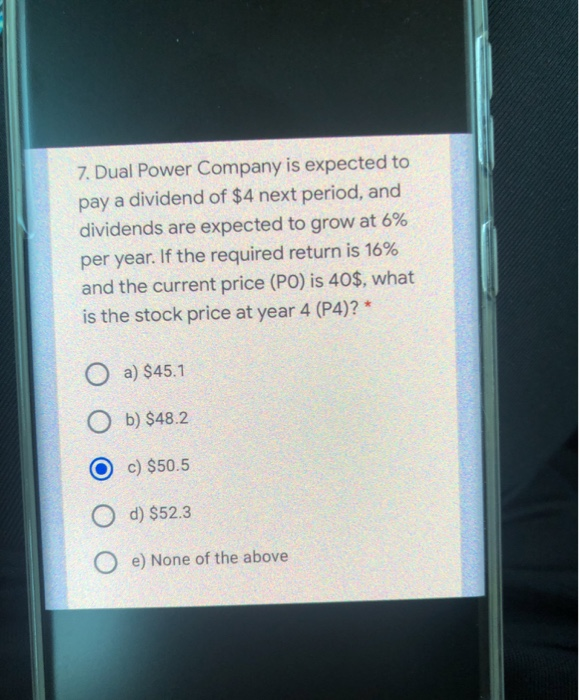

3. A stock just paid a dividend of DO = $1.50. The required rate of return is rs = 11.5%, and the constant growth rate is g = 4.0%. What is the current stock price? O a) $20.11 b) $20.80 O c) $24.31 O d) $24.93 e) None of the above ago 5. Banz Corporation just paid a dividend of DO = $0.75 per share, and that dividend is expected to grow at a constant rate of 4.50% per year in the future. The company's beta is 1.25, the required return on the market is 10.50%, and the risk-free rate is 4.50%. What is the company's current stock price? O a) $10.65 O b) $10.89 O c) $12.26 Od) $12.64 O e) None of the above 6. Atlas Motors is expected to grow at a constant rate of 6% a year into the indefinite future. Its next dividend is expected to be $2.25 a share. The rate of return on stocks similar to Atlas is about 11%. What should a share of Atlas Motors sell for today? * O a) $43 O b) $45 c) $46 d) $50 O e) None of the above 7. Dual Power Company is expected to pay a dividend of $4 next period, and dividends are expected to grow at 6% per year. If the required return is 16% and the current price (PO) is 40$, what is the stock price at year 4 (P4)? * a) $45.1 O b) $48.2 c) $50.5 O d) $52.3 O e) None of the above 8. Adams Co. has an issue of preferred stock outstanding that pays a $5.50 dividend every year in perpetuity. If the required return of this stock is 5%, what is the selling price per share?* O a) $110 O b) $112 Oc) $113 O d) $114 O e) None of the above 12. You have just invested in a bond that offers an annual coupon rate of 6%, with interest paid annually. The face value of the bond is $1,000 and the interest rate in the market is 5%. The bond matures in 10 years. What is the bond's price? * O a. $1,000 O b. $1,077.21 O c. $957 O d. $1,050.28 O e. None of the above 16. Suppose you held a diversified portfolio consisting of 10 different common stocks, investing $500 in each stock. The portfolio's beta is 1.9. Now suppose you decided to sell one of the stocks in your portfolio with a beta of 0.8 for $500 and use the proceeds to buy another stock with a beta of 1.25. What would your portfolio's new beta be? * O a) 1.074 O b) 2.025 O c) 3.865 O d) 4.2 O e) None of the above 20. Antiques R Us is a mature manufacturing firm. The company just paid a $10.46 dividend, but management expects to reduce the payout by 4 percent per year indefinitely. If you require an 11.5 percent return on this stock, what will you pay for a share today?* O a. $61.56 O b. $74.71 O c. $94.05 O d. $64.78 O e. None of the above