Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. a. The current stock price $100. The yield curve is flat, and the interest rate is 5% per year, compounded annually. Consider options with

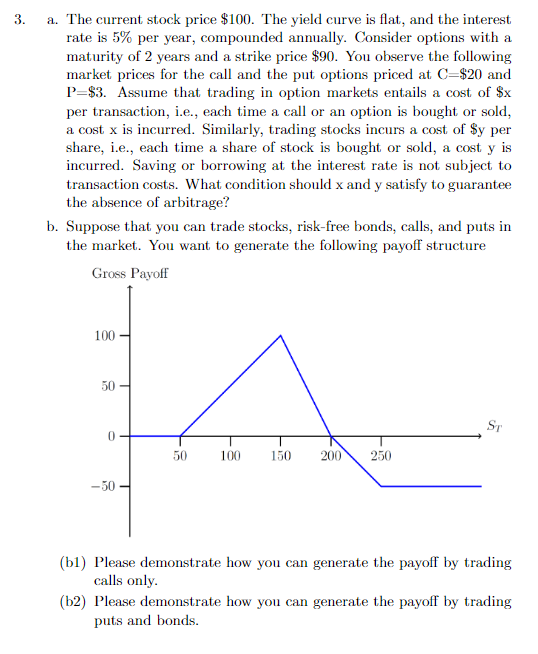

3. a. The current stock price $100. The yield curve is flat, and the interest rate is 5% per year, compounded annually. Consider options with a maturity of 2 years and a strike price $90. You observe the following market prices for the call and the put options priced at C=$20 and P=$3. Assume that trading in option markets entails a cost of $x per transaction, i.e., each time a call or an option is bought or sold, a cost x is incurred. Similarly, trading stocks incurs a cost of $y per share, i.e., each time a share of stock is bought or sold, a cost y is incurred. Saving or borrowing at the interest rate is not subject to transaction costs. What condition should x and y satisfy to guarantee the absence of arbitrage? b. Suppose that you can trade stocks, risk-free bonds, calls, and puts in the market. You want to generate the following payoff structure (b1) Please demonstrate how you can generate the payoff by trading calls only. (b2) Please demonstrate how you can generate the payoff by trading puts and bonds

3. a. The current stock price $100. The yield curve is flat, and the interest rate is 5% per year, compounded annually. Consider options with a maturity of 2 years and a strike price $90. You observe the following market prices for the call and the put options priced at C=$20 and P=$3. Assume that trading in option markets entails a cost of $x per transaction, i.e., each time a call or an option is bought or sold, a cost x is incurred. Similarly, trading stocks incurs a cost of $y per share, i.e., each time a share of stock is bought or sold, a cost y is incurred. Saving or borrowing at the interest rate is not subject to transaction costs. What condition should x and y satisfy to guarantee the absence of arbitrage? b. Suppose that you can trade stocks, risk-free bonds, calls, and puts in the market. You want to generate the following payoff structure (b1) Please demonstrate how you can generate the payoff by trading calls only. (b2) Please demonstrate how you can generate the payoff by trading puts and bonds Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started