Answered step by step

Verified Expert Solution

Question

1 Approved Answer

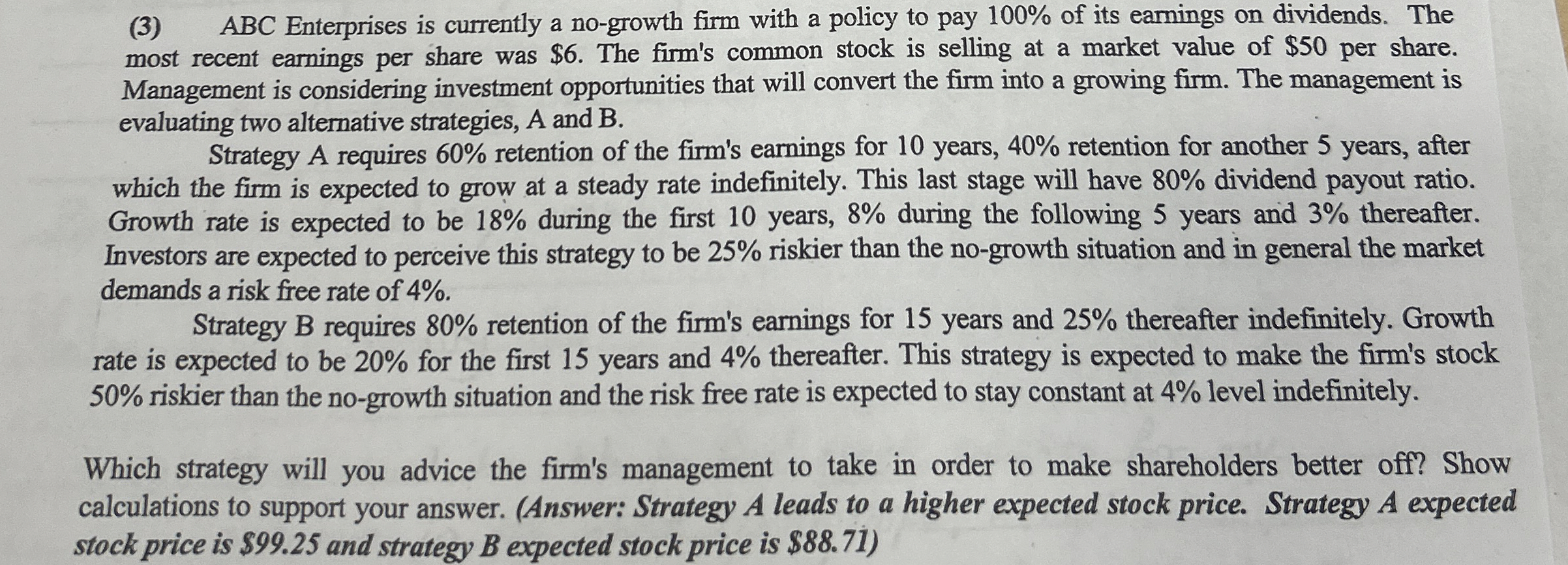

( 3 ) ABC Enterprises is currently a no - growth firm with a policy to pay 1 0 0 % of its earnings on

ABC Enterprises is currently a nogrowth firm with a policy to pay of its earnings on dividends. The

most recent earnings per share was $ The firm's common stock is selling at a market value of $ per share.

Management is considering investment opportunities that will convert the firm into a growing firm. The management is

evaluating two alternative strategies, A and

Strategy A requires retention of the firm's earnings for years, retention for another years, after

which the firm is expected to grow at a steady rate indefinitely. This last stage will have dividend payout ratio.

Growth rate is expected to be during the first years, during the following years and thereafter.

Investors are expected to perceive this strategy to be riskier than the nogrowth situation and in general the market

demands a risk free rate of

Strategy B requires retention of the firm's earnings for years and thereafter indefinitely. Growth

rate is expected to be for the first years and thereafter. This strategy is expected to make the firm's stock

riskier than the nogrowth situation and the risk free rate is expected to stay constant at level indefinitely.

Which strategy will you advice the firm's management to take in order to make shareholders better off? Show

calculations to support your answer. Answer: Strategy A leads to a higher expected stock price. Strategy A expected

stock price is $ and strategy expected stock price is $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started