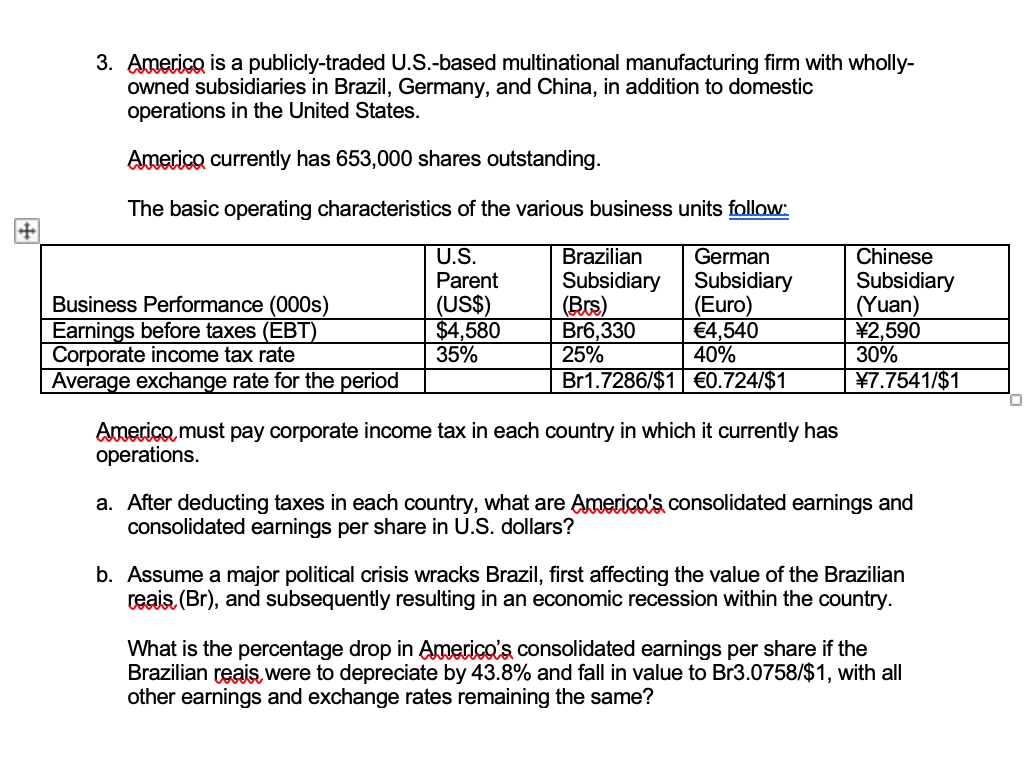

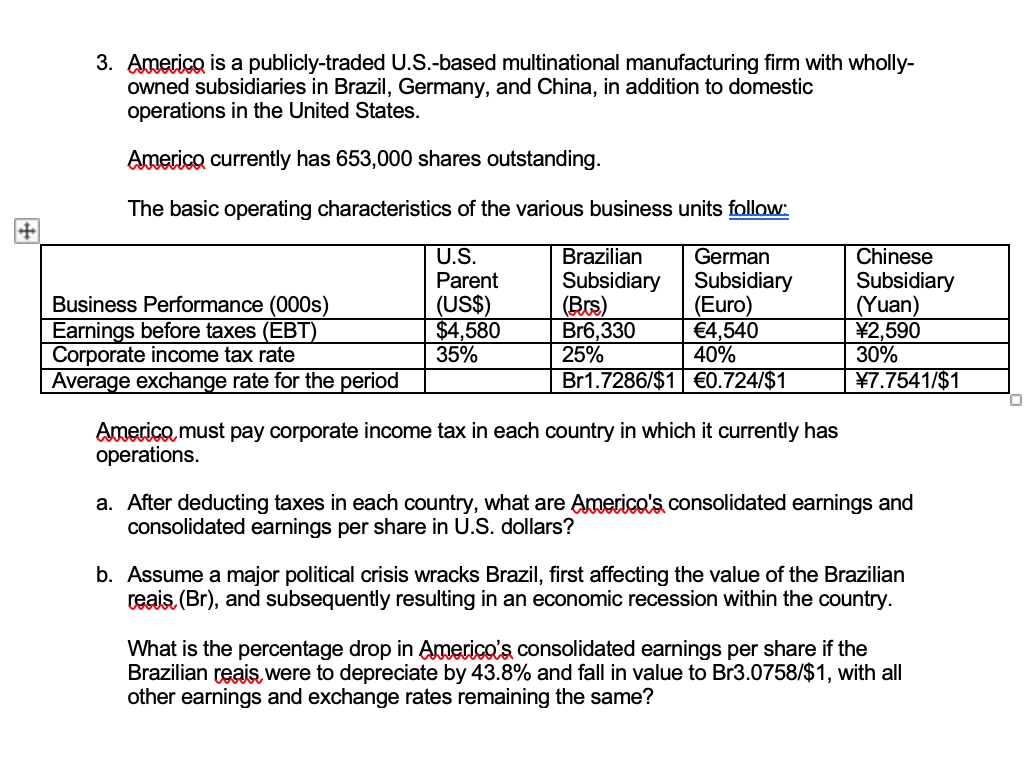

3. Americo is a publicly-traded U.S.-based multinational manufacturing firm with wholly- owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. Americo currently has 653,000 shares outstanding. The basic operating characteristics of the various business units follow U.S. Parent (US$) $4,580 Business Performance (000s) Earnings before taxes (EBT). Corporate income tax rate Average exchange rate for the period Brazilian German Subsidiary Subsidiary (Brs) (Euro) Br6,330 4,540 25% 40% Br1.7286/$10.724/$1 Chinese Subsidiary (Yuan) 2,590 30% \7.7541/$1 35% America must pay corporate income tax in each country in which it currently has operations. a. After deducting taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? b. Assume a major political crisis wracks Brazil, first affecting the value of the Brazilian reais (Br), and subsequently resulting in an economic recession within the country. What is the percentage drop in Americo's consolidated earnings per share if the Brazilian reais, were to depreciate by 43.8% and fall in value to Br3.0758/$1, with all other earnings and exchange rates remaining the same? 3. Americo is a publicly-traded U.S.-based multinational manufacturing firm with wholly- owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. Americo currently has 653,000 shares outstanding. The basic operating characteristics of the various business units follow U.S. Parent (US$) $4,580 Business Performance (000s) Earnings before taxes (EBT). Corporate income tax rate Average exchange rate for the period Brazilian German Subsidiary Subsidiary (Brs) (Euro) Br6,330 4,540 25% 40% Br1.7286/$10.724/$1 Chinese Subsidiary (Yuan) 2,590 30% \7.7541/$1 35% America must pay corporate income tax in each country in which it currently has operations. a. After deducting taxes in each country, what are Americo's consolidated earnings and consolidated earnings per share in U.S. dollars? b. Assume a major political crisis wracks Brazil, first affecting the value of the Brazilian reais (Br), and subsequently resulting in an economic recession within the country. What is the percentage drop in Americo's consolidated earnings per share if the Brazilian reais, were to depreciate by 43.8% and fall in value to Br3.0758/$1, with all other earnings and exchange rates remaining the same