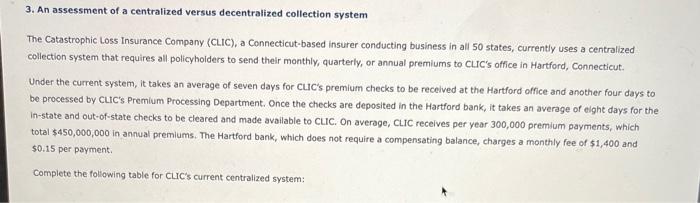

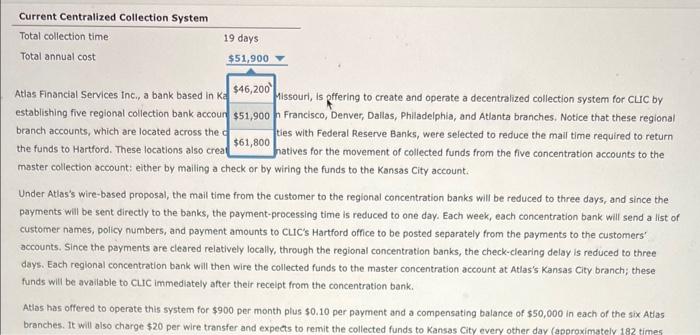

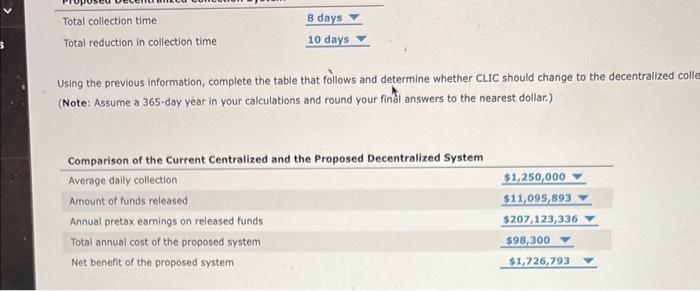

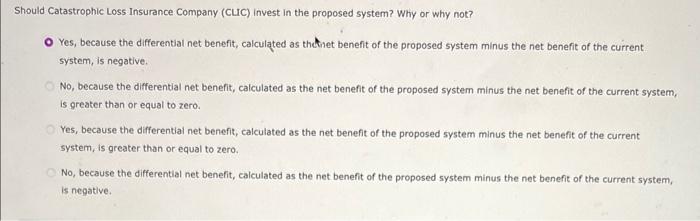

3. An assessment of a centralized versus decentralized collection system The Catastrophic Loss Insurance Company (CLIC), a Connecticut-based insurer conducting business in all 50 states, currently uses a centralized collection system that requires all policyhoiders to send their monthly, quarterly, or annual premiums to CuC's affice in Hartford, Connecticut. Under the current system, it takes an average of seven days for culc's premlum checks to be received at the Hartford office and another four days to be processed by CLiC's Premium Processing Department. Once the checks are deposited in the Hartford bank, it takes an average of elght days for the in-state and out-of-state checks to be cleared and made available to CLiC. On average, CLiC receives per year 300,000 premium payments, which totai \$450,000,000 in annual premlums. The Hartford bank, which does not require a compensating balance, charges a monthly fee of $1,400 and 50.15 per payment. Complete the following table for cur's current centralized system: Current Centralized Collection System master collection account: either by mailing a check or by wiring the funds to the Kansas City account. Under Atlas's wire-based proposal, the mail time from the customer to the regional concentration banks will be reduced to three days, and since the payments will be sent directly to the banks, the payment-processing time is reduced to one day. Each week, each concentration bank will send a list of customer names, policy numbers, and payment amounts to CLiC's Hartford office to be posted separately from the payments to the customers' accounts. Since the payments are cleared relatively locally, through the regional concentration banks, the check-clearing delay is reduced to three days. Each reglonal concentration bank will then wire the collected funds to the master concentration account at Atlas's Kansas City branch; these funds will be available to cilc immediately after their receipt from the concentration bank. Atios has offered to operate this system for $900 per month plus $0.10 per payment and a compensating balance of $50,000 in each of the six Atlas branches. It will also charge $20 per wire transfer and expects to remit the collected funds to Kansas City every other day (approximately 182 times. Using the previous information, complete the table that follows and determine whether CLIC should change to the decentralized coll (Note: Assume a 365-day year in your calculations and round your finl answers to the nearest dollar.) Should Catastrophic Loss Insurance Company (CLIC) invest in the proposed system? Why or why not? Yes, because the differential net benefit, calculated as thetnet benefit of the proposed system minus the net benefit of the current. system, is negative. No, because the differential net benefit, calculated as the net benefit of the proposed system minus the net benefit of the current system, is greater than or equal to zero. Yes, because the differential net benefit, calculated as the net benefit of the proposed system minus the net benefit of the current system, is greater than or equal to zero. No, because the differential net benefit, calculated as the net benefit of the proposed system minus the net benefit of the current system, is negative