Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. An assistant treasurer is currently reevaluating their firm's banking relationship. The firm's current lender charges an effective borrowing cost of 4.25 percent. A competing

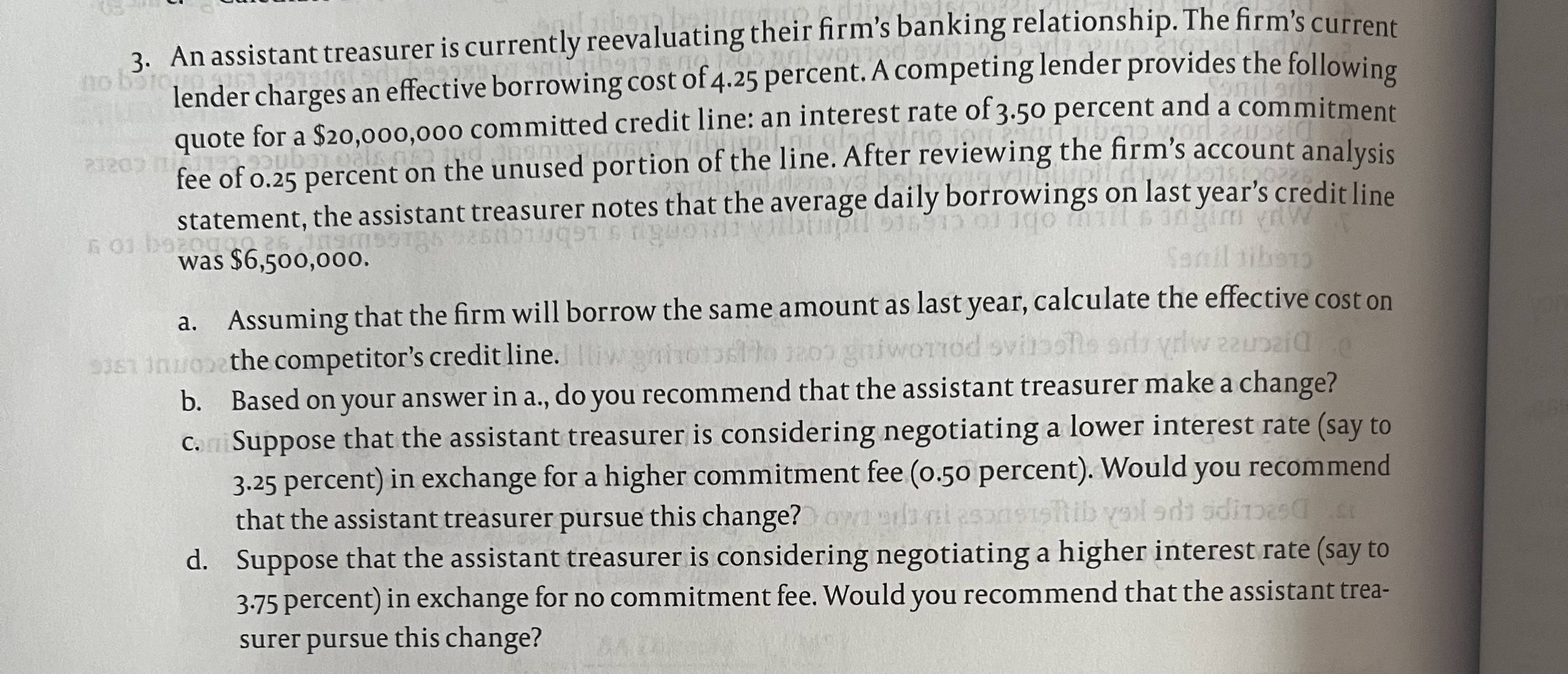

3. An assistant treasurer is currently reevaluating their firm's banking relationship. The firm's current lender charges an effective borrowing cost of 4.25 percent. A competing lender provides the following quote for a $20,000,000 committed credit line: an interest rate of 3.50 percent and a commitment fee of 0.25 percent on the unused portion of the line. After reviewing the firm's account analysis statement, the assistant treasurer notes that the average daily borrowings on last year's credit line was $6,500,000. a. Assuming that the firm will borrow the same amount as last year, calculate the effective cost on the competitor's credit line. b. Based on your answer in a., do you recommend that the assistant treasurer make a change? c. Suppose that the assistant treasurer is considering negotiating a lower interest rate (say to 3.25 percent) in exchange for a higher commitment fee ( 0.50 percent). Would you recommend that the assistant treasurer pursue this change? d. Suppose that the assistant treasurer is considering negotiating a higher interest rate (say to 3.75 percent) in exchange for no commitment fee. Would you recommend that the assistant treasurer pursue this change

3. An assistant treasurer is currently reevaluating their firm's banking relationship. The firm's current lender charges an effective borrowing cost of 4.25 percent. A competing lender provides the following quote for a $20,000,000 committed credit line: an interest rate of 3.50 percent and a commitment fee of 0.25 percent on the unused portion of the line. After reviewing the firm's account analysis statement, the assistant treasurer notes that the average daily borrowings on last year's credit line was $6,500,000. a. Assuming that the firm will borrow the same amount as last year, calculate the effective cost on the competitor's credit line. b. Based on your answer in a., do you recommend that the assistant treasurer make a change? c. Suppose that the assistant treasurer is considering negotiating a lower interest rate (say to 3.25 percent) in exchange for a higher commitment fee ( 0.50 percent). Would you recommend that the assistant treasurer pursue this change? d. Suppose that the assistant treasurer is considering negotiating a higher interest rate (say to 3.75 percent) in exchange for no commitment fee. Would you recommend that the assistant treasurer pursue this change Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started