Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 An investor takes a short position in a one year forward contract on a 30-year Treasury Bond. The Treasury Bond to be delivered in

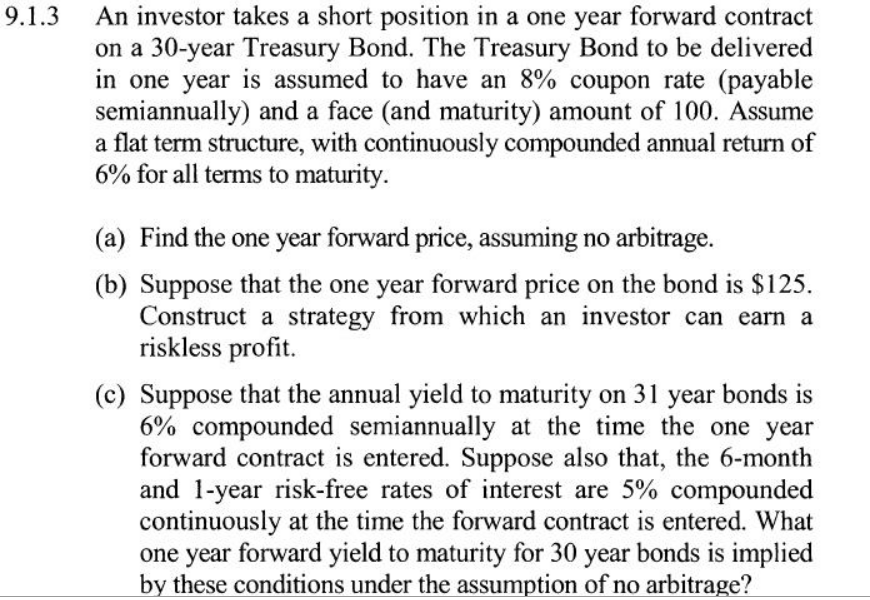

3 An investor takes a short position in a one year forward contract on a 30-year Treasury Bond. The Treasury Bond to be delivered in one year is assumed to have an 8% coupon rate (payable semiannually) and a face (and maturity) amount of 100 . Assume a flat term structure, with continuously compounded annual return of 6% for all terms to maturity. (a) Find the one year forward price, assuming no arbitrage. (b) Suppose that the one year forward price on the bond is $125. Construct a strategy from which an investor can earn a riskless profit. (c) Suppose that the annual yield to maturity on 31 year bonds is 6% compounded semiannually at the time the one year forward contract is entered. Suppose also that, the 6-month and 1-year risk-free rates of interest are 5% compounded continuously at the time the forward contract is entered. What one year forward yield to maturity for 30 year bonds is implied by these conditions under the assumption of no arbitrage

3 An investor takes a short position in a one year forward contract on a 30-year Treasury Bond. The Treasury Bond to be delivered in one year is assumed to have an 8% coupon rate (payable semiannually) and a face (and maturity) amount of 100 . Assume a flat term structure, with continuously compounded annual return of 6% for all terms to maturity. (a) Find the one year forward price, assuming no arbitrage. (b) Suppose that the one year forward price on the bond is $125. Construct a strategy from which an investor can earn a riskless profit. (c) Suppose that the annual yield to maturity on 31 year bonds is 6% compounded semiannually at the time the one year forward contract is entered. Suppose also that, the 6-month and 1-year risk-free rates of interest are 5% compounded continuously at the time the forward contract is entered. What one year forward yield to maturity for 30 year bonds is implied by these conditions under the assumption of no arbitrage Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started