Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Answer all parts (a), (b), (c), (d) and (e) of this question. Consider a model of promotions in which: - A risk-neutral worker

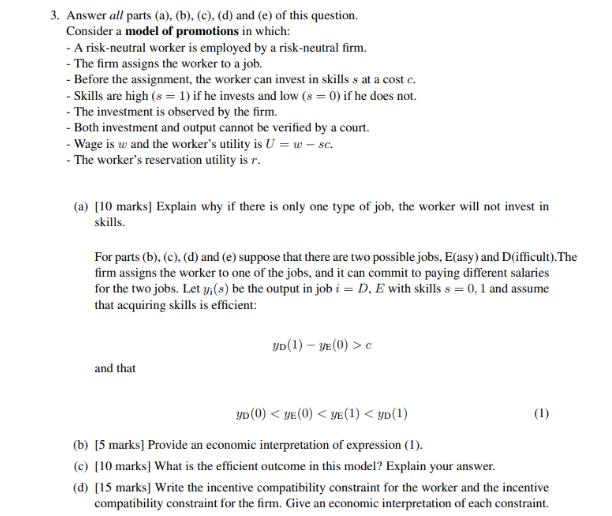

3. Answer all parts (a), (b), (c), (d) and (e) of this question. Consider a model of promotions in which: - A risk-neutral worker is employed by a risk-neutral firm. - The firm assigns the worker to a job. - Before the assignment, the worker can invest in skills s at a cost c. -Skills are high (s = 1) if he invests and low (s = 0) if he does not. - The investment is observed by the firm. - Both investment and output cannot be verified by a court. - Wage is w and the worker's utility is U = w - sc. - The worker's reservation utility is r. (a) [10 marks] Explain why if there is only one type of job, the worker will not invest in skills. For parts (b), (c), (d) and (e) suppose that there are two possible jobs, E(asy) and Difficult). The firm assigns the worker to one of the jobs, and it can commit to paying different salaries for the two jobs. Let y(s) be the output in job i = D. E with skills s = 0, 1 and assume that acquiring skills is efficient: and that YD (1) - YE (0) > C e YD (0)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image contains a question related to economic theory specifically within a model of promotions and risk assessment The question describes a scenario with a riskneutral worker and a riskneutral fir...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started