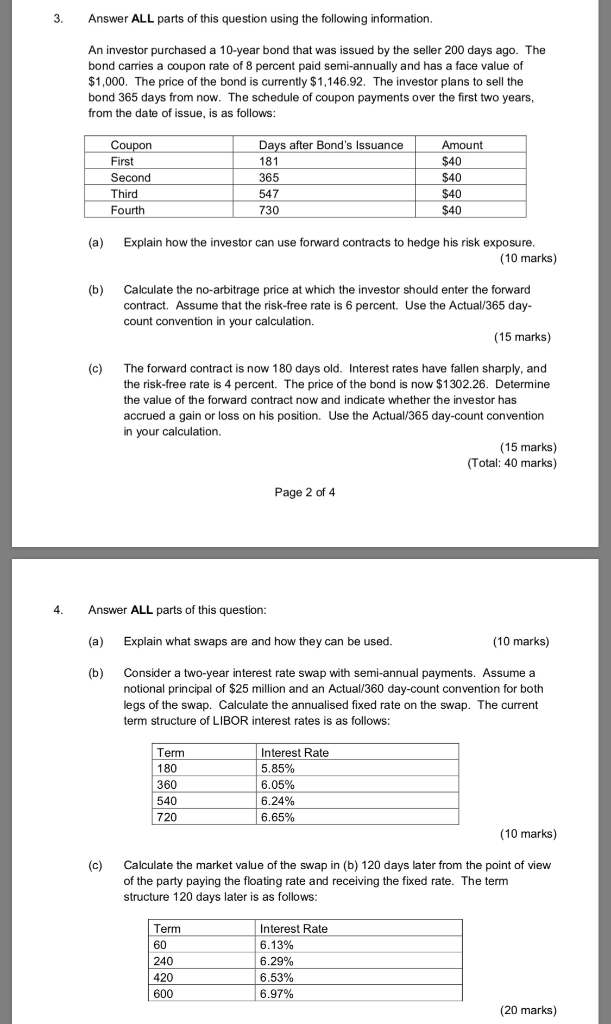

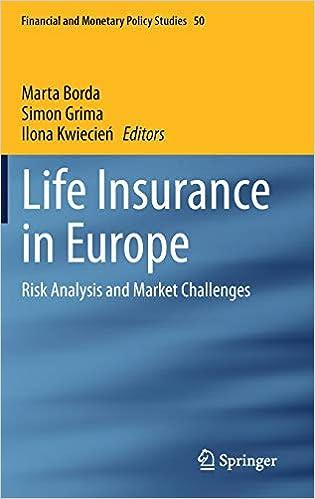

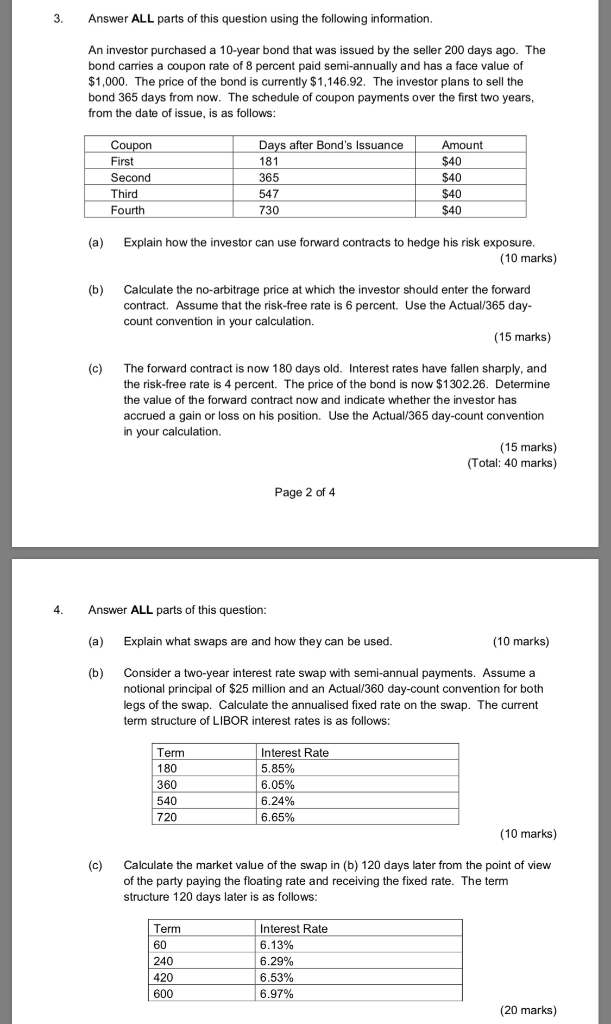

3 Answer ALL parts of this question using the following information An investor purchased a 10-year bond that was issued by the seller 200 days ago. The bond carries a coupon rate of 8 percent paid semi-annually and has a face value of $1,000. The price of the bond is currently $1,146.92. The investor plans to sell the bond 365 days from now. The schedule of coupon payments over the first two years, from the date of issue, is as follows: Coupon Days after Bond's Issuance Amount $40 First 181 Second 365 $40 Third 547 $40 $40 Fourth 730 (a) Explain how the investor can use forward contracts to hedge his risk exposure. (10 marks) (b) Calculate the no-arbitrage price at which the investor should enter the forward contract. Assume that the risk-free rate is 6 percent. Use the Actual/365 day- count convention in your calculation. (15 marks) The forward contract is now 180 days old. Interest rates have fallen sharply, and the risk-free rate is 4 percent. The price of the bond is now $1302.26. Determine the value of the forward contract now and indicate whether the investor has accrued a gain or loss on his position. Use the Actual/365 day-count convention in your calculation. (15 marks) (Total: 40 marks) Page 2 of 4 Answer ALL parts of this question: 4. are and how they can be used Explain what swaps (10 marks) (a) . (b) Consider a two-year interest rate swap with semi-annual payments. Assume a notional principal of $25 million and an Actual/360 day-count convention for both legs of the swap. Calculate the annualised fixed rate on the swap. The current term structure of LIBOR interest rates is as follows: Interest Rate Term 180 5.85% 360 6.05% 540 6.24% 720 6.65% (10 marks) (c) Calculate the market value of the swap in (b) 120 days later from the point of view of the party paying the floating rate and receiving the fixed rate. The term structure 120 days later is as follows: Term Interest Rate 6.13% 60 240 6.29% 6.53% 420 600 6.97% (20 marks) Answer ALL parts of this question: 5. (a) Explaining all assumptions and steps, derive the formula for the single-period Binomial Option Pricing model. (20 marks) (b) Suppose that a stock sells for 125, and the price can either increase by a factor of 1.2 or fall by a factor of 0.8 by the end of the year. A call option on the stock has an exercise price of 132 and a time to expiration of one year. The interest rate is 10%. Using this information: (i) draw value trees illustrating the possible stock price and call option values; (7 marks) (6 marks) (ii) calculate the price of this call; (iii) calculate the number of call options required to hedge one share, and explain why this would give you a risk-free hedge (7 marks) (Total: 40 marks) Page 3 of 4 6. 'Derivatives provide a risk free way for investors to hedge and speculators to profit." Discuss this statement (40 marks) 3 Answer ALL parts of this question using the following information An investor purchased a 10-year bond that was issued by the seller 200 days ago. The bond carries a coupon rate of 8 percent paid semi-annually and has a face value of $1,000. The price of the bond is currently $1,146.92. The investor plans to sell the bond 365 days from now. The schedule of coupon payments over the first two years, from the date of issue, is as follows: Coupon Days after Bond's Issuance Amount $40 First 181 Second 365 $40 Third 547 $40 $40 Fourth 730 (a) Explain how the investor can use forward contracts to hedge his risk exposure. (10 marks) (b) Calculate the no-arbitrage price at which the investor should enter the forward contract. Assume that the risk-free rate is 6 percent. Use the Actual/365 day- count convention in your calculation. (15 marks) The forward contract is now 180 days old. Interest rates have fallen sharply, and the risk-free rate is 4 percent. The price of the bond is now $1302.26. Determine the value of the forward contract now and indicate whether the investor has accrued a gain or loss on his position. Use the Actual/365 day-count convention in your calculation. (15 marks) (Total: 40 marks) Page 2 of 4 Answer ALL parts of this question: 4. are and how they can be used Explain what swaps (10 marks) (a) . (b) Consider a two-year interest rate swap with semi-annual payments. Assume a notional principal of $25 million and an Actual/360 day-count convention for both legs of the swap. Calculate the annualised fixed rate on the swap. The current term structure of LIBOR interest rates is as follows: Interest Rate Term 180 5.85% 360 6.05% 540 6.24% 720 6.65% (10 marks) (c) Calculate the market value of the swap in (b) 120 days later from the point of view of the party paying the floating rate and receiving the fixed rate. The term structure 120 days later is as follows: Term Interest Rate 6.13% 60 240 6.29% 6.53% 420 600 6.97% (20 marks) Answer ALL parts of this question: 5. (a) Explaining all assumptions and steps, derive the formula for the single-period Binomial Option Pricing model. (20 marks) (b) Suppose that a stock sells for 125, and the price can either increase by a factor of 1.2 or fall by a factor of 0.8 by the end of the year. A call option on the stock has an exercise price of 132 and a time to expiration of one year. The interest rate is 10%. Using this information: (i) draw value trees illustrating the possible stock price and call option values; (7 marks) (6 marks) (ii) calculate the price of this call; (iii) calculate the number of call options required to hedge one share, and explain why this would give you a risk-free hedge (7 marks) (Total: 40 marks) Page 3 of 4 6. 'Derivatives provide a risk free way for investors to hedge and speculators to profit." Discuss this statement (40 marks)