Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3) (a)On June 1, 2022, Mr. Michael Leiner acquires a newly issued debt obligation with a maturity amou of $90,000. It matures on May 31,

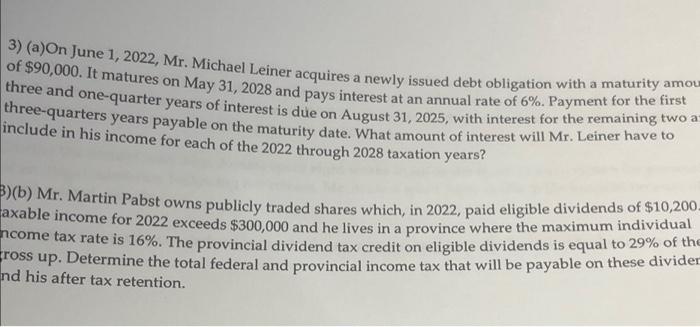

3) (a)On June 1, 2022, Mr. Michael Leiner acquires a newly issued debt obligation with a maturity amou of $90,000. It matures on May 31, 2028 and pays interest at an annual rate of 6%. Payment for the first of interest is due on August 31, 2025, with interest for the remaining two a three and one-quarter years three-quarters years payable on the maturity date. What amount of interest will Mr. Leiner have to include in his income for each of the 2022 through 2028 taxation years? 3)(b) Mr. Martin Pabst owns publicly traded shares which, in 2022, paid eligible dividends of $10,200. axable income for 2022 exceeds $300,000 and he lives in a province where the maximum individual ncome tax rate is 16%. The provincial dividend tax credit on eligible dividends is equal to 29% of the ross up. Determine the total federal and provincial income tax that will be payable on these divider nd his after tax retention.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started