Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Assume that the expected earnings before interest and taxes (EBIT) is E(X)= X and so the expected returns net of taxes of an

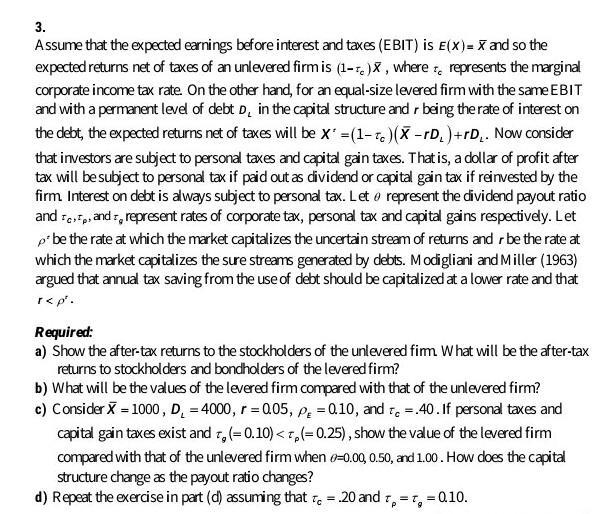

3. Assume that the expected earnings before interest and taxes (EBIT) is E(X)= X and so the expected returns net of taxes of an unlevered firm is (1-1)X, where , represents the marginal corporate income tax rate. On the other hand, for an equal-size levered firm with the same EBIT and with a permanent level of debt D, in the capital structure and r being the rate of interest on the debt, the expected returns net of taxes will be X* =(1-c)(X -rD) +rD. Now consider that investors are subject to personal taxes and capital gain taxes. That is, a dollar of profit after tax will be subject to personal tax if paid out as dividend or capital gain tax if reinvested by the firm. Interest on debt is always subject to personal tax. Leto represent the dividend payout ratio and Tep, and represent rates of corporate tax, personal tax and capital gains respectively. Let * be the rate at which the market capitalizes the uncertain stream of returns and r be the rate at which the market capitalizes the sure streams generated by debts. Modigliani and Miller (1963) argued that annual tax saving from the use of debt should be capitalized at a lower rate and that r

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Modigliani and Miller MM Proposition with Taxes a AfterTax Returns to Stockholders and Bondholders U...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started