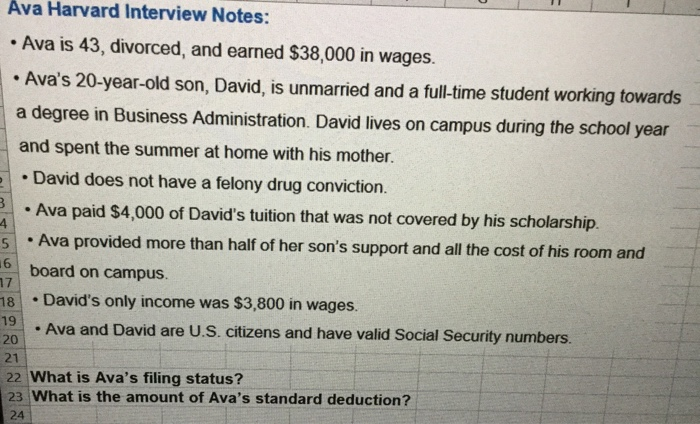

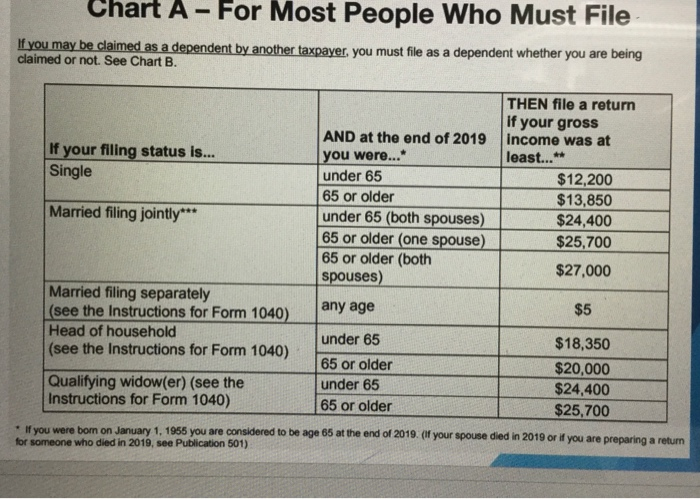

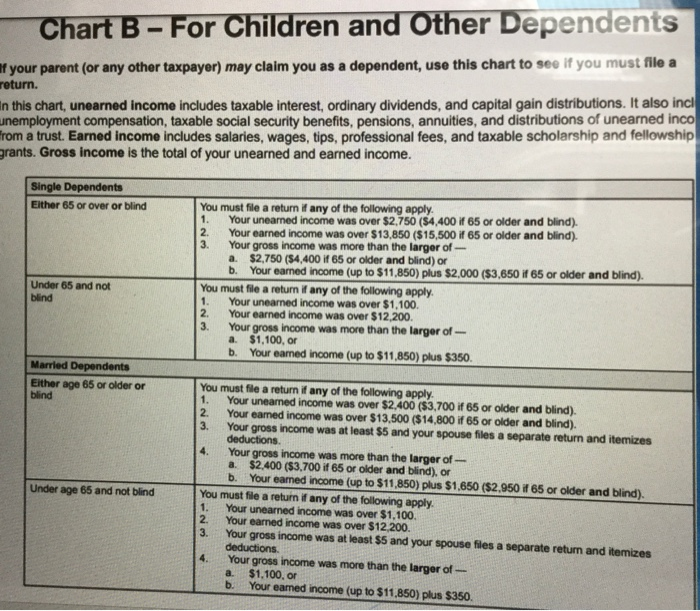

. 3 Ava Harvard Interview Notes: Ava is 43, divorced, and earned $38,000 in wages. Ava's 20-year-old son, David, is unmarried and a full-time student working towards a degree in Business Administration. David lives on campus during the school year and spent the summer at home with his mother. David does not have a felony drug conviction. Ava paid $4,000 of David's tuition that was not covered by his scholarship. 4 5 Ava provided more than half of her son's support and all the cost of his room and 16 board on campus. 17 18 David's only income was $3,800 in wages. 19 Ava and David are U.S. citizens and have valid Social Security numbers. 20 21 22 What is Ava's filing status? 23 What is the amount of Ava's standard deduction? . . 24 Chart A - For Most People Who Must File If you may be claimed as a dependent by another taxpayer, you must file as a dependent whether you are being claimed or not. See Chart B. If your filing status is... Single THEN file a return if your gross income was at least..." $12,200 $13,850 $24,400 $25,700 $27,000 AND at the end of 2019 you were..." under 65 65 or older under 65 (both spouses) 65 or older (one spouse) 65 or older (both spouses) Married filing jointly*** any age $5 Married filing separately (see the Instructions for Form 1040) Head of household (see the Instructions for Form 1040) Qualifying widow(er) (see the Instructions for Form 1040) under 65 65 or older under 65 65 or older $18,350 $20,000 $24,400 $25,700 * If you were born on January 1, 1955 you are considered to be age 65 at the end of 2019. (If your spou for someone who died in 2019, see Publication 501) died in 2019 or if you are preparing a return Chart B - For Children and Other Dependents If your parent (or any other taxpayer) may claim you as a dependent, use this chart to see if you must file a return In this chart, unearned income includes taxable interest, ordinary dividends, and capital gain distributions. It also incl unemployment compensation, taxable social security benefits, pensions, annuities, and distributions of unearned inco from a trust. Earned income includes salaries, wages, tips, professional fees, and taxable scholarship and fellowship grants. Gross income is the total of your unearned and earned income. Single Dependents Either 65 or over or blind Under 65 and not blind You must file a return if any of the following apply. 1. Your unearned income was over $2,750 (54,400 if 65 or older and blind). 2. Your earned income was over $13,850 ($15,500 if 65 or older and blind). 3. Your gross income was more than the larger of - a $2,750 (54,400 if 65 or older and blind) or b. Your earned income (up to $11,850) plus $2,000 ($3,650 if 65 or older and blind). You must file a return if any of the following apply. 1 Your uneared income was over $1,100. 2. Your earned income was over $12,200 3. Your gross income was more than the larger of a $1,100, or b. Your eared income (up to $11,850) plus $350. Married Dependents Either age 65 or older or blind Under age 65 and not blind You must file a return if any of the following apply. 1. Your uneared income was over $2,400 ($3,700 if 65 or older and blind). 2. Your earned income was over $13.500 ($14,800 if 65 or older and blind). 3. Your gross income was at least $5 and your spouse files a separate return and itemizes deductions. 4. Your gross income was more than the larger of - a. $2,400 ($3.700 if 65 or older and blind), or b. Your eared income (up to $11,850) plus $1.650 ($2.950 if 65 or older and blind). You must file a return if any of the following apply. 1. Your unearned income was over $1,100 2. Your earned income was over $12.200. 3. Your gross income was at least $5 and your spouse files a separate return and itemizes deductions 4. Your gross income was more than the larger of a. $1.100, or b. Your eamed income (up to $11,850) plus $350