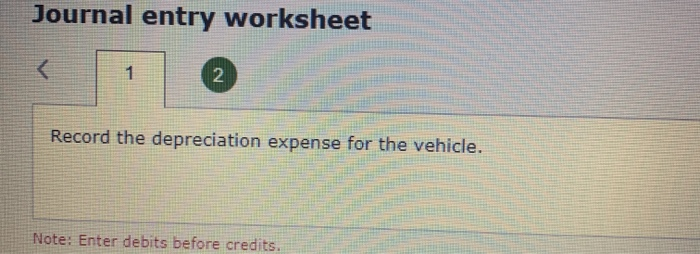

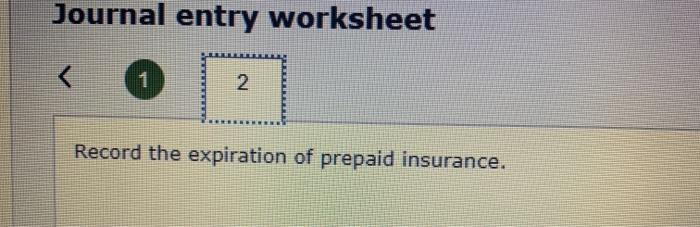

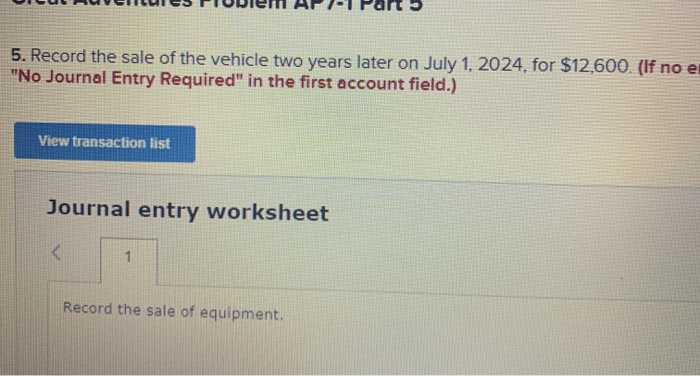

Required information Great Adventures Problem AP7-1 [The following information applies to the questions displayed below.) Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2022, for $14,600. They expect to use the Suburban for five years and then sell the vehicle for $5,800. The following expenditures related to the vehicle were also made on July 1, 2022 The company pays $2.450 to GEICO for a one-year insurance policy. The company spends an extra $5,600 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. An additional $2,650 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22. 2022, the company pays $1,700 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter Great Adventures Problem AP7-1 Part 1 Required: 1. Record the expenditures related to the vehicle on July 1, 2022. Note: The capitalized cost of the vehicle is recorded in the Equipment account (If no entry is required for transaction/event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet Record the expenditures related to the new vehicle. Note: Enter debits before credits. --INSuleet Record the expenditure related to vehicle maintenance. Note: Enter debits before credits. 5 Great Adventures Problem AP7-1 Part 3 3. Prepare a depreciation schedule using the straight-line method. GREAT ADVENTURES Journal entry worksheet Record the depreciation expense for the vehicle. Note: Enter debits before credits. Journal entry worksheet 0 2 | Record the expiration of prepaid insurance. OLU BUVULUI ESTIUuiem API- Part 5 5. Record the sale of the vehicle two years later on July 1, 2024, for $12,600. (If no e "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the sale of equipment