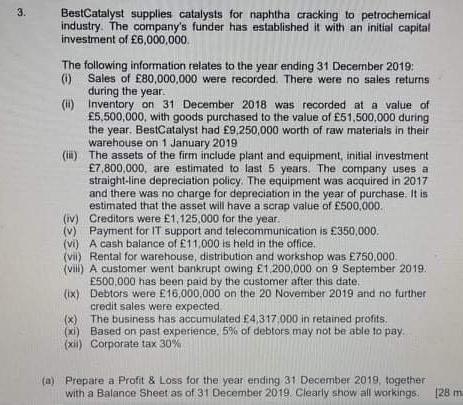

3. BestCatalyst supplies catalysts for naphtha cracking to petrochemical industry. The company's funder has established it with an initial capital investment of 6,000,000 The following information relates to the year ending 31 December 2019, (1) Sales of 80,000,000 were recorded. There were no sales returns during the year (W) Inventory on 31 December 2018 was recorded at a value of 5,500,000, with goods purchased to the value of 51,500,000 during the year. BestCatalyst had 9,250,000 worth of raw materials in their warehouse on 1 January 2019 (th) The assets of the firm include plant and equipment initial investment 7,800,000, are estimated to last 5 years. The company uses a straight-line depreciation policy. The equipment was acquired in 2017 and there was no charge for depreciation in the year of purchase. It is estimated that the asset will have a scrap value of 500,000. (iv) Creditors were 1,125,000 for the year. Payment for IT support and telecommunication is 350,000 (vi) A cash balance of 11.000 is held in the office. (vii) Rental for warehouse, distribution and workshop was 750,000 vill) A customer went bankrupt owing 1,200,000 on 9 September 2019. 500.000 has been paid by the customer after this date. (ix) Debtors were 16,000,000 on the 20 November 2019 and no further credit sales were expected (x) The business has accumulated 4, 317.000 in retained profits. (xi) Based on past experience, 5% of debtors may not be able to pay (xii) Corporate tax 30% (a) Prepare a Profit & Loss for the year ending 31 December 2019, together with a Balance Sheet as of 31 December 2019. Clearly show all workings 128 m 3. BestCatalyst supplies catalysts for naphtha cracking to petrochemical industry. The company's funder has established it with an initial capital investment of 6,000,000 The following information relates to the year ending 31 December 2019, (1) Sales of 80,000,000 were recorded. There were no sales returns during the year (W) Inventory on 31 December 2018 was recorded at a value of 5,500,000, with goods purchased to the value of 51,500,000 during the year. BestCatalyst had 9,250,000 worth of raw materials in their warehouse on 1 January 2019 (th) The assets of the firm include plant and equipment initial investment 7,800,000, are estimated to last 5 years. The company uses a straight-line depreciation policy. The equipment was acquired in 2017 and there was no charge for depreciation in the year of purchase. It is estimated that the asset will have a scrap value of 500,000. (iv) Creditors were 1,125,000 for the year. Payment for IT support and telecommunication is 350,000 (vi) A cash balance of 11.000 is held in the office. (vii) Rental for warehouse, distribution and workshop was 750,000 vill) A customer went bankrupt owing 1,200,000 on 9 September 2019. 500.000 has been paid by the customer after this date. (ix) Debtors were 16,000,000 on the 20 November 2019 and no further credit sales were expected (x) The business has accumulated 4, 317.000 in retained profits. (xi) Based on past experience, 5% of debtors may not be able to pay (xii) Corporate tax 30% (a) Prepare a Profit & Loss for the year ending 31 December 2019, together with a Balance Sheet as of 31 December 2019. Clearly show all workings 128 m