Answered step by step

Verified Expert Solution

Question

1 Approved Answer

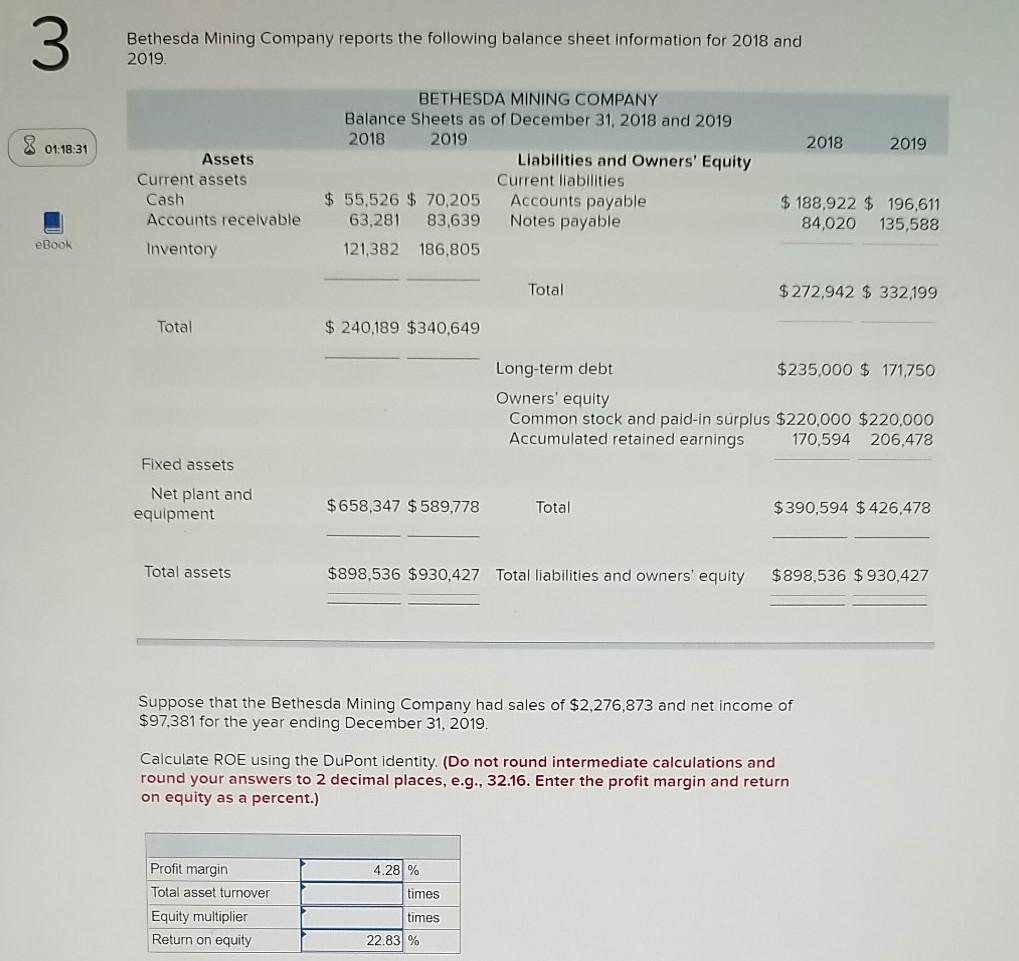

3 Bethesda Mining Company reports the following balance sheet information for 2018 and 2019 8 01:18:31 2018 2019 Assets Current assets Cash Accounts receivable BETHESDA

3 Bethesda Mining Company reports the following balance sheet information for 2018 and 2019 8 01:18:31 2018 2019 Assets Current assets Cash Accounts receivable BETHESDA MINING COMPANY Balance Sheets as of December 31, 2018 and 2019 2018 2019 Liabilities and Owners' Equity Current liabilities $ 55,526 $ 70,205 Accounts payable 63,281 83,639 Notes payable 121,382 186,805 $ 188,922 $ 196,611 84,020 135,588 eBook Inventory Total $ 272,942 $ 332,199 Total $ 240,189 $340,649 Long-term debt $235,000 $ 171750 Owners' equity Common stock and paid-in surplus $220,000 $220,000 Accumulated retained earnings 170,594 206,478 Fixed assets Net plant and equipment $658,347 $ 589,778 Total $390,594 $426,478 Total assets $898,536 $930,427 Total liabilities and owners' equity $898,536 $ 930,427 Suppose that the Bethesda Mining Company had sales of $2,276,873 and net income of $97.381 for the year ending December 31, 2019 Calculate ROE using the DuPont identity. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Enter the profit margin and return on equity as a percent.) 4.28 % times Profit margin Total asset turnover Equity multiplier Return on equity times 22.83 %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started