Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3) Charles-Tano, International, Incorporated is considering changing its portfolio. They have asked you to handle the change. a. First, you have a $1,000 portfolio which

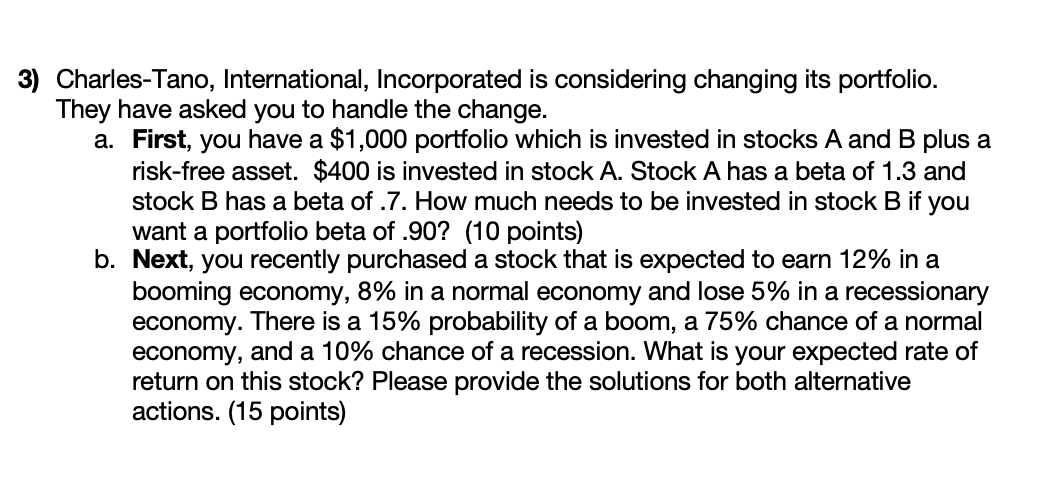

3) Charles-Tano, International, Incorporated is considering changing its portfolio. They have asked you to handle the change. a. First, you have a $1,000 portfolio which is invested in stocks A and B plus a risk-free asset. $400 is invested in stock A. Stock A has a beta of 1.3 and stock B has a beta of .7. How much needs to be invested in stock B if you want a portfolio beta of .90 ? (10 points) b. Next, you recently purchased a stock that is expected to earn 12% in a booming economy, 8% in a normal economy and lose 5% in a recessionary economy. There is a 15% probability of a boom, a 75% chance of a normal economy, and a 10% chance of a recession. What is your expected rate of return on this stock? Please provide the solutions for both alternative actions. (15 points)

3) Charles-Tano, International, Incorporated is considering changing its portfolio. They have asked you to handle the change. a. First, you have a $1,000 portfolio which is invested in stocks A and B plus a risk-free asset. $400 is invested in stock A. Stock A has a beta of 1.3 and stock B has a beta of .7. How much needs to be invested in stock B if you want a portfolio beta of .90 ? (10 points) b. Next, you recently purchased a stock that is expected to earn 12% in a booming economy, 8% in a normal economy and lose 5% in a recessionary economy. There is a 15% probability of a boom, a 75% chance of a normal economy, and a 10% chance of a recession. What is your expected rate of return on this stock? Please provide the solutions for both alternative actions. (15 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started