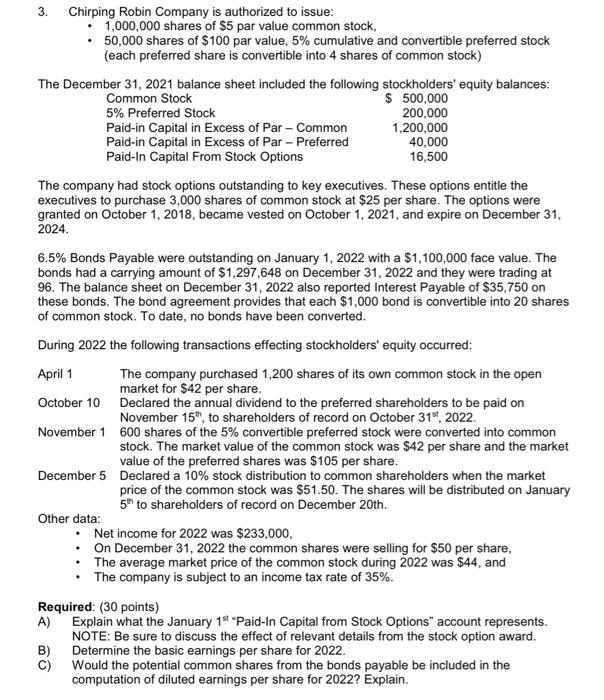

3. Chirping Robin Company is authorized to issue: - 1,000,000 shares of $5 par value common stock, - 50,000 shares of $100 par value, 5% cumulative and convertible preferred stock (each preferred share is convertible into 4 shares of common stock) The December 31. 2021 balance sheet included the followina stockholders' equity balances: The company had stock options outstanding to key executives. These options entitle the executives to purchase 3,000 shares of common stock at $25 per share. The options were granted on October 1, 2018, became vested on October 1, 2021, and expire on December 31, 2024. 6.5% Bonds Payable were outstanding on January 1,2022 with a $1,100,000 face value. The bonds had a carrying amount of $1,297,648 on December 31,2022 and they were trading at 96. The balance sheet on December 31,2022 also reported Interest Payable of $35,750 on these bonds. The bond agreement provides that each $1,000 bond is convertible into 20 shares of common stock. To date, no bonds have been converted. During 2022 the following transactions effecting stockholders' equity occurred: April 1 The company purchased 1,200 shares of its own common stock in the open market for $42 per share. October 10 Declared the annual dividend to the preferred shareholders to be paid on November 15th, to shareholders of record on October 31st,2022. November 1600 shares of the 5% convertible preferred stock were converted into common stock. The market value of the common stock was $42 per share and the market value of the preferred shares was $105 per share. December 5 Declared a 10% stock distribution to common shareholders when the market price of the common stock was $51.50. The shares will be distributed on January 5th to shareholders of record on December 20th. Other data: - Net income for 2022 was $233,000, - On December 31,2022 the common shares were selling for $50 per share, - The average market price of the common stock during 2022 was $44, and - The company is subject to an income tax rate of 35%. Required: ( 30 points) A) Explain what the January 1st "Paid-In Capital from Stock Options" account represents. NOTE: Be sure to discuss the effect of relevant details from the stock option award. B) Determine the basic earnings per share for 2022. C) Would the potential common shares from the bonds payable be included in the computation of diluted earnings per share for 2022 ? Explain