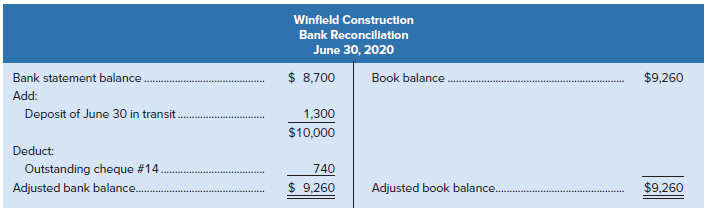

The bank reconciliation prepared by Winfield Construction on June 30, 2020, appeared as follows: The Cash account

Question:

The bank reconciliation prepared by Winfield Construction on June 30, 2020, appeared as follows:

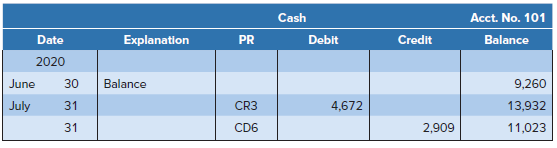

The Cash account in the general ledger appeared as follows on July 31:

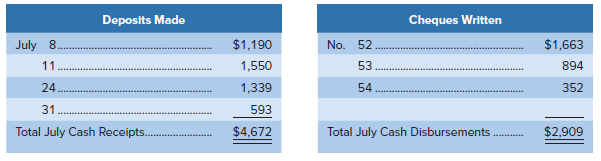

A list of deposits made and cheques written during July, taken from the cash receipts journal and cash disbursements journal, is shown below:

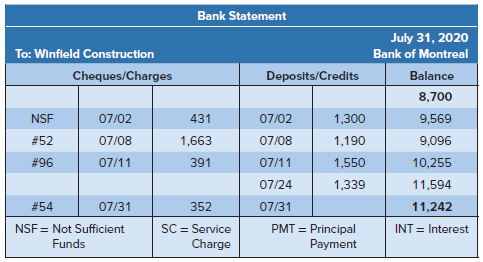

The following bank statement is available for July:

In reviewing cheques returned by the bank, the bookkeeper noted that cheque #96 written by Winburn Construction in the amount of $391 was charged against Winfield?s account in error by the bank. The NSF cheque was regarding a customer account, Jim Anderson.

Required

1. Prepare a bank reconciliation at July 31.

2. Prepare the necessary journal entry to bring the general ledger Cash account into agreement with the adjusted balance on the bank reconciliation.

Analysis Component: If the journal entries in Part 2 were not recorded, what financial statement elements (profit, assets, liabilities, and equity) would be over- or understated?

Step by Step Answer:

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann