Answered step by step

Verified Expert Solution

Question

1 Approved Answer

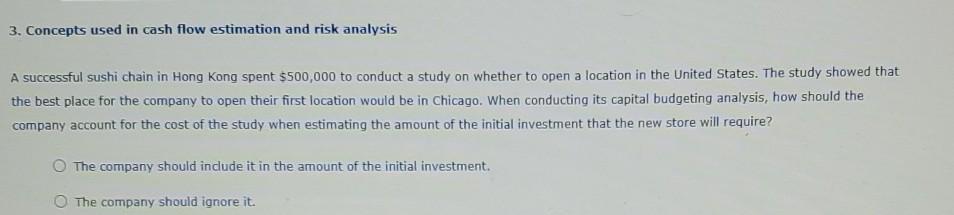

3. Concepts used in cash flow estimation and risk analysis A successful sushi chain in Hong Kong spent $500,000 to conduct a study on whether

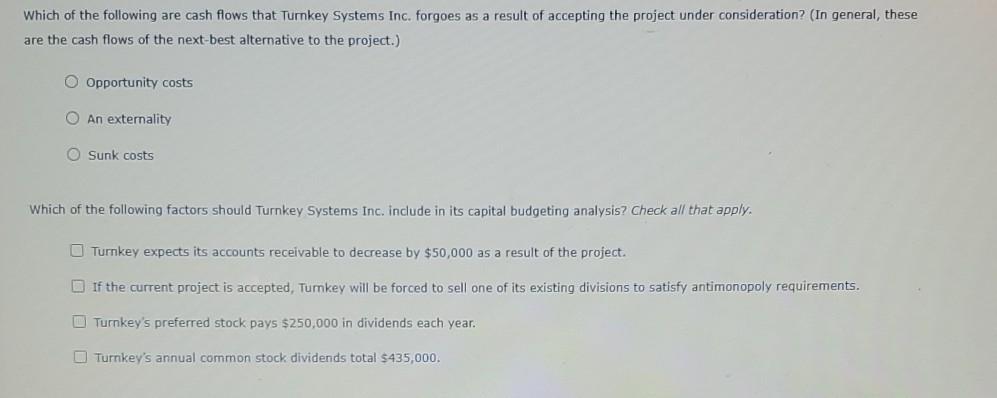

3. Concepts used in cash flow estimation and risk analysis A successful sushi chain in Hong Kong spent $500,000 to conduct a study on whether to open a location in the United States. The study showed that the best place for the company to open their first location would be in Chicago. When conducting its capital budgeting analysis, how should the company account for the cost of the study when estimating the amount of the initial investment that the new store will require? The company should include it in the amount of the initial investment. The company should ignore it. Which of the following are cash flows that Turnkey Systems Inc. forgoes as a result of accepting the project under consideration? (In general, these are the cash flows of the next-best alternative to the project.) O Opportunity costs O An externality O Sunk costs Which of the following factors should Turnkey Systems Inc. include in its capital budgeting analysis? Check all that apply. Turnkey expects its accounts receivable to decrease by $50,000 as a result of the project. If the current project is accepted, Turkey will be forced to sell one of its existing divisions to satisfy antimonopoly requirements. Turnkey's preferred stock pays $250,000 in dividends each year. Turnkey's annual common stock dividends total $435,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started