implement and maintain internal control procedures

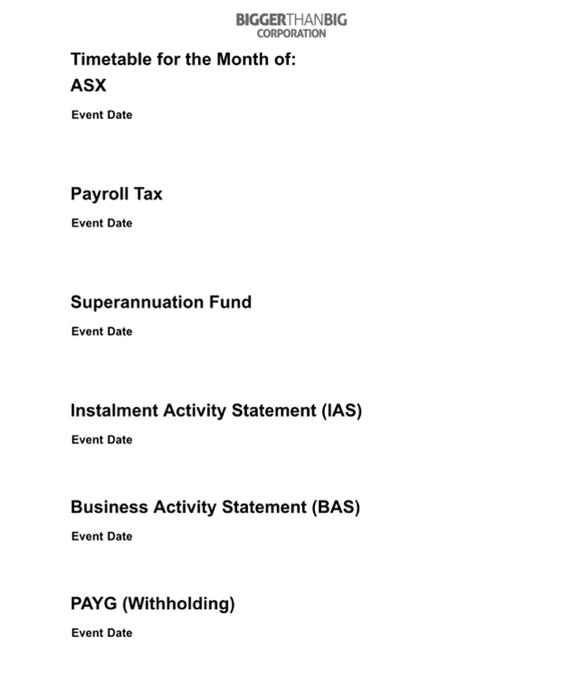

This task will require you to roleplay a meeting with your supervisor, Chris Kohler. You will discuss the reporting requirements and timetables from specific regulatory authorities which will be added to the policies and procedures of Bigger Than Big Corporation. This role play activity will be done in class. You need to organise a time with your teacher to complete this role. You will require access to: Information relating to the continuous and periodic disclosure obligations of the company to the given regulatory authorities: O ASX O ATO Taxation Requirements: IAS, BAS, PAYG (Withholding) o Office of State Revenue - Payroll Tax o Superannuation Fund -Your teacher who will assume the role of: - Your supervisor, Chris Kohler Read the instructions carefully before proceeding. . Source information on the reporting requirements (what needs to be reported) and the time frame (reporting dates) the company follows with respect to the continuous and periodic disclosure obligations of the company to the following regulatory authorities: - ASX (half-year and annual reports) - ATO Taxation Requirements: o IAS (refer to the current month) o BAS (quarterly and monthly) O PAYG (Withholding) Office of State Revenue - Payroll Tax (refer to your State/Territory) Superannuation Fund Outline the information in the space provided below. ASX ATO Taxation Requirements: IAS Specify the current month: ATO Taxation Requirements: BAS ATO Taxation Requirements: PAYG (Withholding) Office of State Revenue - Payroll Tax Specify your State/Territory: Superannuation Fund Steps to take: a. Access the character brief from this link: Reporting Requirements (username: chisholmlearner password: ChisholmOnline@123) This will guide you and your volunteer in completing the roleplaying activity. Note that Keira will not be attending the meeting but you should still take note of the information in her character brief. You will be playing the role of the Accountant and your teacher will be playing the role of Chris Kohler b. In this roleplaying activity, you must be able to: Accurately discuss the reporting requirements and dates for the financial regulatory authorities relevant to the bigger than Big. Demonstrate active listening and questioning skills to elicit, clarify, and convey information. Guidelines and instructions can be found in the character brief. Guidelines: c. To demonstrate your completion of this activity, your volunteer (teacher) is going to complete a Feedback form. You should submit this form as part of your assessment submission. BIGGERTHANBIG CORPORATION Timetable for the Month of: ASX Event Date Payroll Tax Event Date Superannuation Fund Event Date Instalment Activity Statement (IAS) Event Date Business Activity Statement(BAS) Event Date PAYG (Withholding) Event Date This task will require you to roleplay a meeting with your supervisor, Chris Kohler. You will discuss the reporting requirements and timetables from specific regulatory authorities which will be added to the policies and procedures of Bigger Than Big Corporation. This role play activity will be done in class. You need to organise a time with your teacher to complete this role. You will require access to: Information relating to the continuous and periodic disclosure obligations of the company to the given regulatory authorities: O ASX O ATO Taxation Requirements: IAS, BAS, PAYG (Withholding) o Office of State Revenue - Payroll Tax o Superannuation Fund -Your teacher who will assume the role of: - Your supervisor, Chris Kohler Read the instructions carefully before proceeding. . Source information on the reporting requirements (what needs to be reported) and the time frame (reporting dates) the company follows with respect to the continuous and periodic disclosure obligations of the company to the following regulatory authorities: - ASX (half-year and annual reports) - ATO Taxation Requirements: o IAS (refer to the current month) o BAS (quarterly and monthly) O PAYG (Withholding) Office of State Revenue - Payroll Tax (refer to your State/Territory) Superannuation Fund Outline the information in the space provided below. ASX ATO Taxation Requirements: IAS Specify the current month: ATO Taxation Requirements: BAS ATO Taxation Requirements: PAYG (Withholding) Office of State Revenue - Payroll Tax Specify your State/Territory: Superannuation Fund Steps to take: a. Access the character brief from this link: Reporting Requirements (username: chisholmlearner password: ChisholmOnline@123) This will guide you and your volunteer in completing the roleplaying activity. Note that Keira will not be attending the meeting but you should still take note of the information in her character brief. You will be playing the role of the Accountant and your teacher will be playing the role of Chris Kohler b. In this roleplaying activity, you must be able to: Accurately discuss the reporting requirements and dates for the financial regulatory authorities relevant to the bigger than Big. Demonstrate active listening and questioning skills to elicit, clarify, and convey information. Guidelines and instructions can be found in the character brief. Guidelines: c. To demonstrate your completion of this activity, your volunteer (teacher) is going to complete a Feedback form. You should submit this form as part of your assessment submission. BIGGERTHANBIG CORPORATION Timetable for the Month of: ASX Event Date Payroll Tax Event Date Superannuation Fund Event Date Instalment Activity Statement (IAS) Event Date Business Activity Statement(BAS) Event Date PAYG (Withholding) Event Date