Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Consider a two-date economy (t=0,1) in which investors are risk neutral and the risk-free rate is zero. There is a firm consisting in an

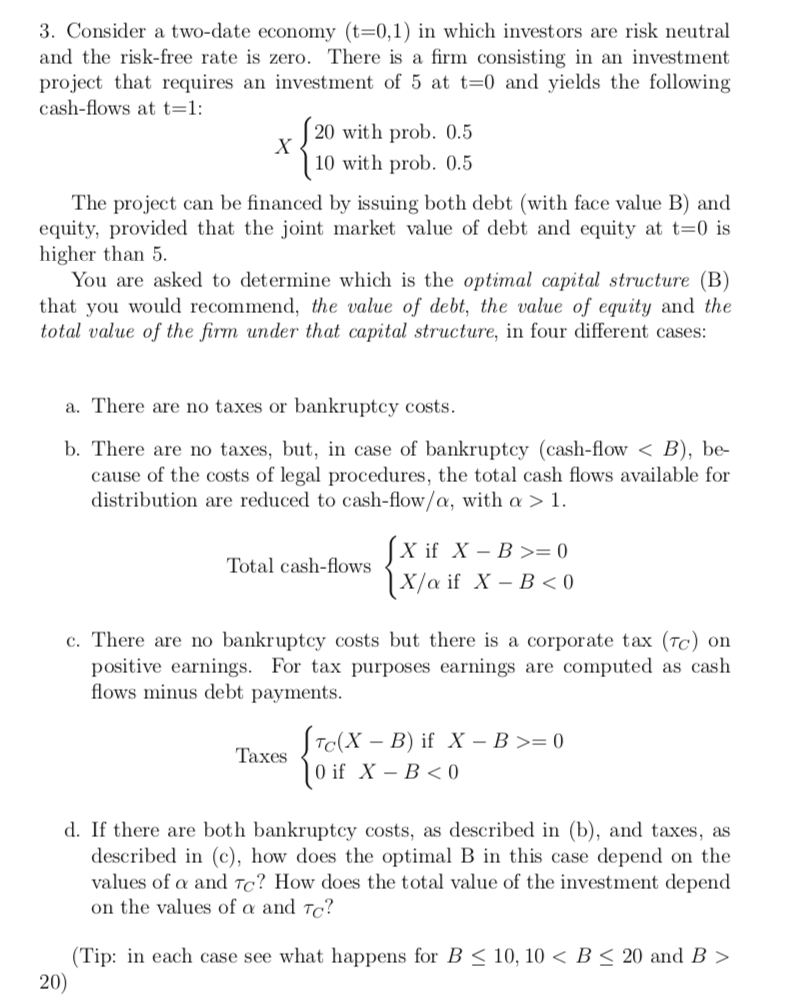

3. Consider a two-date economy (t=0,1) in which investors are risk neutral and the risk-free rate is zero. There is a firm consisting in an investment project that requires an investment of 5 at t=0 and yields the following cash-flows at t=1: S 20 with prob. 0.5 X 10 with prob. 0.5 The project can be financed by issuing both debt (with face value B) and equity, provided that the joint market value of debt and equity at t=0 is higher than 5. You are asked to determine which is the optimal capital structure (B) that you would recommend, the value of debt, the value of equity and the total value of the firm under that capital structure, in four different cases: a. There are no taxes or bankruptcy costs. b. There are no taxes, but, in case of bankruptcy (cash-flow 1. Total cash-flows SX if X B >= 0 1X/a if X B=0 Taxes 10 if X B 20) 3. Consider a two-date economy (t=0,1) in which investors are risk neutral and the risk-free rate is zero. There is a firm consisting in an investment project that requires an investment of 5 at t=0 and yields the following cash-flows at t=1: S 20 with prob. 0.5 X 10 with prob. 0.5 The project can be financed by issuing both debt (with face value B) and equity, provided that the joint market value of debt and equity at t=0 is higher than 5. You are asked to determine which is the optimal capital structure (B) that you would recommend, the value of debt, the value of equity and the total value of the firm under that capital structure, in four different cases: a. There are no taxes or bankruptcy costs. b. There are no taxes, but, in case of bankruptcy (cash-flow 1. Total cash-flows SX if X B >= 0 1X/a if X B=0 Taxes 10 if X B 20)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started