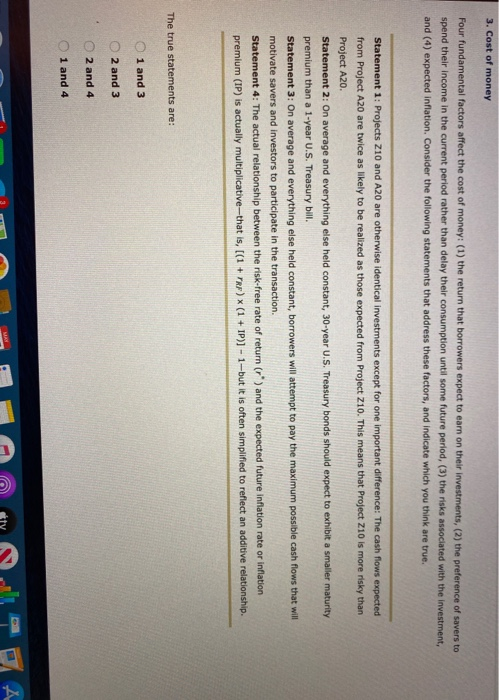

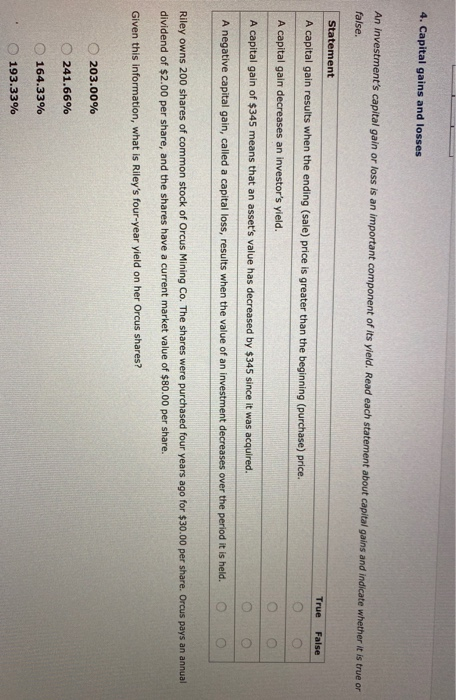

3. Cost of money Four fundamental factors affect the cost of money: (1) the return that borrowers expect to earn on their investments, (2) the preference of savers to spend their income in the current period rather than delay their consumption until some future period, (3) the risks associated with the investment, and (4) expected Inflation. Consider the following statements that address these factors, and indicate which you think are true. Statement 1: Projects Z10 and A20 are otherwise identical investments except for one important difference: The cash flows expected from Project A20 are twice as likely to be realized as those expected from Project Z10. This means that Project Z10 is more risky than Project A20 Statement 2: On average and everything else held constant, 30-year U.S. Treasury bonds should expect to exhibit a smaller maturity premium than a 1-year U.S. Treasury bill. Statement 3: On average and everything else held constant, borrowers will attempt to pay the maximum possible cash flows that will motivate savers and investors to participate in the transaction. Statement 4: The actual relationship between the risk-free rate of return (r) and the expected future inflation rate or inflation premium (IP) is actually multiplicative--that is, [(1 + TRF) (1 + IP)] - 1-but it is often simplified to reflect an additive relationship. The true statements are: 1 and 3 2 and 3 2 and 4 1 and 4 4. Capital gains and losses An investment's capital gain or loss is an important component of its yield. Read each statement about capital gains and indicate whether it is true or false, Statement True False A capital gain results when the ending (sale) price is greater than the beginning (purchase) price. A capital gain decreases an investor's yield. A capital gain of $345 means that an asset's value has decreased by $345 since it was acquired. c A negative capital gain, called a capital loss, results when the value of an investment decreases over the period it is held. Riley owns 200 shares of common stock of Orcus Mining Co. The shares were purchased four years ago for $30.00 per share. Orcus pays an annual dividend of $2.00 per share, and the shares have a current market value of $80.00 per share. Given this information, what is Riley's four-year yield on her Orcus shares? 203.00% 241.66% 164.33% 193.33%