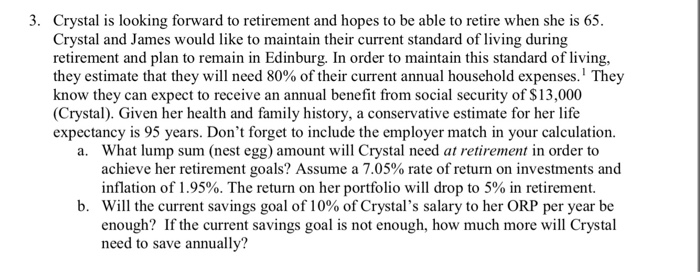

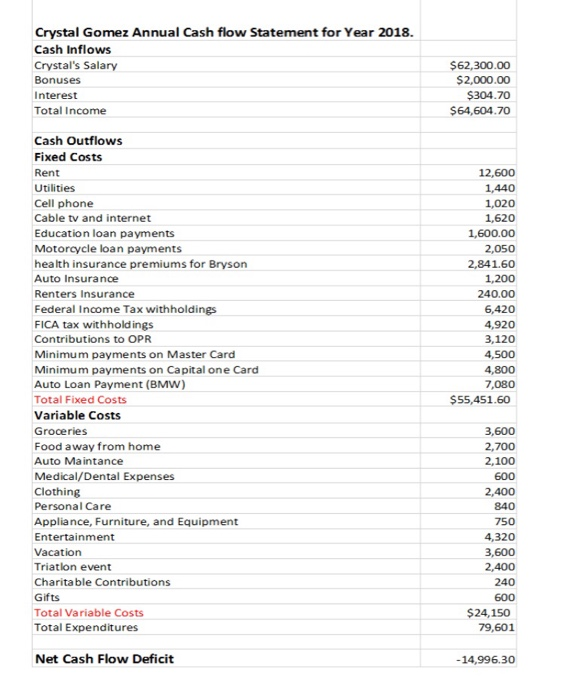

3. Crystal is looking forward to retirement and hopes to be able to retire when she is 65 Crystal and James would like to maintain their current standard of living during retirement and plan to remain in Edinburg. In order to maintain this standard of living, they estimate that they will need 80% of their current annual household expenses." They know they can expect to receive an annual benefit from social security of $13,000 (Crystal). Given her health and family history, a conservative estimate for her life expectancy is 95 years. Don't forget to include the employer match in your calculation. What lump sum (nest egg) amount will Crystal need at retirement in order to achieve her retirement goals? Assume a 7.05% rate of return on investments and inflation of 1.95%. The return on her portfolio will drop to 5% in retirement. Will the current savings goal of 10% of Crystal's salary to her ORP per year be enough? If the current savings goal is not enough, how much more will Crystal need to save annually? a. b. Crystal Gomez Annual Cash flow Statement for Year 2018. Cash Inflows Crystal's Salary Bonuses Interest Total Income $62,300.00 $2,000.00 $304.70 $64,604.70 Cash Outflows Fixed Costs Rent Utilities Cell phone Cable tv and internet Education loan payments Motorcycle loan payments health insurance premiums for Bryson Auto Insurance Renters Insurance Federal Income Tax withholdings FICA tax withholdings Contributions to OPR Minimum payments on Master Card Minimum payments on Capital one Card Auto Loan Payment (BMw) Total Fixed Costs Variable Costs Groceries Food away from home Auto Maintance Medical/Dental Expenses Clothing Personal Care Appliance, Furniture, and Equipment Entertainment Vacation Triatlon event Charitable Contributions Gifts Total Variable Costs Total Expenditures 12,600 1,440 1,020 1,620 1,600.00 2,050 2,841.60 1,200 240.00 6,420 4,920 3,120 4,500 4,800 7,080 55,451.60 3,600 2,700 2,100 600 2,400 840 750 4,320 3,600 2,400 240 600 $24,150 79,601 Net Cash Flow Deficit -14,996.30 3. Crystal is looking forward to retirement and hopes to be able to retire when she is 65 Crystal and James would like to maintain their current standard of living during retirement and plan to remain in Edinburg. In order to maintain this standard of living, they estimate that they will need 80% of their current annual household expenses." They know they can expect to receive an annual benefit from social security of $13,000 (Crystal). Given her health and family history, a conservative estimate for her life expectancy is 95 years. Don't forget to include the employer match in your calculation. What lump sum (nest egg) amount will Crystal need at retirement in order to achieve her retirement goals? Assume a 7.05% rate of return on investments and inflation of 1.95%. The return on her portfolio will drop to 5% in retirement. Will the current savings goal of 10% of Crystal's salary to her ORP per year be enough? If the current savings goal is not enough, how much more will Crystal need to save annually? a. b. Crystal Gomez Annual Cash flow Statement for Year 2018. Cash Inflows Crystal's Salary Bonuses Interest Total Income $62,300.00 $2,000.00 $304.70 $64,604.70 Cash Outflows Fixed Costs Rent Utilities Cell phone Cable tv and internet Education loan payments Motorcycle loan payments health insurance premiums for Bryson Auto Insurance Renters Insurance Federal Income Tax withholdings FICA tax withholdings Contributions to OPR Minimum payments on Master Card Minimum payments on Capital one Card Auto Loan Payment (BMw) Total Fixed Costs Variable Costs Groceries Food away from home Auto Maintance Medical/Dental Expenses Clothing Personal Care Appliance, Furniture, and Equipment Entertainment Vacation Triatlon event Charitable Contributions Gifts Total Variable Costs Total Expenditures 12,600 1,440 1,020 1,620 1,600.00 2,050 2,841.60 1,200 240.00 6,420 4,920 3,120 4,500 4,800 7,080 55,451.60 3,600 2,700 2,100 600 2,400 840 750 4,320 3,600 2,400 240 600 $24,150 79,601 Net Cash Flow Deficit -14,996.30