Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Direct labor cost was $92,000, and indirect labor costs were $9,400. All labor costs were paid in cash. 4. The predetermined overhead rate was

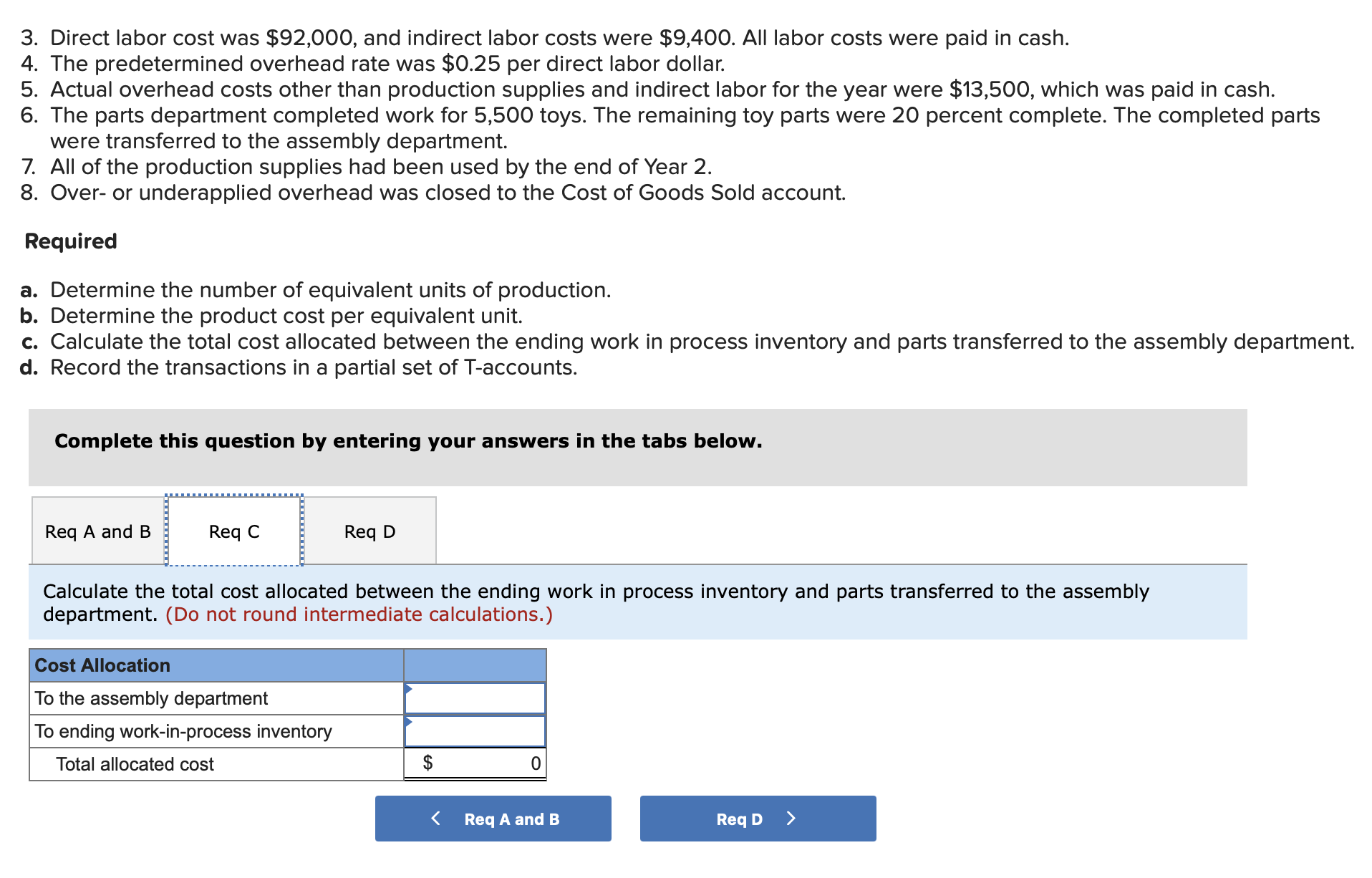

3. Direct labor cost was $92,000, and indirect labor costs were $9,400. All labor costs were paid in cash. 4. The predetermined overhead rate was $0.25 per direct labor dollar. 5. Actual overhead costs other than production supplies and indirect labor for the year were $13,500, which was paid in cash. 6. The parts department completed work for 5,500 toys. The remaining toy parts were 20 percent complete. The completed parts were transferred to the assembly department. 7. All of the production supplies had been used by the end of Year 2. 8. Over- or underapplied overhead was closed to the Cost of Goods Sold account. Required a. Determine the number of equivalent units of production. b. Determine the product cost per equivalent unit. c. Calculate the total cost allocated between the ending work in process inventory and parts transferred to the assembly departmer d. Record the transactions in a partial set of T-accounts. Complete this question by entering your answers in the tabs below. Calculate the total cost allocated between the ending work in process inventory and parts transferred to the assembly department. (Do not round intermediate calculations.) 3. Direct labor cost was $92,000, and indirect labor costs were $9,400. All labor costs were paid in cash. 4. The predetermined overhead rate was $0.25 per direct labor dollar. 5. Actual overhead costs other than production supplies and indirect labor for the year were $13,500, which was paid in cash. 6. The parts department completed work for 5,500 toys. The remaining toy parts were 20 percent complete. The completed parts were transferred to the assembly department. 7. All of the production supplies had been used by the end of Year 2. 8. Over- or underapplied overhead was closed to the Cost of Goods Sold account. Required a. Determine the number of equivalent units of production. b. Determine the product cost per equivalent unit. c. Calculate the total cost allocated between the ending work in process inventory and parts transferred to the assembly departmer d. Record the transactions in a partial set of T-accounts. Complete this question by entering your answers in the tabs below. Calculate the total cost allocated between the ending work in process inventory and parts transferred to the assembly department. (Do not round intermediate calculations.)

3. Direct labor cost was $92,000, and indirect labor costs were $9,400. All labor costs were paid in cash. 4. The predetermined overhead rate was $0.25 per direct labor dollar. 5. Actual overhead costs other than production supplies and indirect labor for the year were $13,500, which was paid in cash. 6. The parts department completed work for 5,500 toys. The remaining toy parts were 20 percent complete. The completed parts were transferred to the assembly department. 7. All of the production supplies had been used by the end of Year 2. 8. Over- or underapplied overhead was closed to the Cost of Goods Sold account. Required a. Determine the number of equivalent units of production. b. Determine the product cost per equivalent unit. c. Calculate the total cost allocated between the ending work in process inventory and parts transferred to the assembly departmer d. Record the transactions in a partial set of T-accounts. Complete this question by entering your answers in the tabs below. Calculate the total cost allocated between the ending work in process inventory and parts transferred to the assembly department. (Do not round intermediate calculations.) 3. Direct labor cost was $92,000, and indirect labor costs were $9,400. All labor costs were paid in cash. 4. The predetermined overhead rate was $0.25 per direct labor dollar. 5. Actual overhead costs other than production supplies and indirect labor for the year were $13,500, which was paid in cash. 6. The parts department completed work for 5,500 toys. The remaining toy parts were 20 percent complete. The completed parts were transferred to the assembly department. 7. All of the production supplies had been used by the end of Year 2. 8. Over- or underapplied overhead was closed to the Cost of Goods Sold account. Required a. Determine the number of equivalent units of production. b. Determine the product cost per equivalent unit. c. Calculate the total cost allocated between the ending work in process inventory and parts transferred to the assembly departmer d. Record the transactions in a partial set of T-accounts. Complete this question by entering your answers in the tabs below. Calculate the total cost allocated between the ending work in process inventory and parts transferred to the assembly department. (Do not round intermediate calculations.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started