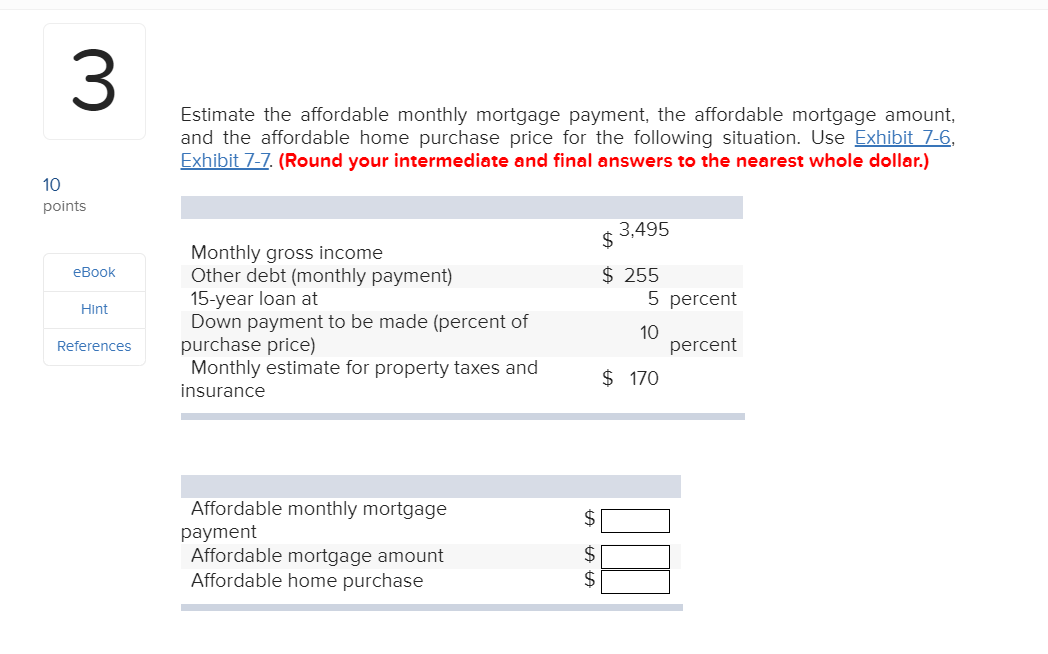

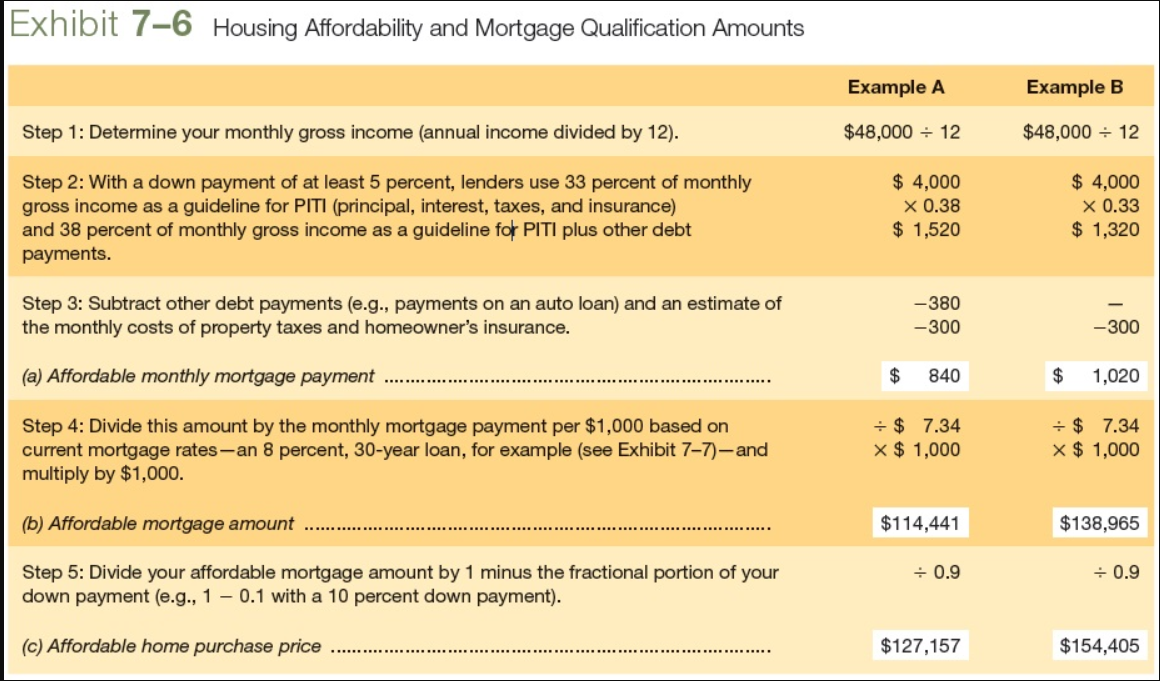

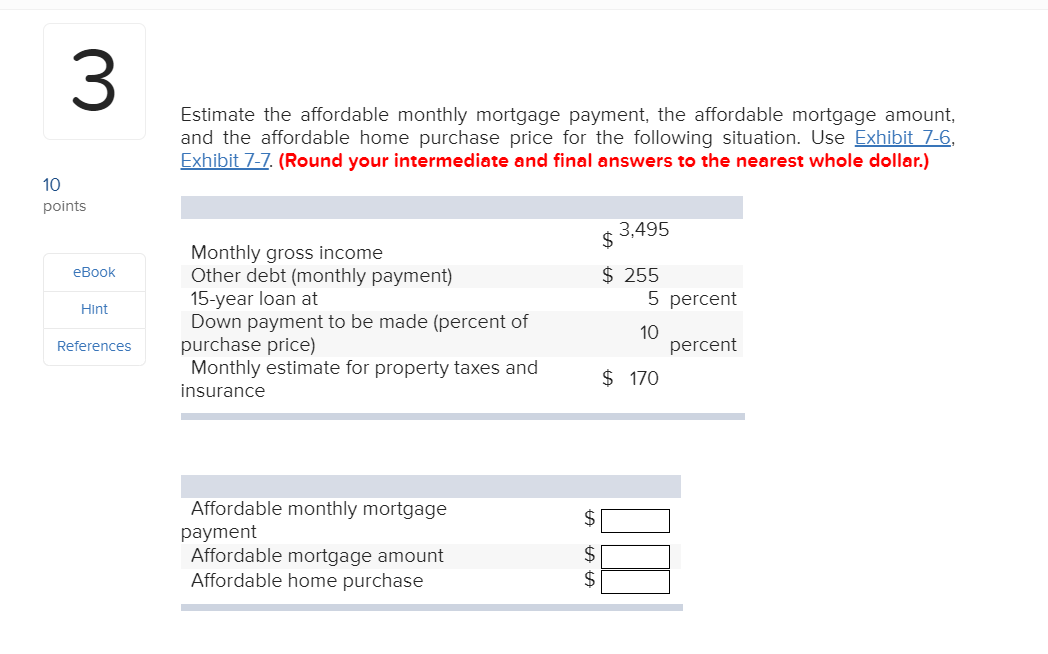

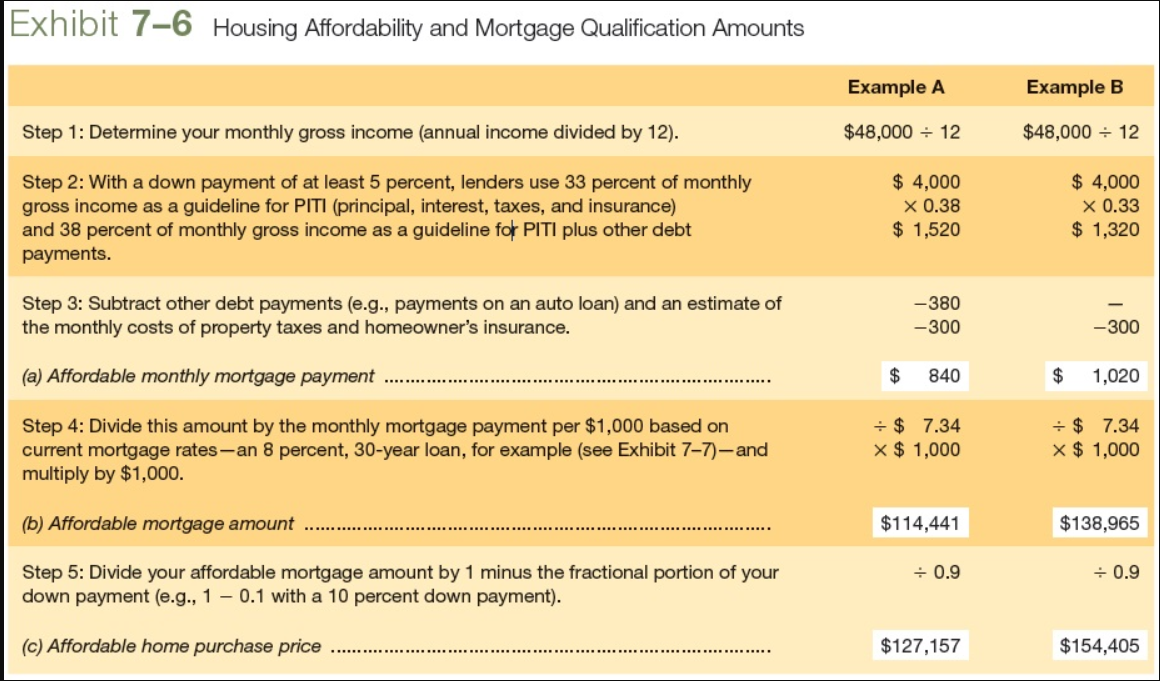

3 Estimate the affordable monthly mortgage payment, the affordable mortgage amount, and the affordable home purchase price for the following situation. Use Exhibit 7-6, Exhibit 7-7. (Round your intermediate and final answers to the nearest whole dollar.) 10 points $ 3,495 eBook Hint Monthly gross income Other debt (monthly payment) 15-year loan at Down payment to be made (percent of purchase price) Monthly estimate for property taxes and insurance $ 255 5 percent 10 percent $ 170 References Affordable monthly mortgage payment Affordable mortgage amount Affordable home purchase Exhibit 7-6 Housing Affordability and Mortgage Qualification Amounts Example A Example B Step 1: Determine your monthly gross income (annual income divided by 12). $48,000 = 12 $48,000 = 12 Step 2: With a down payment of at least 5 percent, lenders use 33 percent of monthly gross income as a guideline for PITI (principal, interest, taxes, and insurance) and 38 percent of monthly gross income as a guideline for PITI plus other debt payments. $ 4,000 x 0.38 $ 1,520 $ 4,000 x 0.33 $ 1,320 -380 Step 3: Subtract other debt payments (e.g., payments on an auto loan) and an estimate of the monthly costs of property taxes and homeowner's insurance. -300 -300 (a) Affordable monthly mortgage payment .... $ 840 $ 1,020 Step 4: Divide this amount by the monthly mortgage payment per $1,000 based on current mortgage rates-an 8 percent, 30-year loan, for example (see Exhibit 7-7)- and multiply by $1,000. - $ 7.34 X $ 1,000 $ 7.34 X $ 1,000 (b) Affordable mortgage amount ........ $114,441 $138,965 Step 5: Divide your affordable mortgage amount by 1 minus the fractional portion of your down payment (e.g., 1 0.1 with a 10 percent down payment). - 0.9 : 0.9 (c) Affordable home purchase price .... $127,157 $154,405 Term Rate 30 Years 25 Years 20 Years 15 Years 3.0% $4.22 $4.74 $5.55 $6.91 Exhibit 7-7 Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount) 4.49 5.01 5.80 3.5 4.0 5.28 4.5 5.56 4.77 5.07 5.37 5.68 7.15 7.40 7.65 7.91 8.17 5.0 6.06 6.33 6.60 6.88 7.16 5.85 5.5 6.14 6.0 6.00 6.44 8.43 8.71 6.5 6.32 6.67 7.45 7.0 7.06 7.75 8.98 6.65 6.99 7.5 7.39 9.27 8.06 8.36 8.0 7.34 7.72 9.56 3 Estimate the affordable monthly mortgage payment, the affordable mortgage amount, and the affordable home purchase price for the following situation. Use Exhibit 7-6, Exhibit 7-7. (Round your intermediate and final answers to the nearest whole dollar.) 10 points $ 3,495 eBook Hint Monthly gross income Other debt (monthly payment) 15-year loan at Down payment to be made (percent of purchase price) Monthly estimate for property taxes and insurance $ 255 5 percent 10 percent $ 170 References Affordable monthly mortgage payment Affordable mortgage amount Affordable home purchase Exhibit 7-6 Housing Affordability and Mortgage Qualification Amounts Example A Example B Step 1: Determine your monthly gross income (annual income divided by 12). $48,000 = 12 $48,000 = 12 Step 2: With a down payment of at least 5 percent, lenders use 33 percent of monthly gross income as a guideline for PITI (principal, interest, taxes, and insurance) and 38 percent of monthly gross income as a guideline for PITI plus other debt payments. $ 4,000 x 0.38 $ 1,520 $ 4,000 x 0.33 $ 1,320 -380 Step 3: Subtract other debt payments (e.g., payments on an auto loan) and an estimate of the monthly costs of property taxes and homeowner's insurance. -300 -300 (a) Affordable monthly mortgage payment .... $ 840 $ 1,020 Step 4: Divide this amount by the monthly mortgage payment per $1,000 based on current mortgage rates-an 8 percent, 30-year loan, for example (see Exhibit 7-7)- and multiply by $1,000. - $ 7.34 X $ 1,000 $ 7.34 X $ 1,000 (b) Affordable mortgage amount ........ $114,441 $138,965 Step 5: Divide your affordable mortgage amount by 1 minus the fractional portion of your down payment (e.g., 1 0.1 with a 10 percent down payment). - 0.9 : 0.9 (c) Affordable home purchase price .... $127,157 $154,405 Term Rate 30 Years 25 Years 20 Years 15 Years 3.0% $4.22 $4.74 $5.55 $6.91 Exhibit 7-7 Mortgage Payment Factors (principal and interest factors per $1,000 of loan amount) 4.49 5.01 5.80 3.5 4.0 5.28 4.5 5.56 4.77 5.07 5.37 5.68 7.15 7.40 7.65 7.91 8.17 5.0 6.06 6.33 6.60 6.88 7.16 5.85 5.5 6.14 6.0 6.00 6.44 8.43 8.71 6.5 6.32 6.67 7.45 7.0 7.06 7.75 8.98 6.65 6.99 7.5 7.39 9.27 8.06 8.36 8.0 7.34 7.72 9.56