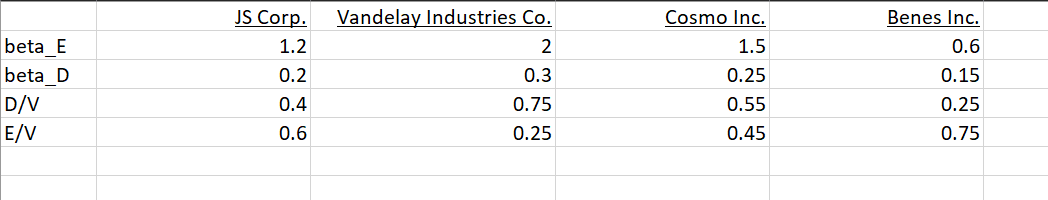

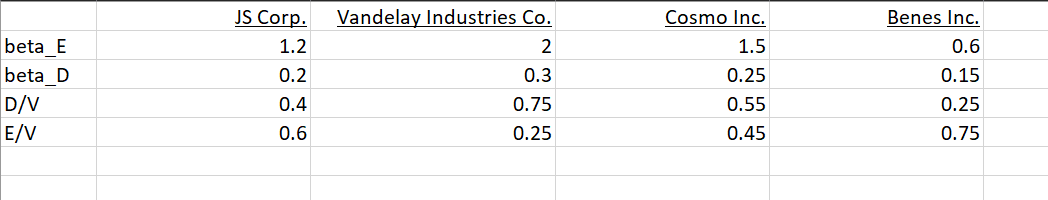

3. Estimating Betas with Comparables You have been hired to help Newman Ltd., a privately-owned company, estimate its cost of equity, and you have identified four comparable companies in the same industry that are publicly-traded: JS Corp., Cosmo Inc, Vandelay Industries Co., and Benes Inc. Data for the publicly-traded comparables are provided in the "q3data" worksheet of the "Assignment 2 Data" Excel spreadsheet posted on eClass. Newman Ltd. plans to maintain a target debt-to-equity ratio of 0.3. Assume that the comparable firms also follow a target leverage ratio policy, and face a common corporate income tax rate of 35%. IT I LIII . - (a) (4 points) Calculate unlevered beta for each comparable company. (b) (1 point) Estimate the unlevered beta for Newman Ltd. using the average of the unlevered betas calculated in part a). (c) (1 point) Estimate the unlevered beta for Newman Ltd. using the median of the unlevered betas calculated in part a). (d) (2 points) Assuming that Newman is a "typical company for its industry, should you use the estimate from part b) or part c) as its unlevered beta? Describe your reasoning (e) (3 points) Calculate the average debt-to-value, average equity-to-value, average lev- ered equity beta, and average debt beta for the four comparable companies. Based on these averages, what is the unlevered beta for a company with "average charac- teristics"? (f) (2 points) Is your answer from part e) different from you answer in part b)? Discuss which of the two answers provide a more reasonable estimate of Newman's unlevered beta. Vandelay Industries Co. beta_E beta_D D/V E/V JS Corp. 1.2 0.2 0.4 0.6 0.3 0.75 0.25 Cosmo Inc. 1.5 0.25 0.55 0.45 Benes Inc. 0.6 0.15 0.25 0.75 3. Estimating Betas with Comparables You have been hired to help Newman Ltd., a privately-owned company, estimate its cost of equity, and you have identified four comparable companies in the same industry that are publicly-traded: JS Corp., Cosmo Inc, Vandelay Industries Co., and Benes Inc. Data for the publicly-traded comparables are provided in the "q3data" worksheet of the "Assignment 2 Data" Excel spreadsheet posted on eClass. Newman Ltd. plans to maintain a target debt-to-equity ratio of 0.3. Assume that the comparable firms also follow a target leverage ratio policy, and face a common corporate income tax rate of 35%. IT I LIII . - (a) (4 points) Calculate unlevered beta for each comparable company. (b) (1 point) Estimate the unlevered beta for Newman Ltd. using the average of the unlevered betas calculated in part a). (c) (1 point) Estimate the unlevered beta for Newman Ltd. using the median of the unlevered betas calculated in part a). (d) (2 points) Assuming that Newman is a "typical company for its industry, should you use the estimate from part b) or part c) as its unlevered beta? Describe your reasoning (e) (3 points) Calculate the average debt-to-value, average equity-to-value, average lev- ered equity beta, and average debt beta for the four comparable companies. Based on these averages, what is the unlevered beta for a company with "average charac- teristics"? (f) (2 points) Is your answer from part e) different from you answer in part b)? Discuss which of the two answers provide a more reasonable estimate of Newman's unlevered beta. Vandelay Industries Co. beta_E beta_D D/V E/V JS Corp. 1.2 0.2 0.4 0.6 0.3 0.75 0.25 Cosmo Inc. 1.5 0.25 0.55 0.45 Benes Inc. 0.6 0.15 0.25 0.75