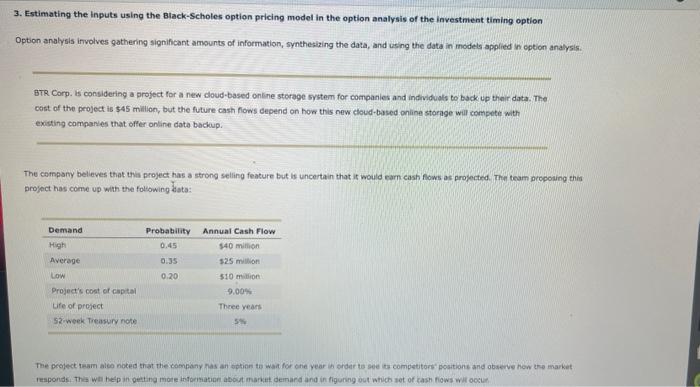

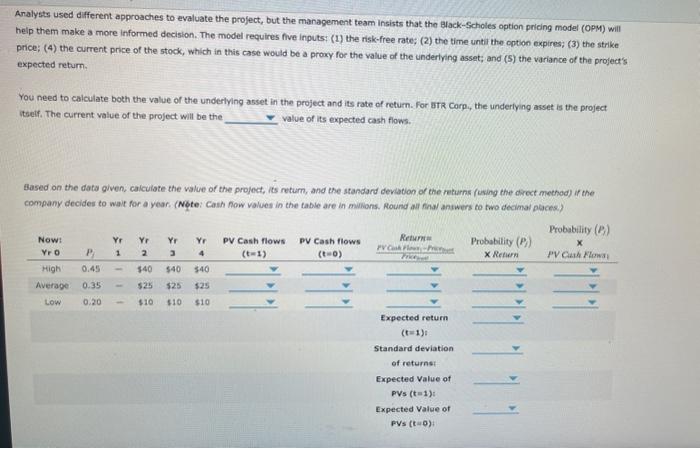

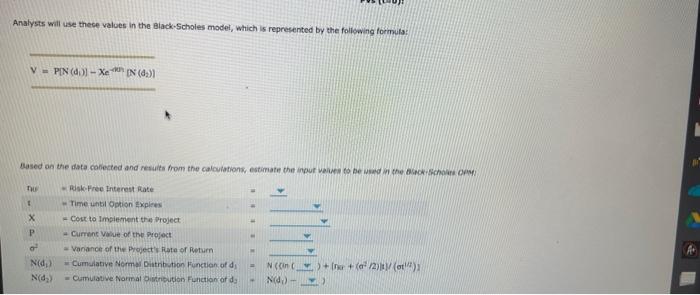

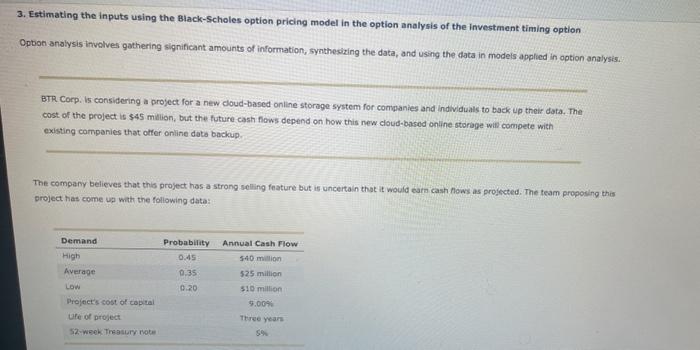

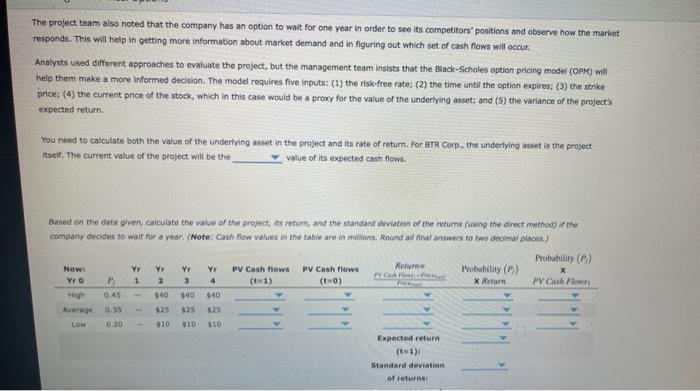

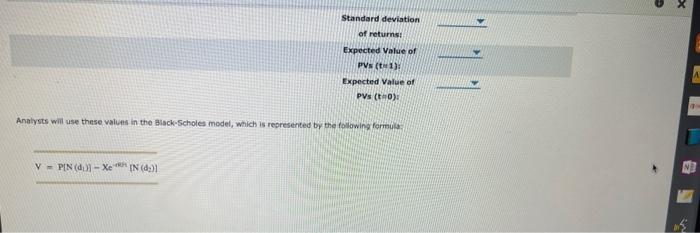

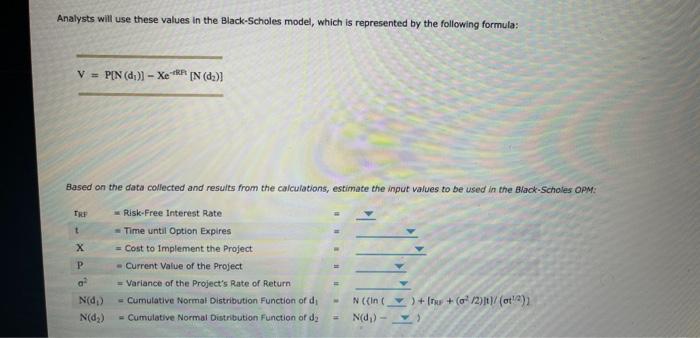

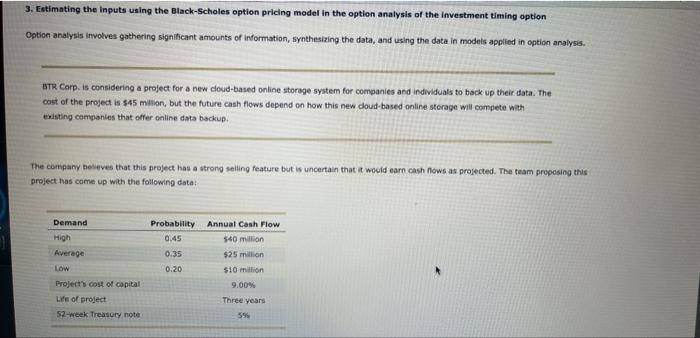

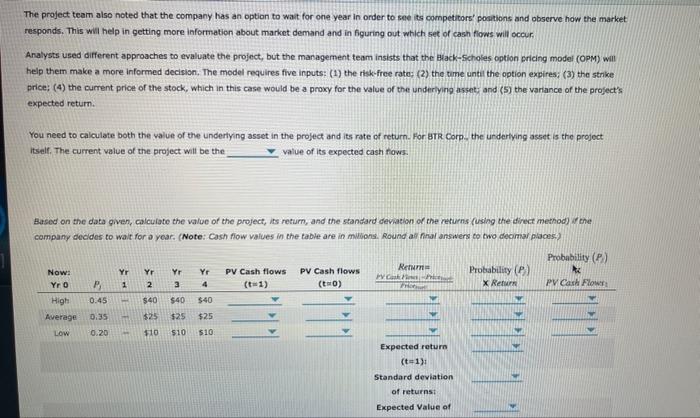

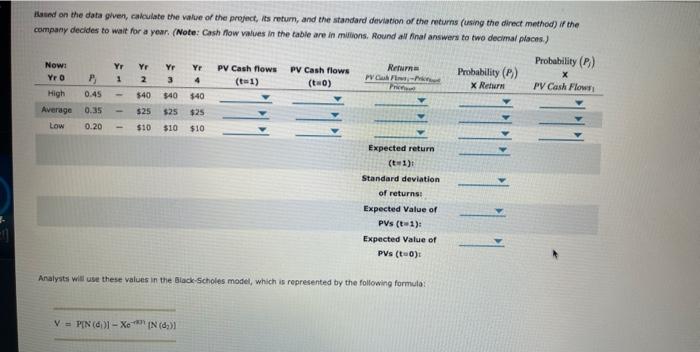

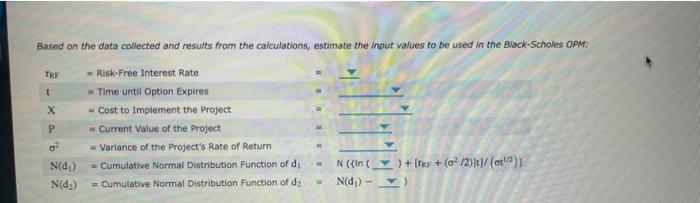

3. Estimating the inputs using the Black-Scholes option pricing model in the option analysis of the investmient timing option Opton analysis involves gathering significant amounts of information, synthesiaing the data, and using the data in models applited in option analysis. BTR Corp. is considering a profect for a new cloud-based onkine storage system for comparies and individuals to back up thair data- The cost of the peoject is 545 milion, but the future cash flows depend on hoo this new cloud-based online storage will compete with existing comparies that offer online dota bockup. The company beleves that tha proyect has a strong seling feature but is uncertain that it would carn cash fows as projected the tearm propouing this project has come up with the folsowing data: The profect tedam aleo nokeid that the company has an option ta wan for ohe year in order to see its competitors" positions and observe hew tre market Analysts used different approaches to evaluate the project, but the management team insists that the Biack-Scholes option pricing model (OpM) will help them make a more informed decision. The model requires five inputs;. (1) the risk-free rate; (2) the time unti the optoon expires; (3) the strike price; (4) the current price of the stock, which in this case would be a proxy for the value of the underiying asset; and (5) the variance of the project's expected returm. You need to calculate both the value of the underlying asset in the project and its rate of return. for atra Corp., the underlying asset is the project itself, The current value of the project will be the value of its expected cash flows. Hased on the data given, calculate the value of the project, its retum, and the standard devation of the returns (osing the direct method) if the company decides to wait for a year. (Note: Cash fow values in the table are in muilions. Aound aul fina) andwers to two decimar places.) Analysts will use these values in the Biack.Scholes model, which is represented by the following formuls: V=P[N(d1)]Xein[N(d2)) 3. Estimating the inputs using the Black-Scholes option pricing model in the option analysis of the investment timing option Opbon analysis involves gathering significant amounts of information, synthesizing the data, and using the data in models applied in option analysis. BTR Corp. Is considering a proyect for a new cloud-based online storoge system for companies and individuals to back up their data. The cost of the project is $45 malion, but the future cash fows depend on how this new cloud-based online storage wifi compete with existing companies that olfer online data backup The company believes that this project has a strong seling feature but is uncertaln that it would eara caash flows as projected. The team proposing this project has come up with the following data: The project team also noted that the company has an option to wait for one year in order to see its competitors" positions and observe how the market responds. This will help in getting more information about market demand and in figuring out which set of cash fows will occur. Analysts used different approaches to evaluate the project, but the management team insists that the Baack-Scholes option pricing model (OpM) will help them make a more informed decision. The model requires five inputs: (1) the risk-free rate: (2) the time until the option expires; (3) the strke price; (4) the current price of the stock, which in this case would bet a proxy for the value of the undortying asset: and (5) the variance of the project's expccted return. You need to calculate both the value of the undertying asset in the project and its rate of return. For arR Corp. the underlying asset is the project itseif, the curtent value of the project will be the value of its expected cash flows. dased ch the data given, calculate the value of the project, its rectimp, and the standard deviakion of the returns (fusing the dinect method) af the company decldes to wait for a vear. (Note: Cash flow values in the tabie are in muliont. Round ail final answers to two decimal Alaces.) Analysts will use these values in the alsck-Scholes model, which is represented by the following formuls: Analysts will use these values in the Black-Scholes model, which is represented by the following formula: V=P[N(d1)]XeRkP[N(d2)] Based on the data collected and resuits from the calculations, estimate the input values to be used in the Black-Scholes opm: 3. Estimating the inputs using the Black-Scholes option pricing model in the option analysis of the investment timing option Option analysis involves gathering significant amounts of information, synthesizing the data, and using the data in models applied in option analysis. BTR Corp. is considering a project for a new doud-based online storage system for companies and individuals to back up their data. The cost of the projed is $45mm mon, but the future cash flows depend on how this new doud based online storage will compete wath existing companies that offer online data backup. The company beleves that this project has a atrong seling feature but is uncertain that a would earn cash nows as projected. The team proposing thils project has came up with the following data: The project team also noted that the company has an option to wait for one year in onder to see its competitors' positions and observe how the market responds. This wil help in getting more information about market demand and in figuring out which set of cash flows will occur. Analysts used different approaches to evaluate the project, but the managernent team insists that the black-Sichokes option pricing model (OpM) will help them make a more informed decision. The model requires five inputs: (1) the risk-free rater (2) the tume unti the option expires; (3) the strike price; (4) the current price of the stock, which in this case would be a proxy for the value of the underiying assett and (5) the variance of the project's expected return. You need to calculate both the walue of the undertying asset in the project and its rate of return. For atr Corp. the underlying asret is the project itself, The current value of the project will be the value of its expected cash fiows. Based on the data given, colculate the value of the project, its retum, and the standard devalion of bhe returns (using the direct method) if che company decldes to wait for a year. (Note: Cash flow values in the table are in mugons. Round abl final answers to two decirnar placesh) issed on the data given, cakculate the value of the project, is retum, and the standard devation of the returns (using the direct method) if the company decides to wait for a year. (Note: Cash fow values in the table are in mitions. Round all fnal answers to two decimal plocks.) Analysts will use these values in the Glack Scholes model, which is represented by the following formula: V=P[N(di)]XcNx[N(d2)] Based on the data coliected and results from the calculations, estimate the input values to be used in the Black-Scholes oph 3. Estimating the inputs using the Black-Scholes option pricing model in the option analysis of the investmient timing option Opton analysis involves gathering significant amounts of information, synthesiaing the data, and using the data in models applited in option analysis. BTR Corp. is considering a profect for a new cloud-based onkine storage system for comparies and individuals to back up thair data- The cost of the peoject is 545 milion, but the future cash flows depend on hoo this new cloud-based online storage will compete with existing comparies that offer online dota bockup. The company beleves that tha proyect has a strong seling feature but is uncertain that it would carn cash fows as projected the tearm propouing this project has come up with the folsowing data: The profect tedam aleo nokeid that the company has an option ta wan for ohe year in order to see its competitors" positions and observe hew tre market Analysts used different approaches to evaluate the project, but the management team insists that the Biack-Scholes option pricing model (OpM) will help them make a more informed decision. The model requires five inputs;. (1) the risk-free rate; (2) the time unti the optoon expires; (3) the strike price; (4) the current price of the stock, which in this case would be a proxy for the value of the underiying asset; and (5) the variance of the project's expected returm. You need to calculate both the value of the underlying asset in the project and its rate of return. for atra Corp., the underlying asset is the project itself, The current value of the project will be the value of its expected cash flows. Hased on the data given, calculate the value of the project, its retum, and the standard devation of the returns (osing the direct method) if the company decides to wait for a year. (Note: Cash fow values in the table are in muilions. Aound aul fina) andwers to two decimar places.) Analysts will use these values in the Biack.Scholes model, which is represented by the following formuls: V=P[N(d1)]Xein[N(d2)) 3. Estimating the inputs using the Black-Scholes option pricing model in the option analysis of the investment timing option Opbon analysis involves gathering significant amounts of information, synthesizing the data, and using the data in models applied in option analysis. BTR Corp. Is considering a proyect for a new cloud-based online storoge system for companies and individuals to back up their data. The cost of the project is $45 malion, but the future cash fows depend on how this new cloud-based online storage wifi compete with existing companies that olfer online data backup The company believes that this project has a strong seling feature but is uncertaln that it would eara caash flows as projected. The team proposing this project has come up with the following data: The project team also noted that the company has an option to wait for one year in order to see its competitors" positions and observe how the market responds. This will help in getting more information about market demand and in figuring out which set of cash fows will occur. Analysts used different approaches to evaluate the project, but the management team insists that the Baack-Scholes option pricing model (OpM) will help them make a more informed decision. The model requires five inputs: (1) the risk-free rate: (2) the time until the option expires; (3) the strke price; (4) the current price of the stock, which in this case would bet a proxy for the value of the undortying asset: and (5) the variance of the project's expccted return. You need to calculate both the value of the undertying asset in the project and its rate of return. For arR Corp. the underlying asset is the project itseif, the curtent value of the project will be the value of its expected cash flows. dased ch the data given, calculate the value of the project, its rectimp, and the standard deviakion of the returns (fusing the dinect method) af the company decldes to wait for a vear. (Note: Cash flow values in the tabie are in muliont. Round ail final answers to two decimal Alaces.) Analysts will use these values in the alsck-Scholes model, which is represented by the following formuls: Analysts will use these values in the Black-Scholes model, which is represented by the following formula: V=P[N(d1)]XeRkP[N(d2)] Based on the data collected and resuits from the calculations, estimate the input values to be used in the Black-Scholes opm: 3. Estimating the inputs using the Black-Scholes option pricing model in the option analysis of the investment timing option Option analysis involves gathering significant amounts of information, synthesizing the data, and using the data in models applied in option analysis. BTR Corp. is considering a project for a new doud-based online storage system for companies and individuals to back up their data. The cost of the projed is $45mm mon, but the future cash flows depend on how this new doud based online storage will compete wath existing companies that offer online data backup. The company beleves that this project has a atrong seling feature but is uncertain that a would earn cash nows as projected. The team proposing thils project has came up with the following data: The project team also noted that the company has an option to wait for one year in onder to see its competitors' positions and observe how the market responds. This wil help in getting more information about market demand and in figuring out which set of cash flows will occur. Analysts used different approaches to evaluate the project, but the managernent team insists that the black-Sichokes option pricing model (OpM) will help them make a more informed decision. The model requires five inputs: (1) the risk-free rater (2) the tume unti the option expires; (3) the strike price; (4) the current price of the stock, which in this case would be a proxy for the value of the underiying assett and (5) the variance of the project's expected return. You need to calculate both the walue of the undertying asset in the project and its rate of return. For atr Corp. the underlying asret is the project itself, The current value of the project will be the value of its expected cash fiows. Based on the data given, colculate the value of the project, its retum, and the standard devalion of bhe returns (using the direct method) if che company decldes to wait for a year. (Note: Cash flow values in the table are in mugons. Round abl final answers to two decirnar placesh) issed on the data given, cakculate the value of the project, is retum, and the standard devation of the returns (using the direct method) if the company decides to wait for a year. (Note: Cash fow values in the table are in mitions. Round all fnal answers to two decimal plocks.) Analysts will use these values in the Glack Scholes model, which is represented by the following formula: V=P[N(di)]XcNx[N(d2)] Based on the data coliected and results from the calculations, estimate the input values to be used in the Black-Scholes oph