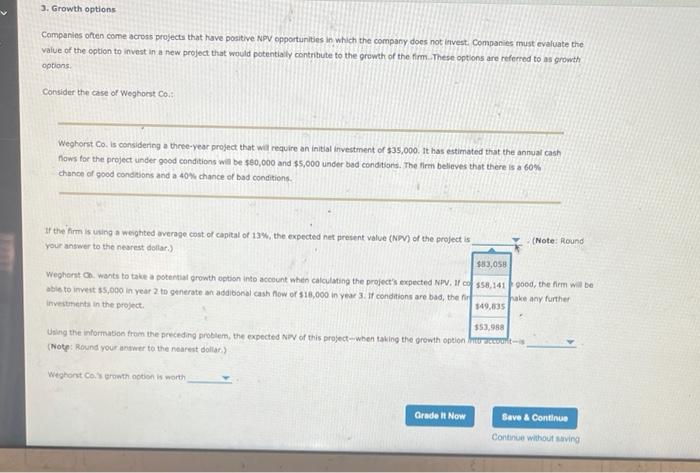

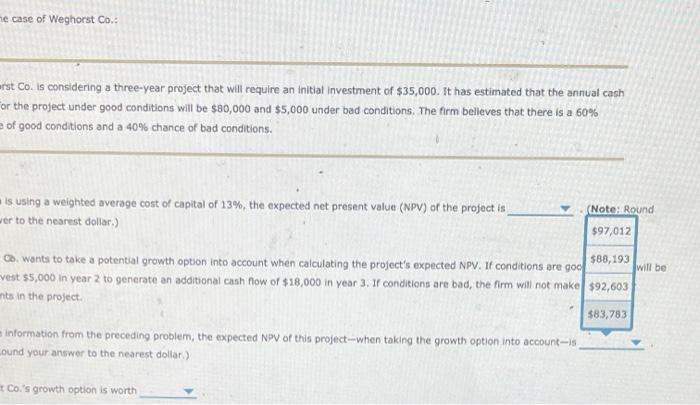

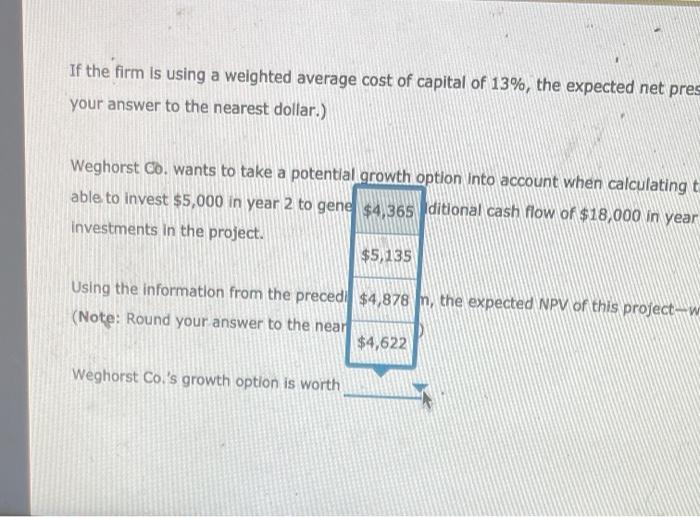

3. Growth options Companies often come across projects that have positive NPV opportunities in which the company does not invest Companies must evaluate the value of the option to invest in a new project that would potentially contribute to the growth of the firm.These options are referred to as growth options Consider the case of Weghorst Co. Weghorst Co. is considering a three-year project that we require an initial investment of $35,000. It has estimated that the annual cash nows for the project under good conditions will be $60,000 and $5,000 under bad conditions. The firm believes that there is a 60% chance of good conditions and a 40% chance of bad conditions If the firm is using a weighted average cost of capital of 13%, the expected net present Value (NPV) of the project is (Note: Round your answer to the nearest dollar) $3,058 Weghorst wants to take a potential growth option into account when calculating the project's expected NPV. 1558.141 pood, the firm will be able to invest $5,000 in year 2 to generate an additional cash now of 518,000 in Yew 3.1 conditions are bad, the fake any further Investments in the project $49,135 $53,958 Uning the information from the preceding problem, the expected NPV of this project--when taking the growth option toccolt- (Note: Round your answer to the nearest dollar) Weghort Courowth notion is worth Grade It Now Save & Continue Continue without saving he case of Weghorst Co. erst Co. is considering a three-year project that will require an initial investment of $35,000. It has estimated that the annual cash For the project under good conditions will be $80,000 and $5,000 under bad conditions. The firm belleves that there is a 60% of good conditions and a 40% chance of bad conditions. is using a weighted average cost of capital of 13%, the expected net present value (NPV) or the project is wer to the nearest dollar) (Note: Round $97,012 $68,193 Co wants to take a potential growth option into account when calculating the project's expected NPV. If conditions are goo will be vest $5,000 in year 2 to generate an additional cash flow of $18,000 in year 3. Il conditions are bad, the firm will not make $92,603 mts in the project $83,783 Information from the preceding problem, the expected NPV of this project-when taking the growth option into account -- ound your answer to the nearest dollar) Co.'s growth option is worth If the firm is using a weighted average cost of capital of 13%, the expected net pres your answer to the nearest dollar.) Weghorst Co. wants to take a potential growth option into account when calculating t able to invest $5,000 in year 2 to gene $4,365 ditional cash flow of $18,000 in year Investments in the project. $5,135 Using the information from the precedil $4,878 In, the expected NPV of this project-W (Note: Round your answer to the near $4,622 Weghorst Co.'s growth option is worth