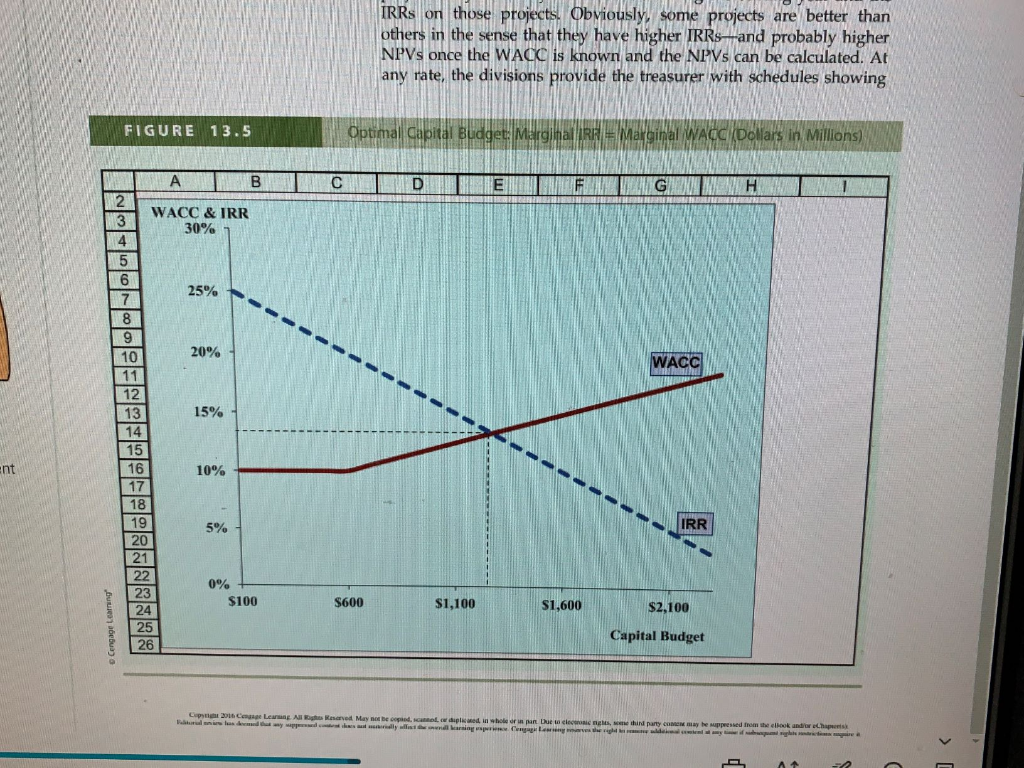

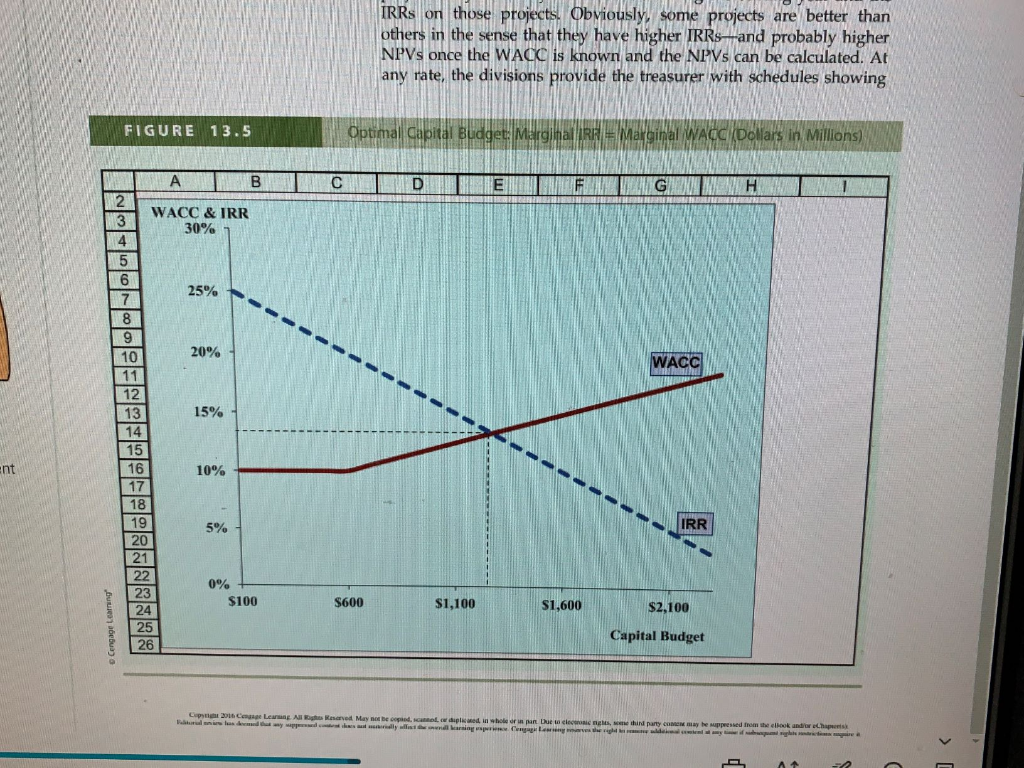

3 - In terms of Figure 13-5. a) In terms of Figure 13-5 what will happen to WACC if interest rates went up? b) In terms of Figure 13-5 what will happen to IRR if interest rates went up? c) In terms of Figure 13-5 where will the new equilibrium be? More investment or less investment? d) How would an event such as the credit crisis of 2008, where interest rates for many corporate borrowers climbed quite high, affect the size of a firm's capital budget? cweRRS on those Prorects Obsiously., some projects are better than rs in the sense that they have higher IRR and probably higher NPVs once the WACC is known and the NIVs can be calculated. At any rate, the divisions provide the treasurer with schedules showing ie rs in mili illions) FIGURE 13.5 WACC & IRR 30% 4 WACC 20% 10 12 13 14 15 16 17 18 19 20 15% 10% nt IRR 5% 21 S1.600 23 24 25 $100 $600 $1,100 $2,100 Capital Budget 26 el r duplswed in whole or in nan Due tn eleconic nels, wne thind party conenm may be sappessed fnom the ellook and'or ethapents 3 - In terms of Figure 13-5. a) In terms of Figure 13-5 what will happen to WACC if interest rates went up? b) In terms of Figure 13-5 what will happen to IRR if interest rates went up? c) In terms of Figure 13-5 where will the new equilibrium be? More investment or less investment? d) How would an event such as the credit crisis of 2008, where interest rates for many corporate borrowers climbed quite high, affect the size of a firm's capital budget? cweRRS on those Prorects Obsiously., some projects are better than rs in the sense that they have higher IRR and probably higher NPVs once the WACC is known and the NIVs can be calculated. At any rate, the divisions provide the treasurer with schedules showing ie rs in mili illions) FIGURE 13.5 WACC & IRR 30% 4 WACC 20% 10 12 13 14 15 16 17 18 19 20 15% 10% nt IRR 5% 21 S1.600 23 24 25 $100 $600 $1,100 $2,100 Capital Budget 26 el r duplswed in whole or in nan Due tn eleconic nels, wne thind party conenm may be sappessed fnom the ellook and'or ethapents