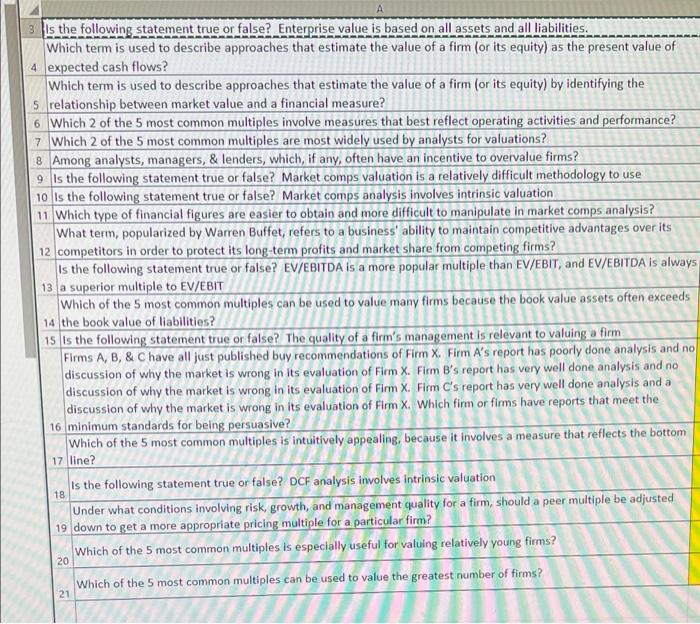

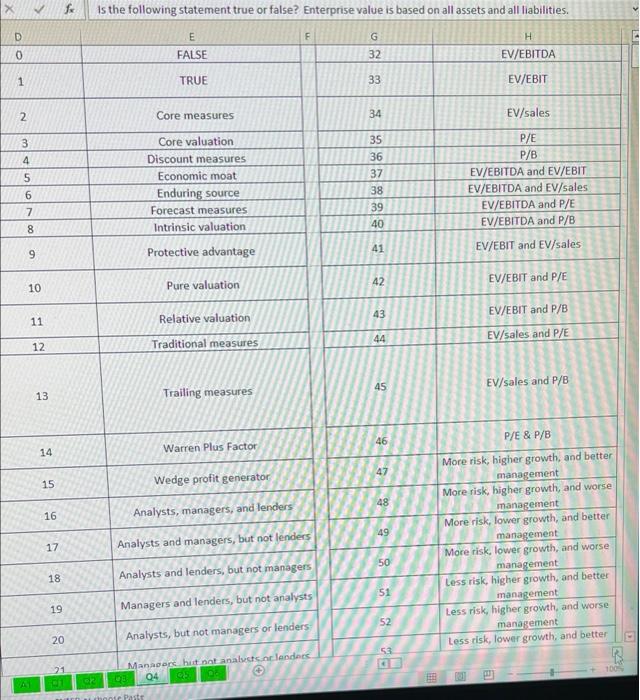

3 Is the following statement true or false? Enterprise value is based on all assets and all liabilities. Which term is used to describe approaches that estimate the value of a firm (or its equity) as the present value of 4 expected cash flows? Which term is used to describe approaches that estimate the value of a firm (or its equity) by identifying the 5 relationship between market value and a financial measure? 6 Which 2 of the 5 most common multiples involve measures that best reflect operating activities and performance? 7 Which 2 of the 5 most common multiples are most widely used by analysts for valuations? 8. Among analysts, managers, & lenders, which, if any, often have an incentive to overvalue firms? 9 Is the following statement true or false? Market comps valuation is a relatively difficult methodology to use 10 is the following statement true or false? Market comps analysis involves intrinsic valuation 11. Which type of financial figures are easier to obtain and more difficult to manipulate in market comps analysis? What term, popularized by Warren Buffet, refers to a business' ability to maintain competitive advantages over its 12 competitors in order to protect its long-term profits and market share from competing firms? Is the following statement true or false? EV/EBITDA is a more popular multiple than EV/EBIT, and EV/EBITDA is always 13 a superior multiple to EV/EBIT Which of the 5 most common multiples can be used to value many firms because the book value assets often exceeds 14 the book value of liabilities? 15 Is the following statement true or false? The quality of a firm's management is relevant to valuing a firm Firms A, B, & C have all just published buy recommendations of Firm X. Firm A's report has poorly done analysis and no discussion of why the market is wrong in its evaluation of Firm X. Firm B's report has very well done analysis and no discussion of why the market is wrong in its evaluation of Firm X. Firm C's report has very well done analysis and a discussion of why the market is wrong in its evaluation of Firm X. Which firm or firms have reports that meet the 16 minimum standards for being persuasive? Which of the 5 most common multiples is intuitively appealing, because it involves a measure that reflects the bottom 17 line? is the following statement true or false? DCF analysis involves intrinsic valuation Under what conditions involving risk, growth, and management quality for a firm, should a peer multiple be adjusted 19 down to get a more appropriate pricing multiple for a particular firm? Which of the 5 most common multiples is especially useful for valuing relatively young firms? Which of the 5 most common multiples can be used to value the greatest number of firms? 18 20 21 fo D Is the following statement true or false? Enterprise value is based on all assets and all liabilities. G H FALSE 32 EV/EBITDA E F 0 1 TRUE 33 EV/EBIT Core measures 34 EV/sales N 3 4 5 6 7 35 36 37 38 Core valuation Discount measures Economic moat Enduring source Forecast measures Intrinsic valuation Protective advantage P/E P/B EV/EBITDA and EV/EBIT EV/EBITDA and EV/sales EV/EBITDA and P/E EV/EBITDA and P/B EV/EBIT and EV/sales 39 40 8 41 9 42 EV/EBIT and P/E 10 Pure valuation 43 11 Relative valuation Traditional measures EV/EBIT and P/B EV/sales and P/E 44 12 45 EV/sales and P/B 13 Trailing measures 46 14 Warren Plus Factor 47 15 Wedge profit generator 48 16 Analysts, managers, and lenders 49 P/E & P/B More risk, higher growth, and better management More risk, higher growth, and worse management More risk, lower growth, and better management More risk, lower growth, and worse management Less risk, higher growth, and better management Less risk, higher growth, and worse management Less risk, lower growth, and better 17 Analysts and managers, but not lenders 50 18 Analysts and lenders, but not managers 51 19 Managers and lenders, but not analysts 52 20 Analysts, but not managers or lenders 53 21 Mansard hitnotanalustalando DB 04 100 e Past 3 Is the following statement true or false? Enterprise value is based on all assets and all liabilities. Which term is used to describe approaches that estimate the value of a firm (or its equity) as the present value of 4 expected cash flows? Which term is used to describe approaches that estimate the value of a firm (or its equity) by identifying the 5 relationship between market value and a financial measure? 6 Which 2 of the 5 most common multiples involve measures that best reflect operating activities and performance? 7 Which 2 of the 5 most common multiples are most widely used by analysts for valuations? 8. Among analysts, managers, & lenders, which, if any, often have an incentive to overvalue firms? 9 Is the following statement true or false? Market comps valuation is a relatively difficult methodology to use 10 is the following statement true or false? Market comps analysis involves intrinsic valuation 11. Which type of financial figures are easier to obtain and more difficult to manipulate in market comps analysis? What term, popularized by Warren Buffet, refers to a business' ability to maintain competitive advantages over its 12 competitors in order to protect its long-term profits and market share from competing firms? Is the following statement true or false? EV/EBITDA is a more popular multiple than EV/EBIT, and EV/EBITDA is always 13 a superior multiple to EV/EBIT Which of the 5 most common multiples can be used to value many firms because the book value assets often exceeds 14 the book value of liabilities? 15 Is the following statement true or false? The quality of a firm's management is relevant to valuing a firm Firms A, B, & C have all just published buy recommendations of Firm X. Firm A's report has poorly done analysis and no discussion of why the market is wrong in its evaluation of Firm X. Firm B's report has very well done analysis and no discussion of why the market is wrong in its evaluation of Firm X. Firm C's report has very well done analysis and a discussion of why the market is wrong in its evaluation of Firm X. Which firm or firms have reports that meet the 16 minimum standards for being persuasive? Which of the 5 most common multiples is intuitively appealing, because it involves a measure that reflects the bottom 17 line? is the following statement true or false? DCF analysis involves intrinsic valuation Under what conditions involving risk, growth, and management quality for a firm, should a peer multiple be adjusted 19 down to get a more appropriate pricing multiple for a particular firm? Which of the 5 most common multiples is especially useful for valuing relatively young firms? Which of the 5 most common multiples can be used to value the greatest number of firms? 18 20 21 fo D Is the following statement true or false? Enterprise value is based on all assets and all liabilities. G H FALSE 32 EV/EBITDA E F 0 1 TRUE 33 EV/EBIT Core measures 34 EV/sales N 3 4 5 6 7 35 36 37 38 Core valuation Discount measures Economic moat Enduring source Forecast measures Intrinsic valuation Protective advantage P/E P/B EV/EBITDA and EV/EBIT EV/EBITDA and EV/sales EV/EBITDA and P/E EV/EBITDA and P/B EV/EBIT and EV/sales 39 40 8 41 9 42 EV/EBIT and P/E 10 Pure valuation 43 11 Relative valuation Traditional measures EV/EBIT and P/B EV/sales and P/E 44 12 45 EV/sales and P/B 13 Trailing measures 46 14 Warren Plus Factor 47 15 Wedge profit generator 48 16 Analysts, managers, and lenders 49 P/E & P/B More risk, higher growth, and better management More risk, higher growth, and worse management More risk, lower growth, and better management More risk, lower growth, and worse management Less risk, higher growth, and better management Less risk, higher growth, and worse management Less risk, lower growth, and better 17 Analysts and managers, but not lenders 50 18 Analysts and lenders, but not managers 51 19 Managers and lenders, but not analysts 52 20 Analysts, but not managers or lenders 53 21 Mansard hitnotanalustalando DB 04 100 e Past