Answered step by step

Verified Expert Solution

Question

1 Approved Answer

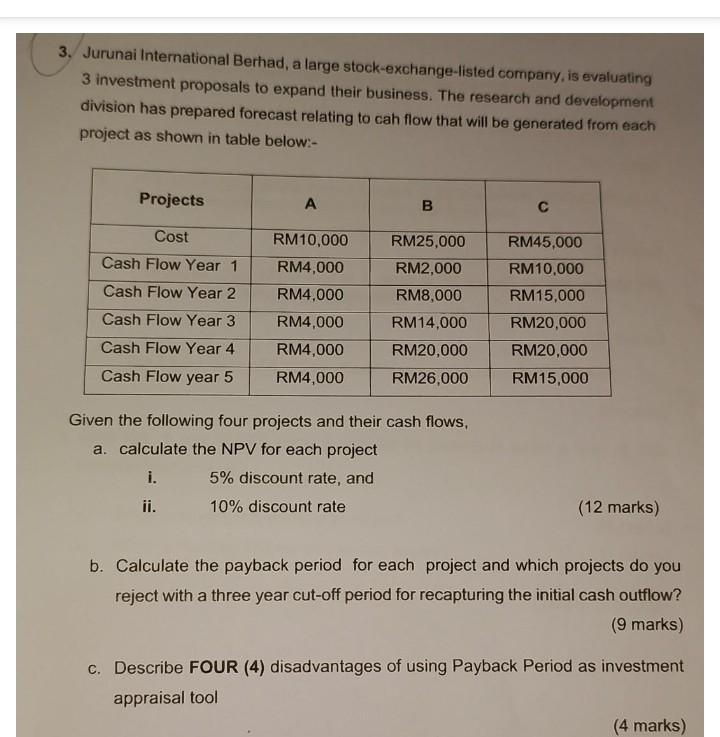

3. Jurunai International Berhad, a large stock-exchange-listed company, is evaluating 3 investment proposals to expand their business. The research and development division has prepared forecast

3. Jurunai International Berhad, a large stock-exchange-listed company, is evaluating 3 investment proposals to expand their business. The research and development division has prepared forecast relating to cah flow that will be generated from each project as shown in table below:- Given the following four projects and their cash flows, a. calculate the NPV for each project i. 5% discount rate, and ii. 10% discount rate (12 marks) b. Calculate the payback period for each project and which projects do you reject with a three year cut-off period for recapturing the initial cash outflow? (9 marks) c. Describe FOUR (4) disadvantages of using Payback Period as investment appraisal tool

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started