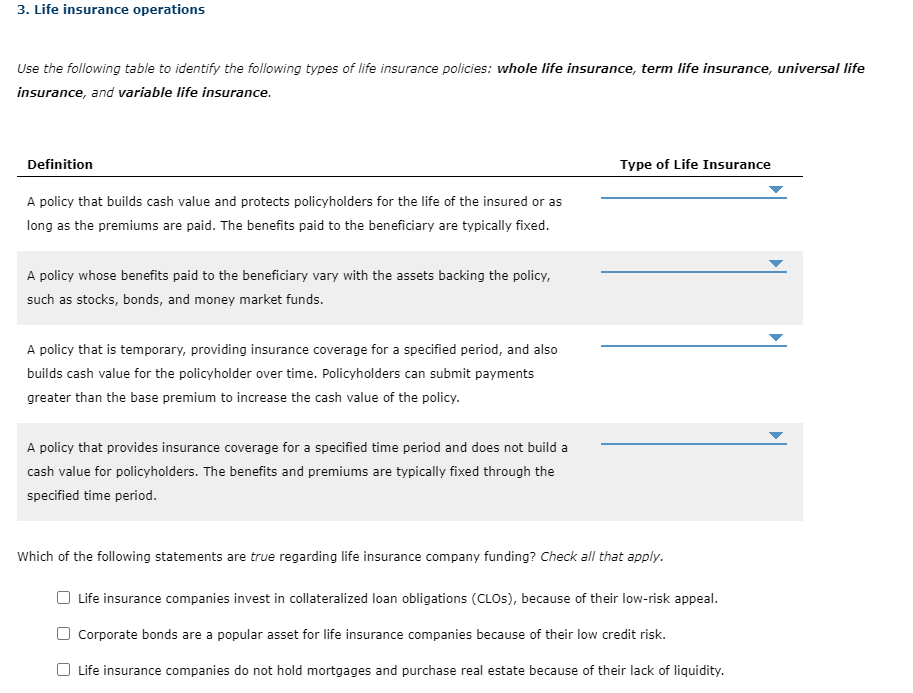

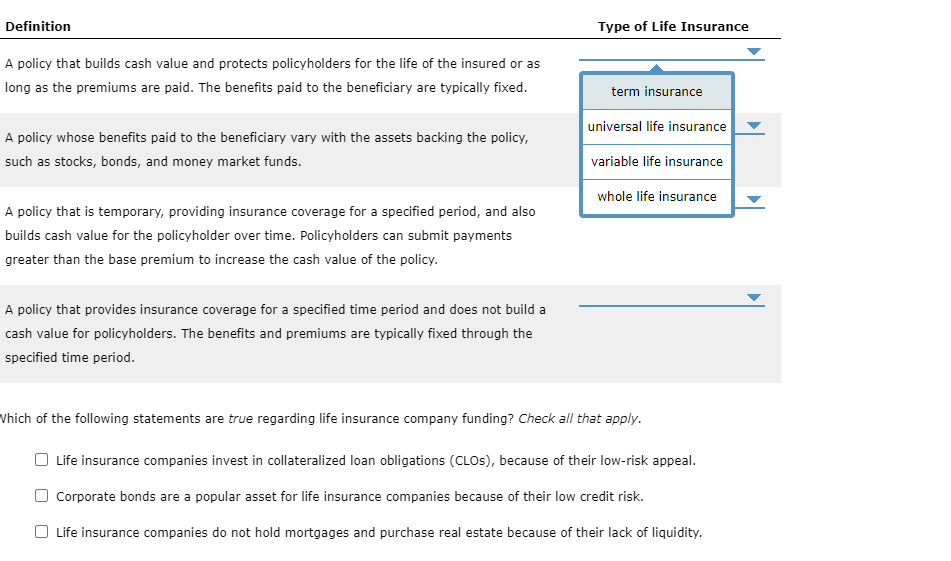

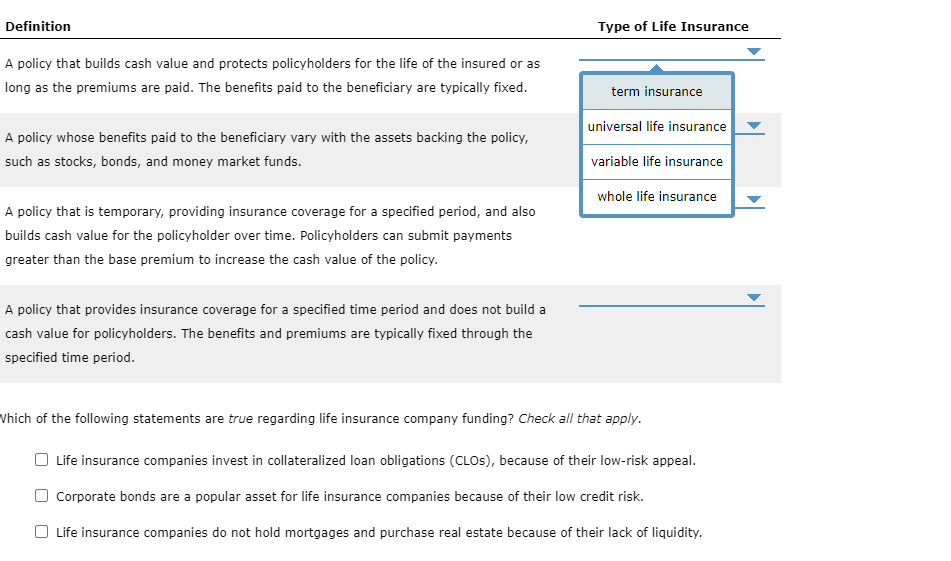

3. Life insurance operations Use the following table to identify the following types of life insurance policies: whole life insurance, term life insurance, universal life insurance, and variable life insurance. Definition Type of Life Insurance A policy that builds cash value and protects policyholders for the life of the insured or as long as the premiums are paid. The benefits paid to the beneficiary are typically fixed. A policy whose benefits paid to the beneficiary vary with the assets backing the policy, such as stocks, bonds, and money market funds. A policy that is temporary, providing insurance coverage for a specified period, and also builds cash value for the policyholder over time. Policyholders can submit payments greater than the base premium to increase the cash value of the policy. A policy that provides insurance coverage for a specified time period and does not build a cash value for policyholders. The benefits and premiums are typically fixed through the specified time period. Which of the following statements are true regarding life insurance company funding? Check all that apply. Life insurance companies invest in collateralized loan obligations (CLOs), because of their low-risk appeal. Corporate bonds are a popular asset for life insurance companies because of their low credit risk. Life insurance companies do not hold mortgages and purchase real estate because of their lack of liquidity. Definition Type of Life Insurance A policy that builds cash value and protects policyholders for the life of the insured or as long as the premiums are paid. The benefits paid to the beneficiary are typically fixed. term insurance universal life insurance A policy whose benefits paid to the beneficiary vary with the assets backing the policy, such as stocks, bonds, and money market funds. variable life insurance whole life insurance A policy that is temporary, providing insurance coverage for a specified period, and also builds cash value for the policyholder over time. Policyholders can submit payments greater than the base premium to increase the cash value of the policy. A policy that provides insurance coverage for a specified time period and does not build a cash value for policyholders. The benefits and premiums are typically fixed through the specified time period. Which of the following statements are true regarding life insurance company funding? Check all that apply. Life insurance companies invest in collateralized loan obligations (CLOs), because of their low-risk appeal. Corporate bonds are a popular asset for life insurance companies because of their low credit risk. Life insurance companies do not hold mortgages and purchase real estate because of their lack of liquidity