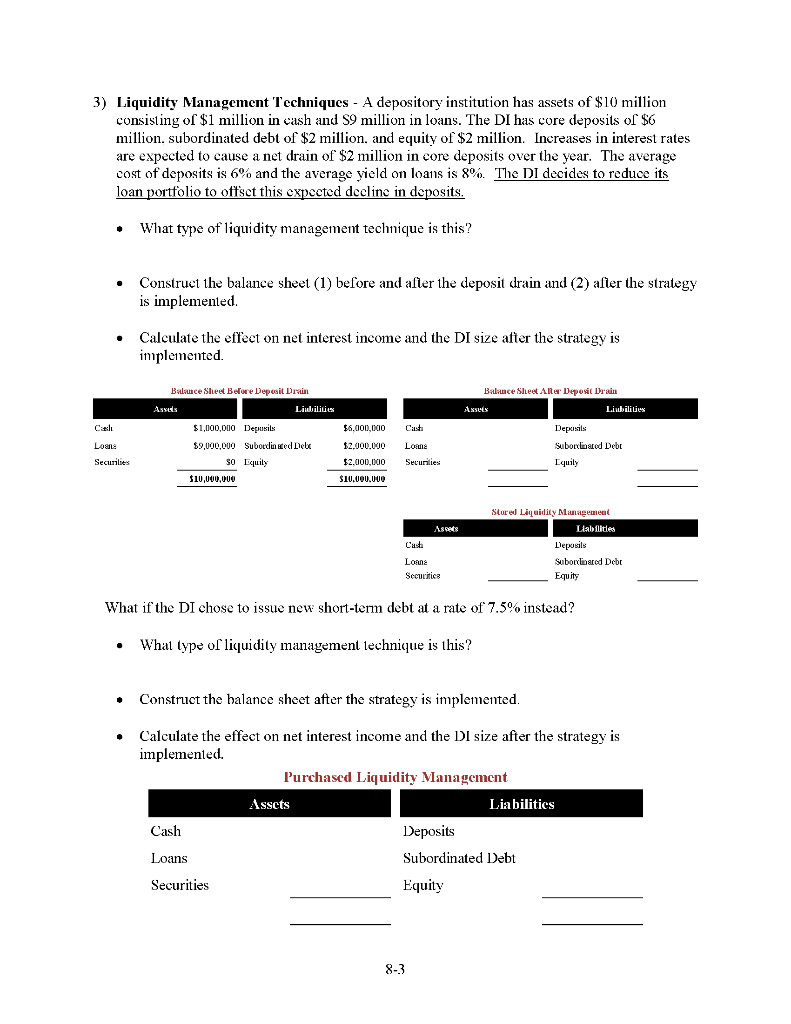

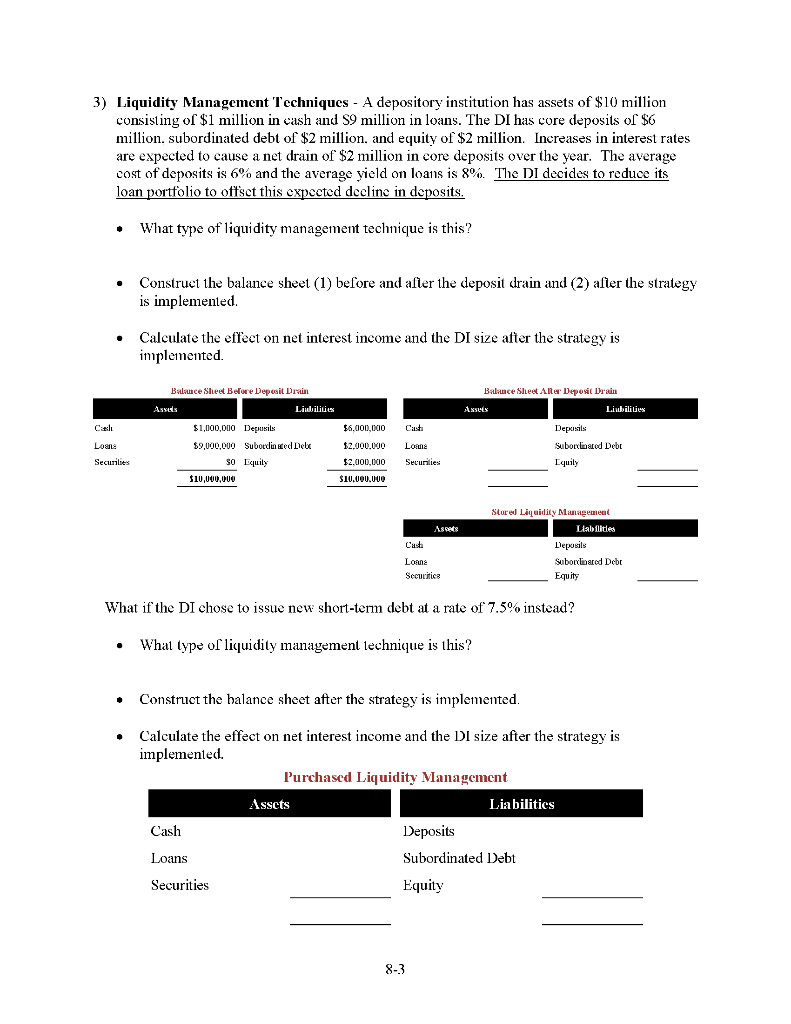

3) Liquidity Management Techniques - A depository institution has assets of $10 million consisting of $1 million in cash and S9 million in loans. The DI has core deposits of $6 million subordinated debt of $2 million, and equity of $2 million. Increases in interest rates are expected to cause a net drain of $2 million in core deposits over the year. The average cost of deposits is 6% and the average yield on loans is 8%. The DI decides to reduce its loan portfolio to offset this expected decline in deposits. What type of liquidity management technique is this? Construct the balance sheet (1) before and after the deposit drain and (2) after the strategy is implemented. Calculate the effect on net interest income and the DI size after the strategy is implemented Balance Sheet Altar Deposit Drain Balance Sheet Bore Deposit Drum Asses Libilities Asses Liubilities Carli Casti Loans Securities $1,000,000 Depuis $9,000,000 Subordinced Debe SO Equity $10,000,000 $6,000,000 12.000.000 $2.000.000 Lou Securities Depuis Subordinated Debt Equily $10.000.000 Stored Liquidity Management Liabilities Deposits Suborclared Debt Equity Long Secucitice What if the DI chose to issue new short-term debt at a rate of 7.5% instead? What type of liquidity management technique is this? . Construct the balance sheet after the strategy is implemented. Calculate the effect on net interest income and the Di size after the strategy is implemented. Purchased Liquidity Management Asscts Liabilities Cash Deposits Loans Subordinated Debt Securities Equity 8-3 3) Liquidity Management Techniques - A depository institution has assets of $10 million consisting of $1 million in cash and S9 million in loans. The DI has core deposits of $6 million subordinated debt of $2 million, and equity of $2 million. Increases in interest rates are expected to cause a net drain of $2 million in core deposits over the year. The average cost of deposits is 6% and the average yield on loans is 8%. The DI decides to reduce its loan portfolio to offset this expected decline in deposits. What type of liquidity management technique is this? Construct the balance sheet (1) before and after the deposit drain and (2) after the strategy is implemented. Calculate the effect on net interest income and the DI size after the strategy is implemented Balance Sheet Altar Deposit Drain Balance Sheet Bore Deposit Drum Asses Libilities Asses Liubilities Carli Casti Loans Securities $1,000,000 Depuis $9,000,000 Subordinced Debe SO Equity $10,000,000 $6,000,000 12.000.000 $2.000.000 Lou Securities Depuis Subordinated Debt Equily $10.000.000 Stored Liquidity Management Liabilities Deposits Suborclared Debt Equity Long Secucitice What if the DI chose to issue new short-term debt at a rate of 7.5% instead? What type of liquidity management technique is this? . Construct the balance sheet after the strategy is implemented. Calculate the effect on net interest income and the Di size after the strategy is implemented. Purchased Liquidity Management Asscts Liabilities Cash Deposits Loans Subordinated Debt Securities Equity 8-3