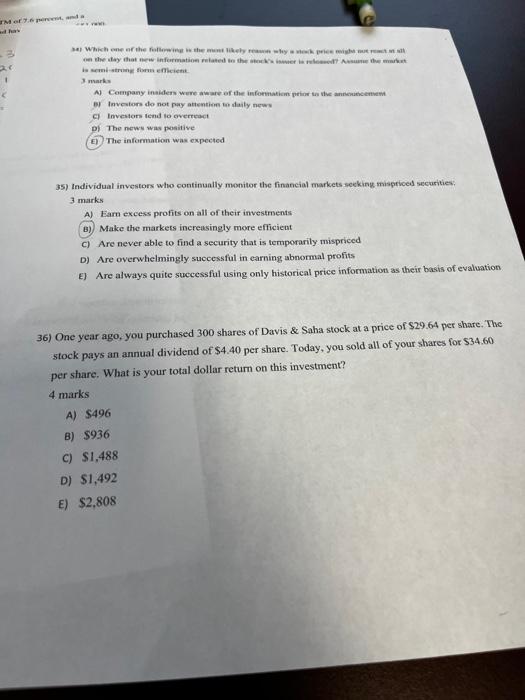

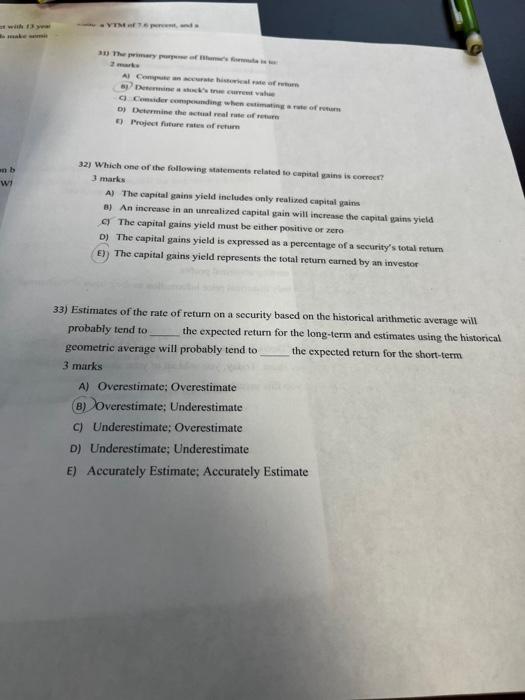

3 marks D) Investors do not pay atiention ten disty newe C) Investars tend to overtenct (D) The news was positive (E) The information was expected 35) Individual investors who continually monitor the financial markets secking mispriced securities: 3 marks A) Earu excess profits on all of their investroents B) Make the markets increusingly more efficient C) Are never able to find a security that is temporarily mispriced D) Are overwhelmingly successful in earning abnormal profits. E) Are always quite successful using only historical price information as their basis of evaluation 36) One year ago, you purchased 300 shares of Davis &. Saha stock at a price of $29.64 per share. The stock pays an annual dividend of $4.40 per share. Today, you sold all of your $ hares for $34.60 per share. What is your total dollar return on this investment? 4 marks A) $496 B) $936 c) 51,488 B) 51,492 E) 32,808 2 mak. D) Determine the netuat real ruse af retarn 9) Project fiture natew of retaim 32) Which ond of the following atatements related to eapital gains is comecn? 3 marks A) The capital gains yield includes only realixed capital gains B) An increase in an unrealized capital gain will increase the capital pains yield C) The capital gains yield must be either positive or zero D) The capital gains yield is expressed as a percentage of a security's total return E) The capital gains yield represents the total return earned by an investor 33) Estimates of the rate of return on a security based on the historical arithmetic average will probably tend to the expected return for the long-term and estimates using the historical geometric average will probably tend to the expected return for the short-term 3 marks A) Overestimate; Overestimate B) Overestimate; Underestimate c) Underestimate; Overestimate D) Underestimate; Underestimate E) Accurately Estimate; Accurately Estimate 3 marks D) Investors do not pay atiention ten disty newe C) Investars tend to overtenct (D) The news was positive (E) The information was expected 35) Individual investors who continually monitor the financial markets secking mispriced securities: 3 marks A) Earu excess profits on all of their investroents B) Make the markets increusingly more efficient C) Are never able to find a security that is temporarily mispriced D) Are overwhelmingly successful in earning abnormal profits. E) Are always quite successful using only historical price information as their basis of evaluation 36) One year ago, you purchased 300 shares of Davis &. Saha stock at a price of $29.64 per share. The stock pays an annual dividend of $4.40 per share. Today, you sold all of your $ hares for $34.60 per share. What is your total dollar return on this investment? 4 marks A) $496 B) $936 c) 51,488 B) 51,492 E) 32,808 2 mak. D) Determine the netuat real ruse af retarn 9) Project fiture natew of retaim 32) Which ond of the following atatements related to eapital gains is comecn? 3 marks A) The capital gains yield includes only realixed capital gains B) An increase in an unrealized capital gain will increase the capital pains yield C) The capital gains yield must be either positive or zero D) The capital gains yield is expressed as a percentage of a security's total return E) The capital gains yield represents the total return earned by an investor 33) Estimates of the rate of return on a security based on the historical arithmetic average will probably tend to the expected return for the long-term and estimates using the historical geometric average will probably tend to the expected return for the short-term 3 marks A) Overestimate; Overestimate B) Overestimate; Underestimate c) Underestimate; Overestimate D) Underestimate; Underestimate E) Accurately Estimate; Accurately Estimate