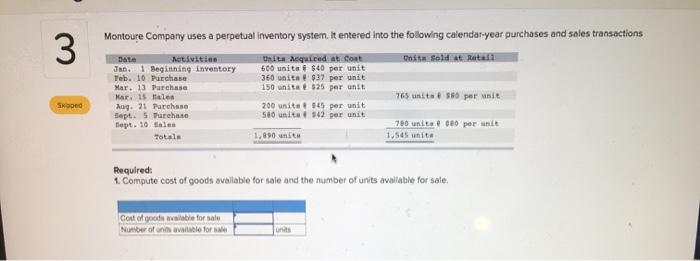

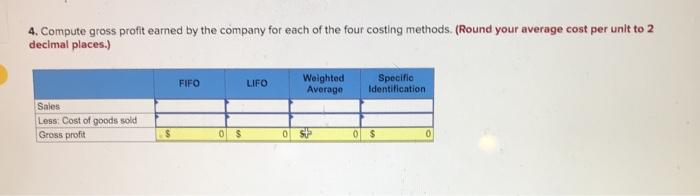

3 Montoure Company uses a perpetual inventory system. It entered into the following calendar-year purchases and sales transactions Data Activities Unita Acquired at coat i foto JAN. Beginning inventory 600 units $40 per unit Teb. 10 Purchase 360 unitat 937 per unit Mar. 13 Purchase 150 unitat 925 per unit Mar 15 Wales 765 units + 386 per unit Aug. 21 Parchase 200 units 545 per unit Sept. 5 Turchase 50 units. 342 per unit Dept. 10 sale 780 unita # 180 per unit Totale 1,890 units 1.545 unite Skoped Required: compute cost of goods available for sale and the number of units available for sale Cont of goods walate for sale Number of units available for units 2. Compute the number of units in ending inventory. Ending inventory units 4. Compute gross profit earned by the company for each of the four costing methods. (Round your average cost per unit to 2 decimal places.) FIFO LIFO Weighted Average Specific Identification Sales Less: Cost of goods sold Gross profit $ 0 $ 0 SP 0 $ 0 5. The company's manager earns a bonus based on a percent of gross profit. Which method of inventory costing produces the highest bonus for the manager? Weighted Average O FIFO Specific Identification LIFO 3 Montoure Company uses a perpetual inventory system. It entered into the following calendar-year purchases and sales transactions Data Activities Unita Acquired at coat i foto JAN. Beginning inventory 600 units $40 per unit Teb. 10 Purchase 360 unitat 937 per unit Mar. 13 Purchase 150 unitat 925 per unit Mar 15 Wales 765 units + 386 per unit Aug. 21 Parchase 200 units 545 per unit Sept. 5 Turchase 50 units. 342 per unit Dept. 10 sale 780 unita # 180 per unit Totale 1,890 units 1.545 unite Skoped Required: compute cost of goods available for sale and the number of units available for sale Cont of goods walate for sale Number of units available for units 2. Compute the number of units in ending inventory. Ending inventory units 4. Compute gross profit earned by the company for each of the four costing methods. (Round your average cost per unit to 2 decimal places.) FIFO LIFO Weighted Average Specific Identification Sales Less: Cost of goods sold Gross profit $ 0 $ 0 SP 0 $ 0 5. The company's manager earns a bonus based on a percent of gross profit. Which method of inventory costing produces the highest bonus for the manager? Weighted Average O FIFO Specific Identification LIFO