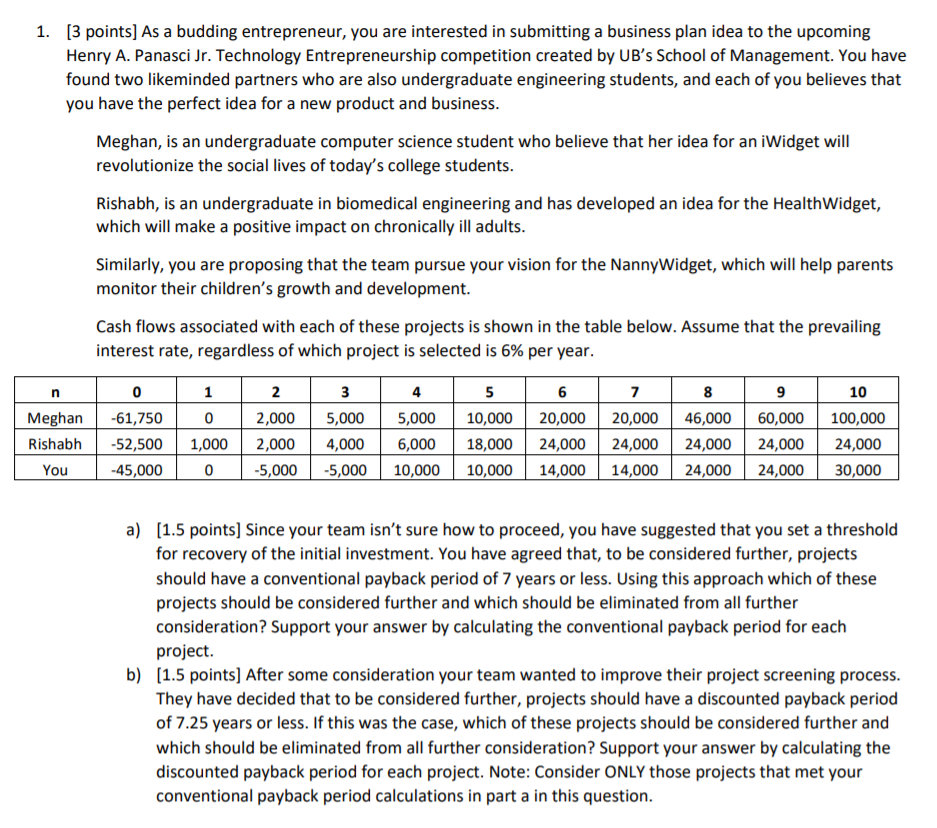

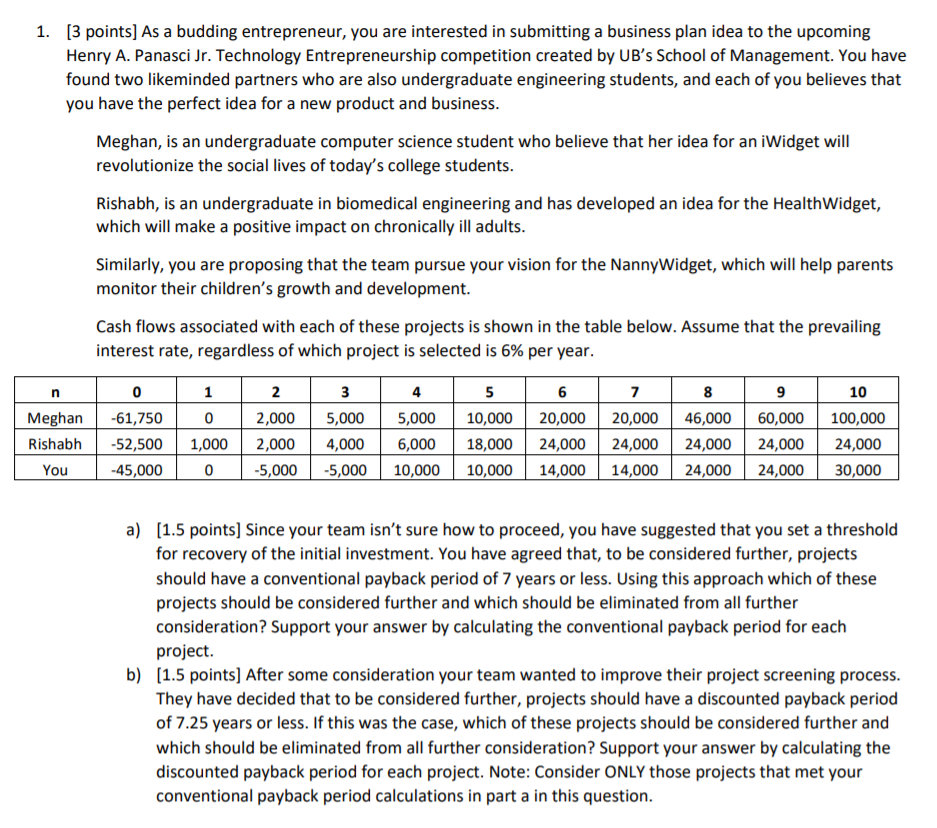

[3 points] As a budding entrepreneur, you are interested in submitting a business plan idea to the upcoming Henry A. Panasci Jr. Technology Entrepreneurship competition created by UB's School of Management. You have found two likeminded partners who are also undergraduate engineering students, and each of you believes that you have the perfect idea for a new product and business 1. Meghan, is an undergraduate computer science student who believe that her idea for an iWidget will revolutionize the social lives of today's college students Rishabh, is an undergraduate in biomedical engineering and has developed an idea for the HealthWidget, which will make a positive impact on chronically ill adults Similarly, you are proposing that the team pursue your vision for the NannyWidget, which will help parents monitor their children's growth and development. Cash flows associated with each of these projects is shown in the table below. Assume that the prevailing interest rate, regardless of which project is selected is 6% per year. 4 6 8 10 2,0005,0005,000 10,000 20,000 20,00046,000 60,000 100,000 Rishabh52,500 1,000 2,000 4,0006,00018,000 24,000 24,000 24,000 24,000 24,000 5,0005,00010,000 10,000 14,000 14,00024,000 24,000 30,000 Meghan-61,750 You 45,000 a) [1.5 points] Since your team isn't sure how to proceed, you have suggested that you set a threshold for recovery of the initial investment. You have agreed that, to be considered further, projects should have a conventional payback period of 7 years or less. Using this approach which of these projects should be considered further and which should be eliminated from all further consideration? Support your answer by calculating the conventional payback period for each project [1.5 points] After some consideration your team wanted to improve their project screening process They have decided that to be considered further, projects should have a discounted payback period of 7.25 years or less. If this was the case, which of these projects should be considered further and which should be eliminated from all further consideration? Support your answer by calculating the discounted payback period for each project. Note: Consider ONLY those projects that met your conventional payback period calculations in part a in this question. b)