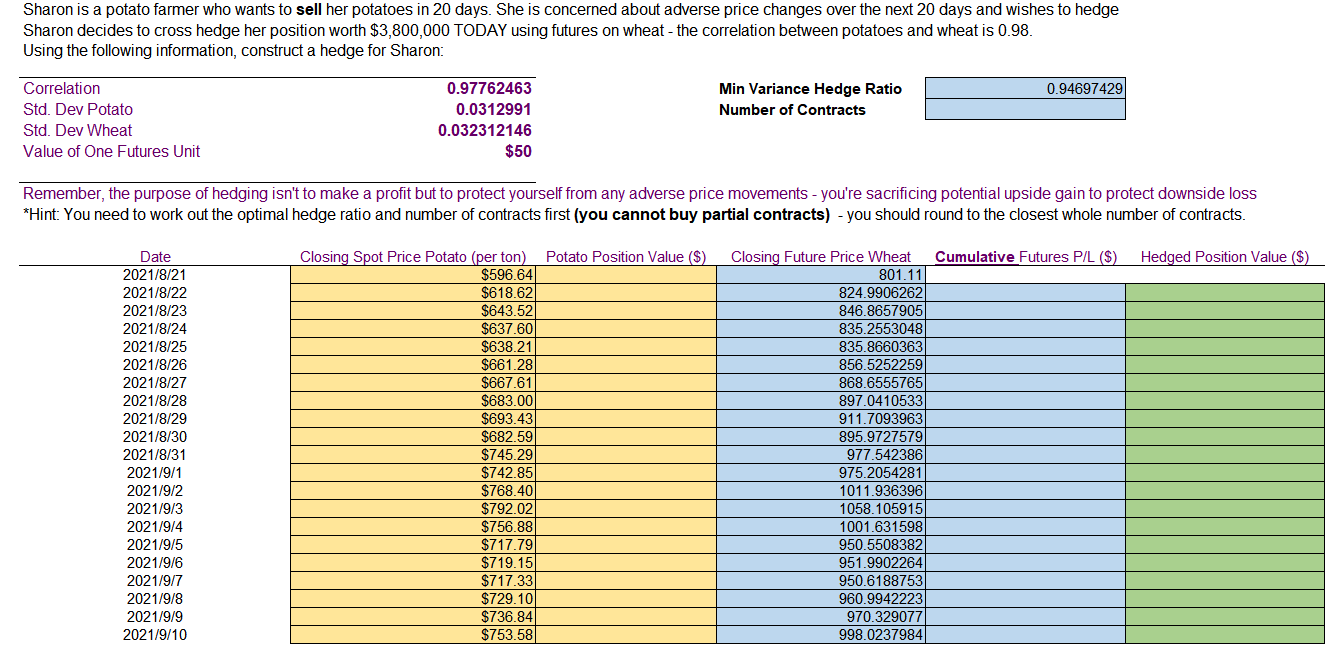

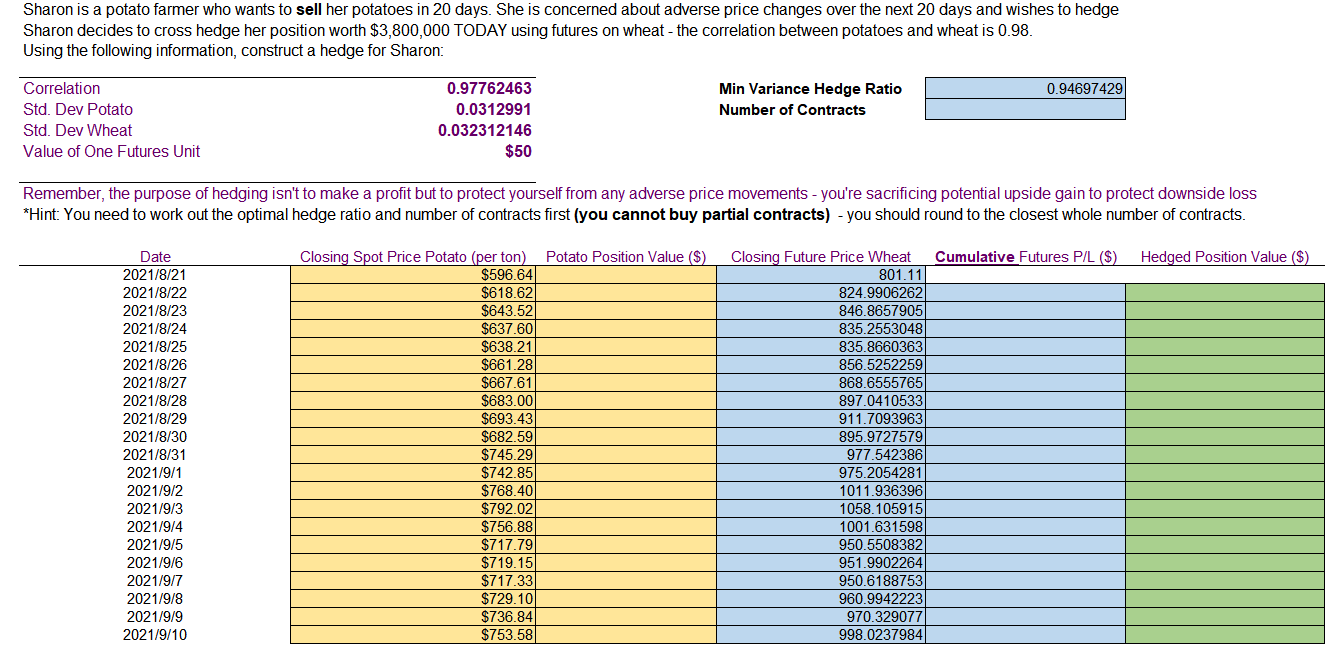

Sharon is a potato farmer who wants to sell her potatoes in 20 days. She is concerned about adverse price changes over the next 20 days and wishes to hedge Sharon decides to cross hedge her position worth $3,800,000 TODAY using futures on wheat - the correlation between potatoes and wheat is 0.98. Using the following information, construct a hedge for Sharon: 0.94697429 Min Variance Hedge Ratio Number of Contracts Correlation Std. Dev Potato Std. Dev Wheat Value of One Futures Unit 0.97762463 0.0312991 0.032312146 $50 Remember, the purpose of hedging isn't to make a profit but to protect yourself from any adverse price movements - you're sacrificing potential upside gain to protect downside loss *Hint: You need to work out the optimal hedge ratio and number of contracts first (you cannot buy partial contracts) - you should round to the closest whole number of contracts. Potato Position Value ($) Hedged Position Value ($) Date 2021/8/21 2021/8/22 2021/8/23 2021/8/24 2021/8/25 2021/8/26 2021/8/27 2021/8/28 2021/8/29 2021/8/30 2021/8/31 2021/9/1 2021/9/2 2021/9/3 2021/9/4 2021/9/5 2021/9/6 2021/9/7 2021/9/8 2021/9/9 2021/9/10 Closing Spot Price Potato (per ton) $596.64 $618.62 $643.52 $637.601 $638.21 $661.28 $667.61 $683.00 $693.43 $682.59 $745.29 $742.85 $768.40 $792.02 $756.88 $717.79 $719.15 $717.33 $729.10 $736.84 $753.58 Closing Future Price Wheat Cumulative Futures P/L (S) 801.11 824.9906262 846.8657905 835.2553048 835.8660363 856.5252259 868.6555765 897.0410533) 911.7093963 895.9727579 977.542386 975.2054281 1011.936396 1058.105915 1001.631598 950.5508382 951.9902264 950.6188753 960.9942223 970.329077 998.0237984 Sharon is a potato farmer who wants to sell her potatoes in 20 days. She is concerned about adverse price changes over the next 20 days and wishes to hedge Sharon decides to cross hedge her position worth $3,800,000 TODAY using futures on wheat - the correlation between potatoes and wheat is 0.98. Using the following information, construct a hedge for Sharon: 0.94697429 Min Variance Hedge Ratio Number of Contracts Correlation Std. Dev Potato Std. Dev Wheat Value of One Futures Unit 0.97762463 0.0312991 0.032312146 $50 Remember, the purpose of hedging isn't to make a profit but to protect yourself from any adverse price movements - you're sacrificing potential upside gain to protect downside loss *Hint: You need to work out the optimal hedge ratio and number of contracts first (you cannot buy partial contracts) - you should round to the closest whole number of contracts. Potato Position Value ($) Hedged Position Value ($) Date 2021/8/21 2021/8/22 2021/8/23 2021/8/24 2021/8/25 2021/8/26 2021/8/27 2021/8/28 2021/8/29 2021/8/30 2021/8/31 2021/9/1 2021/9/2 2021/9/3 2021/9/4 2021/9/5 2021/9/6 2021/9/7 2021/9/8 2021/9/9 2021/9/10 Closing Spot Price Potato (per ton) $596.64 $618.62 $643.52 $637.601 $638.21 $661.28 $667.61 $683.00 $693.43 $682.59 $745.29 $742.85 $768.40 $792.02 $756.88 $717.79 $719.15 $717.33 $729.10 $736.84 $753.58 Closing Future Price Wheat Cumulative Futures P/L (S) 801.11 824.9906262 846.8657905 835.2553048 835.8660363 856.5252259 868.6555765 897.0410533) 911.7093963 895.9727579 977.542386 975.2054281 1011.936396 1058.105915 1001.631598 950.5508382 951.9902264 950.6188753 960.9942223 970.329077 998.0237984