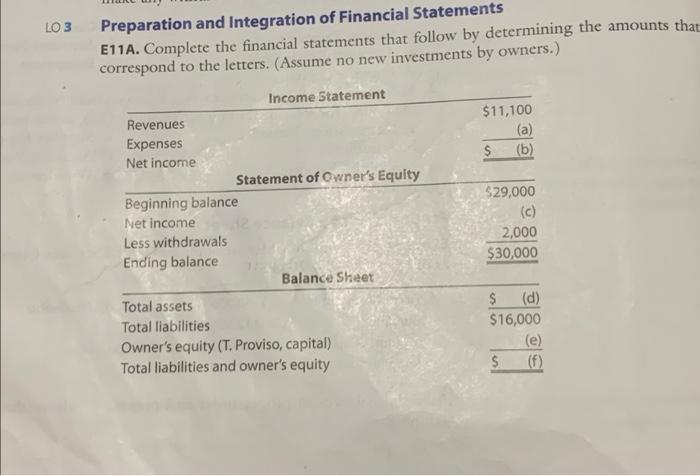

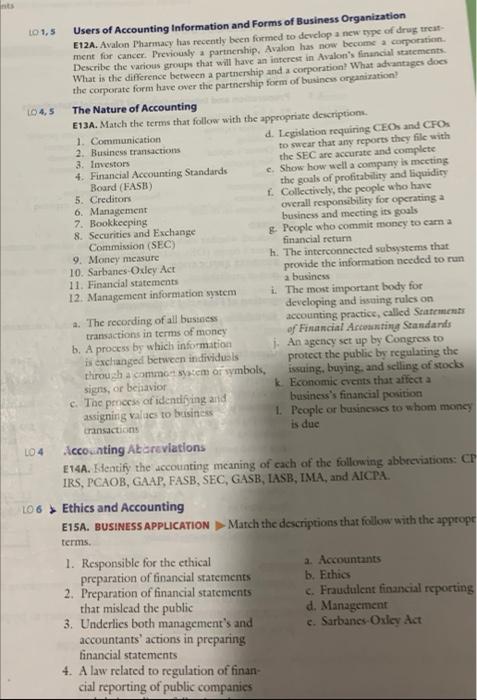

3 Preparation and Integration of Financial Statements E11A. Complete the financial statements that follow by determining the amounts that correspond to the letters. (Assume no new investments by owners.) io 1,5 Users of Accounting Information and Forms of Business Organization E12A. Avalon Tharmacy has recently been formed to devclop a new type of drug treatment for cancer. Previoualy a partnenhip, Avalon has now becoms a corporation. Describe the various groups that will have an interest in Avalon's financial statements. What is the difference between a partnership and a corporation? What advantages docs the corporate form have over the partnership form of busincss organiration? 104,5 The Nature of Accounting E13A. Match the terms that follow with the appropriate descriptions. 1. Communication d. Legillation requiring CEOS and CFOs 2. Business transactions to swcar that any reports thcy file with 3. Imveston 4. Financial Accounting Standards the SEC are accurate and complete. Board (FASB) 5. Credators 6. Management 7. Bookkecping 8. Securitics and Exchange Commission (SEC) c. Show how well a company is mecting 9. Mancy measurc the goals of profitability and liquidify 10. Sarbanes-Oxley Act f. Collectively, the people who have 11. Financial statements cverall responsibility for operating a 12. Management information syatem busincss and mecting its goals a. The recording of all busteess g. People who commit mancy to carm a financial return transactions in terms of money h. The interconnected sebsystems that b. A process by which information prowide the information needed to run if exchanged between individuals through a campoon syseem of symbols, a busincss sighs, or beinavior k. Feoncmic events that affect a c. Tac process of identifying and business's financial porition assigning values to buisinters. 1. People or busincsses to whom money transacticins is due 10.4 flecounting Atarcviations E14A. Kieatify the uccouating meaning of cach of the following abbreviations: CP IRS, PCAOB, GAAP, FASB, SEC, GASB, LASB, IMA, and AICPA. 106 * Ethics and Accounting E15A. BUSINESS APPLICATION D. Match the descriptions that follow with the apptope tcrms. 1. Responsible for the ethical a. Accountants preparation of financial statcments b. Frhies 2. Preparation of financial statcments c. Fraudulent financial reporting that mislead the public d. Managernent 3. Underlies both management's and C. Sarbancs. Dxley duet accountants' actions in preparing financial statements 4. A law related to regulation of financial reporting of public companics