Answered step by step

Verified Expert Solution

Question

1 Approved Answer

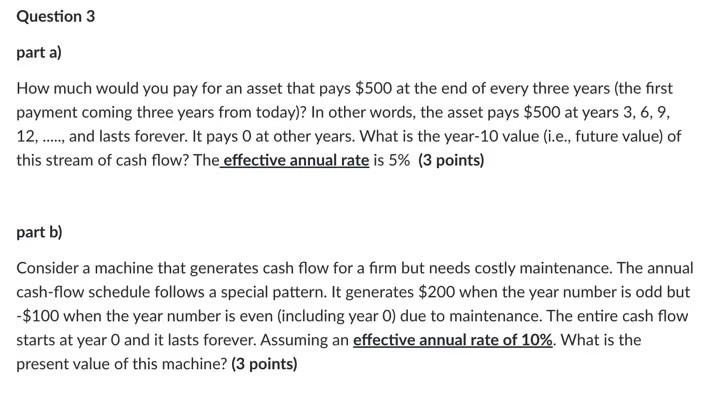

3 Question 3 part a) How much would you pay for an asset that pays $500 at the end of every three years (the first

3

Question 3 part a) How much would you pay for an asset that pays $500 at the end of every three years (the first payment coming three years from today)? In other words, the asset pays $500 at years 3, 6, 9, 12, ..., and lasts forever. It pays O at other years. What is the year-10 value (i.e., future value) of this stream of cash flow? The effective annual rate is 5% (3 points) part b) Consider a machine that generates cash flow for a firm but needs costly maintenance. The annual cash-flow schedule follows a special pattern. It generates $200 when the year number is odd but -$100 when the year number is even (including year 0) due to maintenance. The entire cash flow starts at year and it lasts forever. Assuming an effective annual rate of 10%. What is the present value of this machine? (3 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started