Answered step by step

Verified Expert Solution

Question

1 Approved Answer

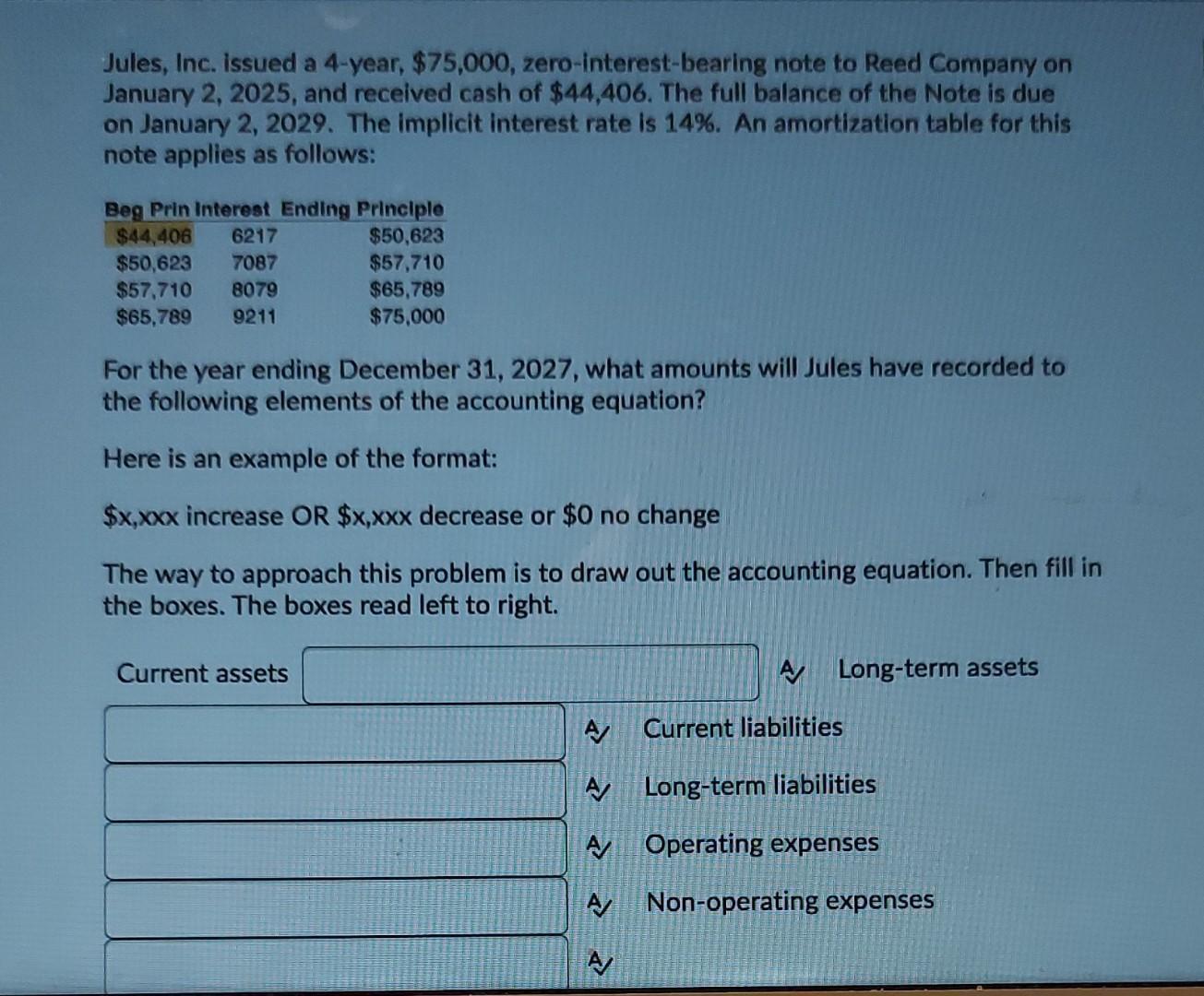

Jules, Inc. issued a 4-year, $75,000, zero-interest-bearing note to Reed Company on January 2, 2025, and received cash of $44,406. The full balance of

Jules, Inc. issued a 4-year, $75,000, zero-interest-bearing note to Reed Company on January 2, 2025, and received cash of $44,406. The full balance of the Note is due on January 2, 2029. The implicit interest rate is 14%. An amortization table for this note applies as follows: Beg Prin Interest Ending Principle $50,623 $44,406 6217 $50,623 7087 $57,710 8079 $65,789 9211 $57,710 $65,789 $75,000 For the year ending December 31, 2027, what amounts will Jules have recorded to the following elements of the accounting equation? Here is an example of the format: $x,xxx increase OR $x,xxx decrease or $0 no change The way to approach this problem is to draw out the accounting equation. Then fill in the boxes. The boxes read left to right. Current assets A A A A A/ A Long-term assets Current liabilities Long-term liabilities Operating expenses Non-operating expenses

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

For the year ending December 31 2027 Jules will have recorded t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started