Question

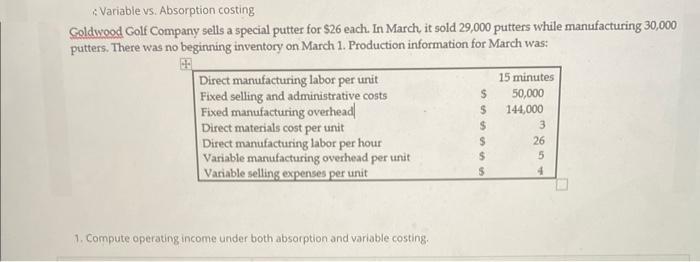

Variable vs. Absorption costing Goldwood Golf Company sells a special putter for $26 each. In March, it sold 29,000 putters while manufacturing 30,000 putters.

Variable vs. Absorption costing Goldwood Golf Company sells a special putter for $26 each. In March, it sold 29,000 putters while manufacturing 30,000 putters. There was no beginning inventory on March 1. Production information for March was: Direct manufacturing labor per unit Fixed selling and administrative costs Fixed manufacturing overhead Direct materials cost per unit Direct manufacturing labor per hour Variable manufacturing overhead per unit Variable selling expenses per unit 1. Compute operating income under both absorption and variable costing. S $ $ $ $ $ 15 minutes 50,000 144,000 3 26 5 4

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Absorption Costing Operating income Sales Revenue Total Cost Sales Revenue 2900...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Accounting A Managerial Emphasis

Authors: Horngren, Srikant Datar, George Foster, Madhav Rajan, Christ

6th Canadian edition

978-0132893534, 9780133389401, 132893533, 133389405, 978-0133392883

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App