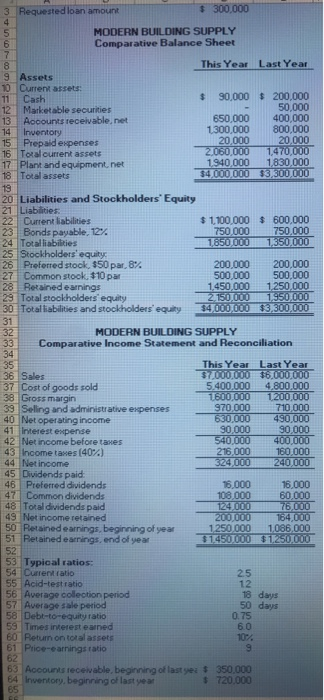

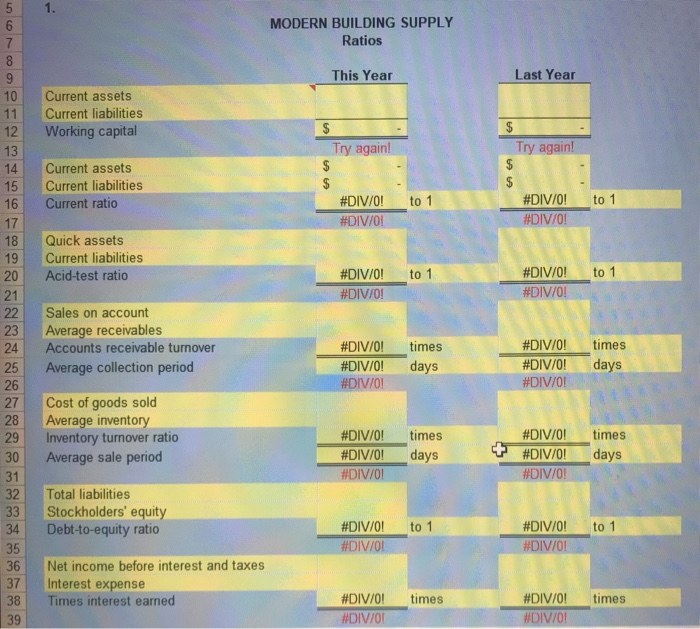

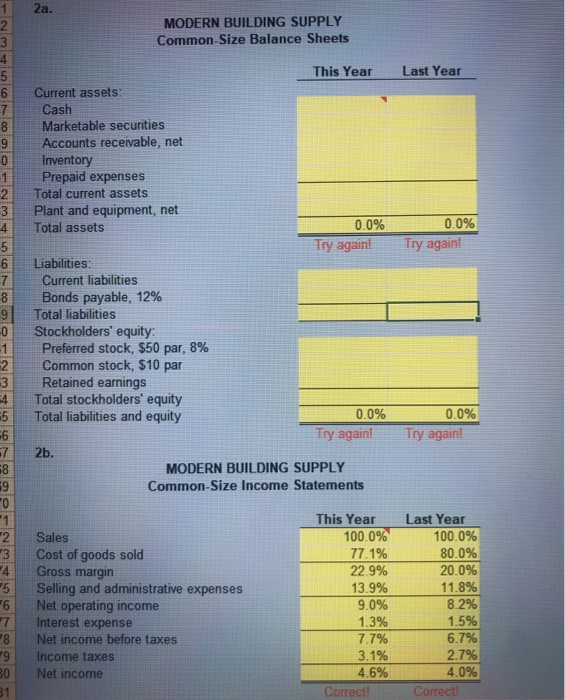

3 Requested loan amount MODERN BUILDING SUPPLY Comparative Balance Sheet This Year Last Year 9 Assets 10 Current assets 11 Cash 12 Marketable securities 13 Accounts receivable, net s 90,000 200,000 50,000 650,000 400,000 1300,000 800,000 entory 20,000 15 Prepaid expenses 16 Toal current assets 17 Plant and equipment. net 18 Total assets 13 20 Liabilities and Stockholders Equity 1940,000 1,830,000 $1100,000 600,000 750,000 750,000 22 Current liabilities 23 Bonds payable. 124 24 Totalliabilties 1350 000135000 25 Stockholders equitys 261 Preferred stock, $50 par, 8% 27 Common stook. $10 par 28 Betained eanings 23 Total stookholders equity 30 Total liabilities and stockholders' equity 31 200,000 200,000 500,000 500,000 1.450.000 1250,000 $4.000,000 $3,300,000 MODERN BUILDING SUPPLY Comparative Income Statement and Reconciliation 34 This Year Last Year 5400,000 4800,000 710,000 36 Sales 37 Cost of goods sold 38 Gross margin 39 Seling and administrative expenses 40 Net operating income 41 Interest expense 42 Net income before tanes 43 income tases (40%) 44 Net income 45 Dividends paid 46 Preferred dividends 47 Common dividends 48 Total dividends paid 49 Net income retained 50 Retained earnings, beginning of year 51 Retained earnings, end of year 970,000 90,000 540,000 400,000 216,000160,000 90,000 16,000 108,000 16,000 60,000 200,000 164,000 1250,000 1086,000 53 Typical ratios 54 Current ratio 55 Acid-test ratio 56 Average colection period 57 Average sale period 58 Debt-to-equity ratio 2.5 12 18 days 50 days 0.75 6.0 10% Times interest eaned 60 Returm on toal assets 61 Price-earnings ratio 63 Accounts receivable, beginning of last yei $ 350,000 g of last ye ar s 720,000 MODERN BUILDING SUPPLY Ratios Last Year This Year 10 Current assets 11 Current liabilities 12 Working capital 13 Try again Try again! 14 Current assets 15 Current liabilities 16 Current ratio 17 #DIV/0! #DIV/0! tol #DIV/01 #DIV/01 to 1 .. 18 Quick assets 19 Current liabilities 20 Acid-test ratio 21 22 Sales on account 23 Average receivables 24 Accounts receivable turnover 25 Average collection period 26 27 Cost of goods sold 28 Average inventory 29 Inventory turnover ratio #DIV/0! #DIV/0! tol #DIV/0! #DIV/0! to! #01V/01 #DIV/0! DIV/O! times days #DIV/0! #DIV/0! #DIV/0! times days #DIV/0! times #DIV/0! times 30 Average sale period 31 32 Total liabilities 33 Stockholders' equity 34 Debt-to-equity ratio 35 36 Net income before interest and taxes 37 Interest expense 38 Times interest earned 39 #DIV/0! #DIV/0! #DIV/01 #DIV/0! #DIV/0! to 1 to 1 #DIV/0! #DIV/01 #DIV/01 times times 1 2a. MODERN BUILDING SUPPLY Common-Size Balance Sheets This Year Last Year 6Current assets: 7Cash 8 Marketable securities 9 Accounts receivable, net 0Inventory 1 Prepaid expenses 2Total current assets 3 Plant and equipment, net 4 Total assets 0 0% 0096 Try again! fry again! 6 Liabilities: 7Current liabilities 8/ Bonds payable, 1296 9 Total liabilities 0 Stockholders' equity: Preferred stock, $50 par, 8% 2 Common stock, $10 par 3 Retained earnings 4 Total stockholders' equity 5 Total liabilities and equity 6 72b. 8 9 0.0% 0096 Try again! Try again! MODERN BUILDING SUPPLY Common-Size Income Statements This Year Last Year 2 Sales 3 Cost of goods sold 4 Gross margin 5 Selling and administrative expenses 6 Net operating income 7Interest expense 8 Net income before taxes 9 Income taxes 0 Net income 100 096 771% 22 9% 13.9% 9.0% 1.3% 7 7% 3.1% 4.6% 100.0% 80.0% 20.0% 11.8% 8.2% 6.7% 2.7% 4,0% Correct Comect