Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Scenario and sensitivity analysis Intel is currently trading at $20.50, interest rates are currently 1.2%, and 1.5 year call options on Intel with

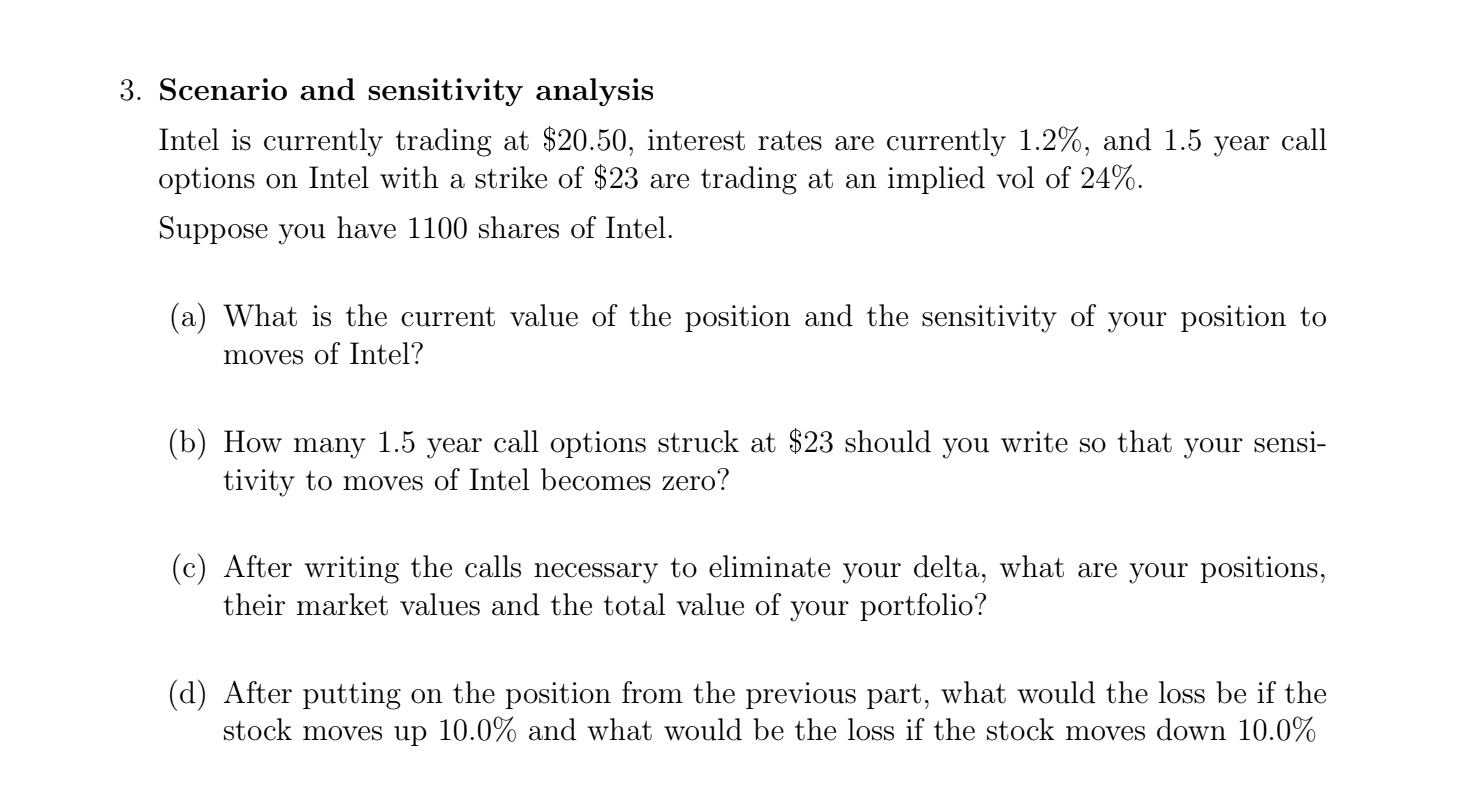

3. Scenario and sensitivity analysis Intel is currently trading at $20.50, interest rates are currently 1.2%, and 1.5 year call options on Intel with a strike of $23 are trading at an implied vol of 24%. Suppose you have 1100 shares of Intel. (a) What is the current value of the position and the sensitivity of your position to moves of Intel? (b) How many 1.5 year call options struck at $23 should you write so that your sensi- tivity to moves of Intel becomes zero? (c) After writing the calls necessary to eliminate your delta, what are your positions, their market values and the total value of your portfolio? (d) After putting on the position from the previous part, what would the loss be if the stock moves up 10.0% and what would be the loss if the stock moves down 10.0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started