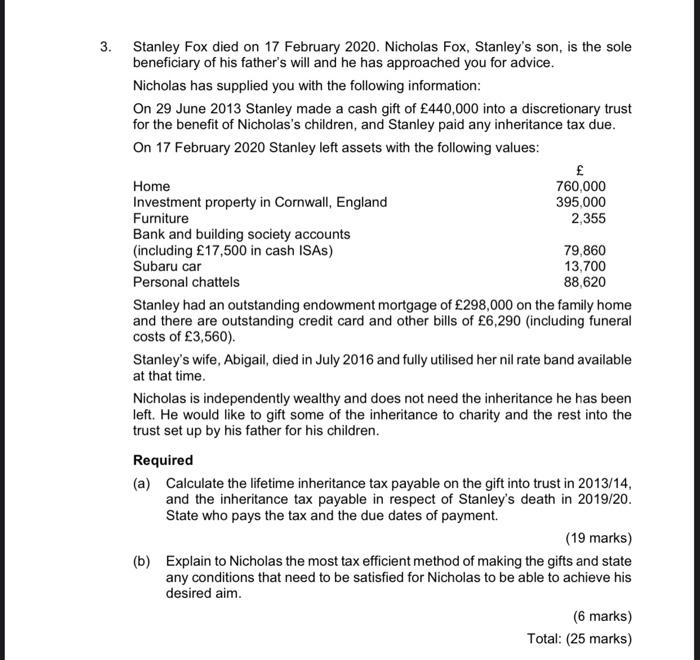

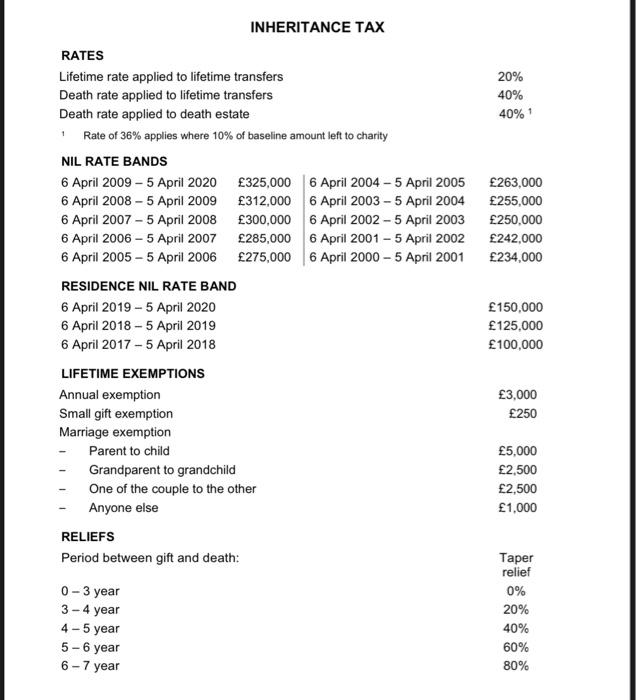

3. Stanley Fox died on 17 February 2020. Nicholas Fox, Stanley's son, is the sole beneficiary of his father's will and he has approached you for advice. Nicholas has supplied you with the following information: On 29 June 2013 Stanley made a cash gift of 440,000 into a discretionary trust for the benefit of Nicholas's children, and Stanley paid any inheritance tax due. On 17 February 2020 Stanley left assets with the following values: Home 760,000 Investment property in Cornwall, England 395,000 Furniture 2,355 Bank and building society accounts (including 17,500 in cash ISAs) 79,860 Subaru car 13,700 Personal chattels 88,620 Stanley had an outstanding endowment mortgage of 298,000 on the family home and there are outstanding credit card and other bills of 6,290 (including funeral costs of 3,560). Stanley's wife, Abigail, died in July 2016 and fully utilised her nil rate band available at that time. Nicholas is independently wealthy and does not need the inheritance he has been left. He would like to gift some of the inheritance to charity and the rest into the trust set up by his father for his children. Required (a) Calculate the lifetime inheritance tax payable on the gift into trust in 2013/14, and the inheritance tax payable in respect of Stanley's death in 2019/20. State who pays the tax and the due dates of payment. (19 marks) (b) Explain to Nicholas the most tax efficient method of making the gifts and state any conditions that need to be satisfied for Nicholas to be able to achieve his desired aim. (6 marks) Total: (25 marks) INHERITANCE TAX 20% 40% 40% 263.000 255,000 250,000 242,000 234,000 RATES Lifetime rate applied to lifetime transfers Death rate applied to lifetime transfers Death rate applied to death estate 1 Rate of 36% applies where 10% of baseline amount left to charity NIL RATE BANDS 6 April 2009 - 5 April 2020 325,000 6 April 2004 - 5 April 2005 6 April 2008 - 5 April 2009 312,000 6 April 2003 - 5 April 2004 6 April 2007 - 5 April 2008 300,000 6 April 2002-5 April 2003 6 April 2006 - 5 April 2007 285,000 6 April 2001 - 5 April 2002 6 April 2005 - 5 April 2006 275,000 6 April 2000 - 5 April 2001 RESIDENCE NIL RATE BAND 6 April 2019 - 5 April 2020 6 April 2018 - 5 April 2019 6 April 2017 - 5 April 2018 LIFETIME EXEMPTIONS Annual exemption Small gift exemption Marriage exemption Parent to child Grandparent to grandchild One of the couple to the other Anyone else RELIEFS Period between gift and death: 150,000 125,000 100,000 3,000 250 5,000 2,500 2,500 1,000 0-3 year 3-4 year 4-5 year 5-6 year 6-7 year Taper relief 0% 20% 40% 60% 80% 3. Stanley Fox died on 17 February 2020. Nicholas Fox, Stanley's son, is the sole beneficiary of his father's will and he has approached you for advice. Nicholas has supplied you with the following information: On 29 June 2013 Stanley made a cash gift of 440,000 into a discretionary trust for the benefit of Nicholas's children, and Stanley paid any inheritance tax due. On 17 February 2020 Stanley left assets with the following values: Home 760,000 Investment property in Cornwall, England 395,000 Furniture 2,355 Bank and building society accounts (including 17,500 in cash ISAs) 79,860 Subaru car 13,700 Personal chattels 88,620 Stanley had an outstanding endowment mortgage of 298,000 on the family home and there are outstanding credit card and other bills of 6,290 (including funeral costs of 3,560). Stanley's wife, Abigail, died in July 2016 and fully utilised her nil rate band available at that time. Nicholas is independently wealthy and does not need the inheritance he has been left. He would like to gift some of the inheritance to charity and the rest into the trust set up by his father for his children. Required (a) Calculate the lifetime inheritance tax payable on the gift into trust in 2013/14, and the inheritance tax payable in respect of Stanley's death in 2019/20. State who pays the tax and the due dates of payment. (19 marks) (b) Explain to Nicholas the most tax efficient method of making the gifts and state any conditions that need to be satisfied for Nicholas to be able to achieve his desired aim. (6 marks) Total: (25 marks) INHERITANCE TAX 20% 40% 40% 263.000 255,000 250,000 242,000 234,000 RATES Lifetime rate applied to lifetime transfers Death rate applied to lifetime transfers Death rate applied to death estate 1 Rate of 36% applies where 10% of baseline amount left to charity NIL RATE BANDS 6 April 2009 - 5 April 2020 325,000 6 April 2004 - 5 April 2005 6 April 2008 - 5 April 2009 312,000 6 April 2003 - 5 April 2004 6 April 2007 - 5 April 2008 300,000 6 April 2002-5 April 2003 6 April 2006 - 5 April 2007 285,000 6 April 2001 - 5 April 2002 6 April 2005 - 5 April 2006 275,000 6 April 2000 - 5 April 2001 RESIDENCE NIL RATE BAND 6 April 2019 - 5 April 2020 6 April 2018 - 5 April 2019 6 April 2017 - 5 April 2018 LIFETIME EXEMPTIONS Annual exemption Small gift exemption Marriage exemption Parent to child Grandparent to grandchild One of the couple to the other Anyone else RELIEFS Period between gift and death: 150,000 125,000 100,000 3,000 250 5,000 2,500 2,500 1,000 0-3 year 3-4 year 4-5 year 5-6 year 6-7 year Taper relief 0% 20% 40% 60% 80%