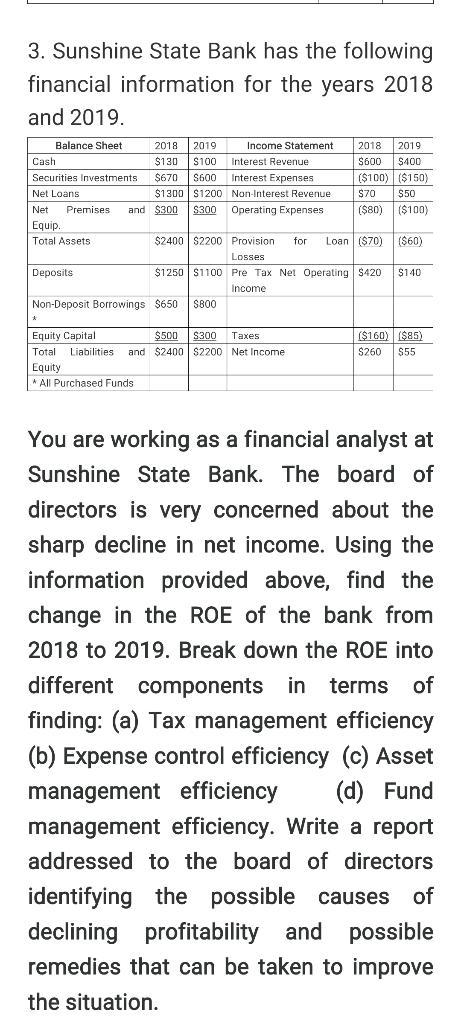

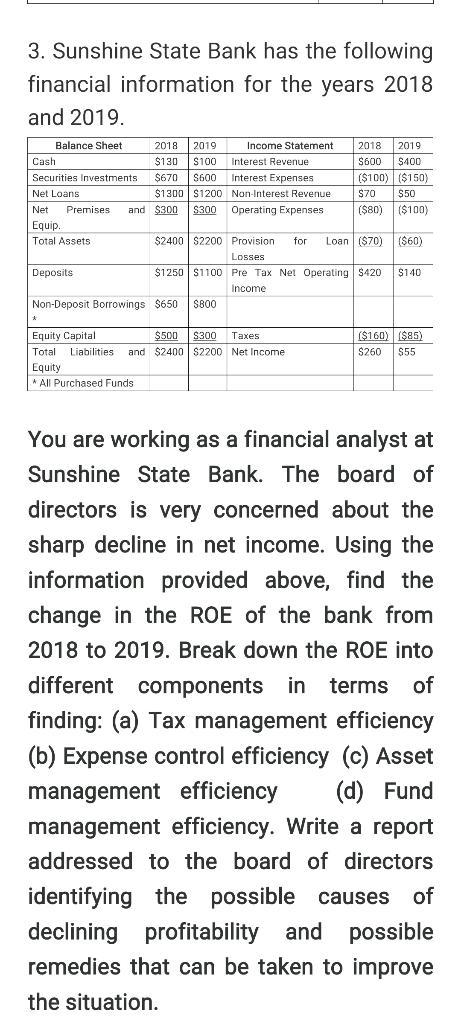

3. Sunshine State Bank has the following financial information for the years 2018 and 2019. Cash Balance Sheet 2018 2019 Income Statement $130 $100 Interest Revenue Securities Investments $670 S600 Interest Expenses Net Loans $1300 S1200 Non-Interest Revenue Net Premises and $300 S300 Operating Expenses 2018 2010 $600 $400 ($100) ($150) $70 $50 ($80) ($100) Equip ($60) Total Assets $2400 S2200 Provision for Loan ($70) Losses Deposits $1250 S1100 Pre Tax Net Operating $420 Income Non-Deposit Borrowings $650 S800 $140 Taxes Equity Capital Total Liabilities $500 S300 and $2400 S2200 Net Income ($160) $85) $260 S55 Equity * All Purchased Funds You are working as a financial analyst at Sunshine State Bank. The board of directors is very concerned about the sharp decline in net income. Using the information provided above, find the change in the ROE of the bank from 2018 to 2019. Break down the ROE into different components in terms of finding: (a) Tax management efficiency (b) Expense control efficiency (c) Asset management efficiency (d) Fund management efficiency. Write a report addressed to the board of directors identifying the possible causes of declining profitability and possible remedies that can be taken to improve the situation. 3. Sunshine State Bank has the following financial information for the years 2018 and 2019. Cash Balance Sheet 2018 2019 Income Statement $130 $100 Interest Revenue Securities Investments $670 S600 Interest Expenses Net Loans $1300 S1200 Non-Interest Revenue Net Premises and $300 S300 Operating Expenses 2018 2010 $600 $400 ($100) ($150) $70 $50 ($80) ($100) Equip ($60) Total Assets $2400 S2200 Provision for Loan ($70) Losses Deposits $1250 S1100 Pre Tax Net Operating $420 Income Non-Deposit Borrowings $650 S800 $140 Taxes Equity Capital Total Liabilities $500 S300 and $2400 S2200 Net Income ($160) $85) $260 S55 Equity * All Purchased Funds You are working as a financial analyst at Sunshine State Bank. The board of directors is very concerned about the sharp decline in net income. Using the information provided above, find the change in the ROE of the bank from 2018 to 2019. Break down the ROE into different components in terms of finding: (a) Tax management efficiency (b) Expense control efficiency (c) Asset management efficiency (d) Fund management efficiency. Write a report addressed to the board of directors identifying the possible causes of declining profitability and possible remedies that can be taken to improve the situation