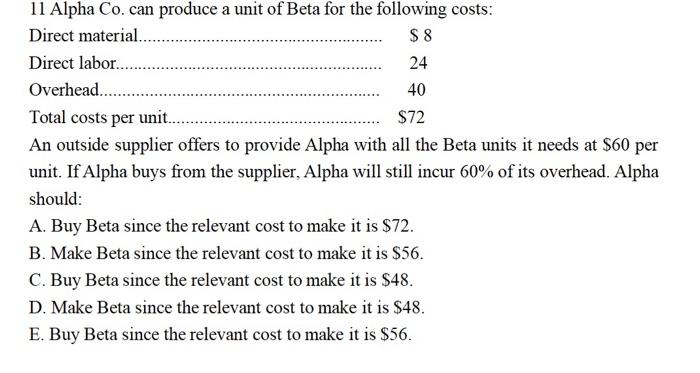

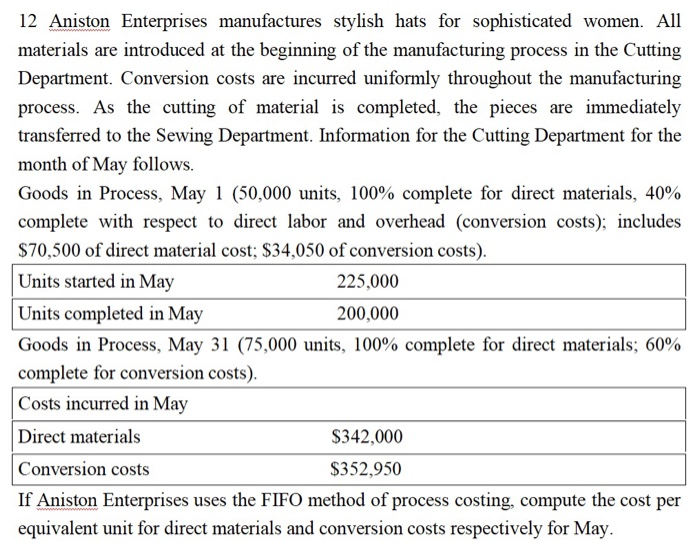

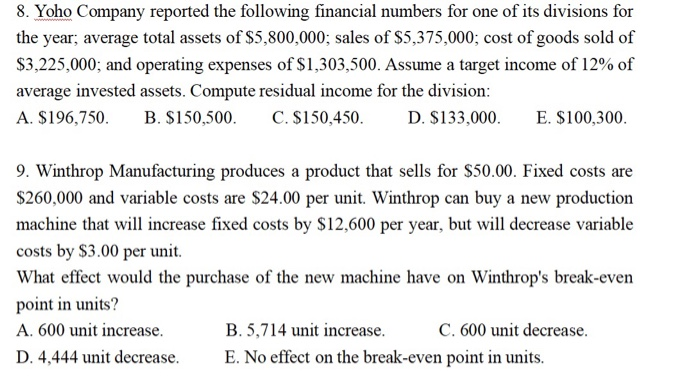

11 Alpha Co. can produce a unit of Beta for the following costs: Direct material. $ 8 Direct labor....... 24 Overhead........ 40 Total costs per unit... $72 An outside supplier offers to provide Alpha with all the Beta units it needs at $60 per unit. If Alpha buys from the supplier, Alpha will still incur 60% of its overhead. Alpha should: A. Buy Beta since the relevant cost to make it is $72. B. Make Beta since the relevant cost to make it is $56. C. Buy Beta since the relevant cost to make it is $48. D. Make Beta since the relevant cost to make it is $48. E. Buy Beta since the relevant cost to make it is $56. 12 Aniston Enterprises manufactures stylish hats for sophisticated women. All materials are introduced at the beginning of the manufacturing process in the Cutting Department. Conversion costs are incurred uniformly throughout the manufacturing process. As the cutting of material is completed, the pieces are immediately transferred to the Sewing Department. Information for the Cutting Department for the month of May follows. Goods in Process, May 1 (50,000 units, 100% complete for direct materials, 40% complete with respect to direct labor and overhead (conversion costs); includes $70,500 of direct material cost; $34,050 of conversion costs). Units started in May 225,000 Units completed in May 200,000 Goods in Process, May 31 (75,000 units, 100% complete for direct materials; 60% complete for conversion costs). Costs incurred in May Direct materials $342,000 Conversion costs $352,950 If Aniston Enterprises uses the FIFO method of process costing, compute the cost per equivalent unit for direct materials and conversion costs respectively for May. 8. Yoho Company reported the following financial numbers for one of its divisions for the year; average total assets of $5,800,000; sales of $5,375,000; cost of goods sold of $3,225,000; and operating expenses of $1,303,500. Assume a target income of 12% of average invested assets. Compute residual income for the division: A. $196,750. B. $150,500 C. $150,450 D. $133,000 E. $100,300. 9. Winthrop Manufacturing produces a product that sells for $50.00. Fixed costs are $260,000 and variable costs are $24.00 per unit. Winthrop can buy a new production machine that will increase fixed costs by $12,600 per year, but will decrease variable costs by $3.00 per unit What effect would the purchase of the new machine have on Winthrop's break-even point in units? A. 600 unit increase B. 5,714 unit increase. C. 600 unit decrease. D. 4,444 unit decrease. E. No effect on the break-even point in units