Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Suppose the columns in the matrix in question 1 describe the allocations over four asset classes [domestic bonds (DB), foreign bonds (FB), domestic

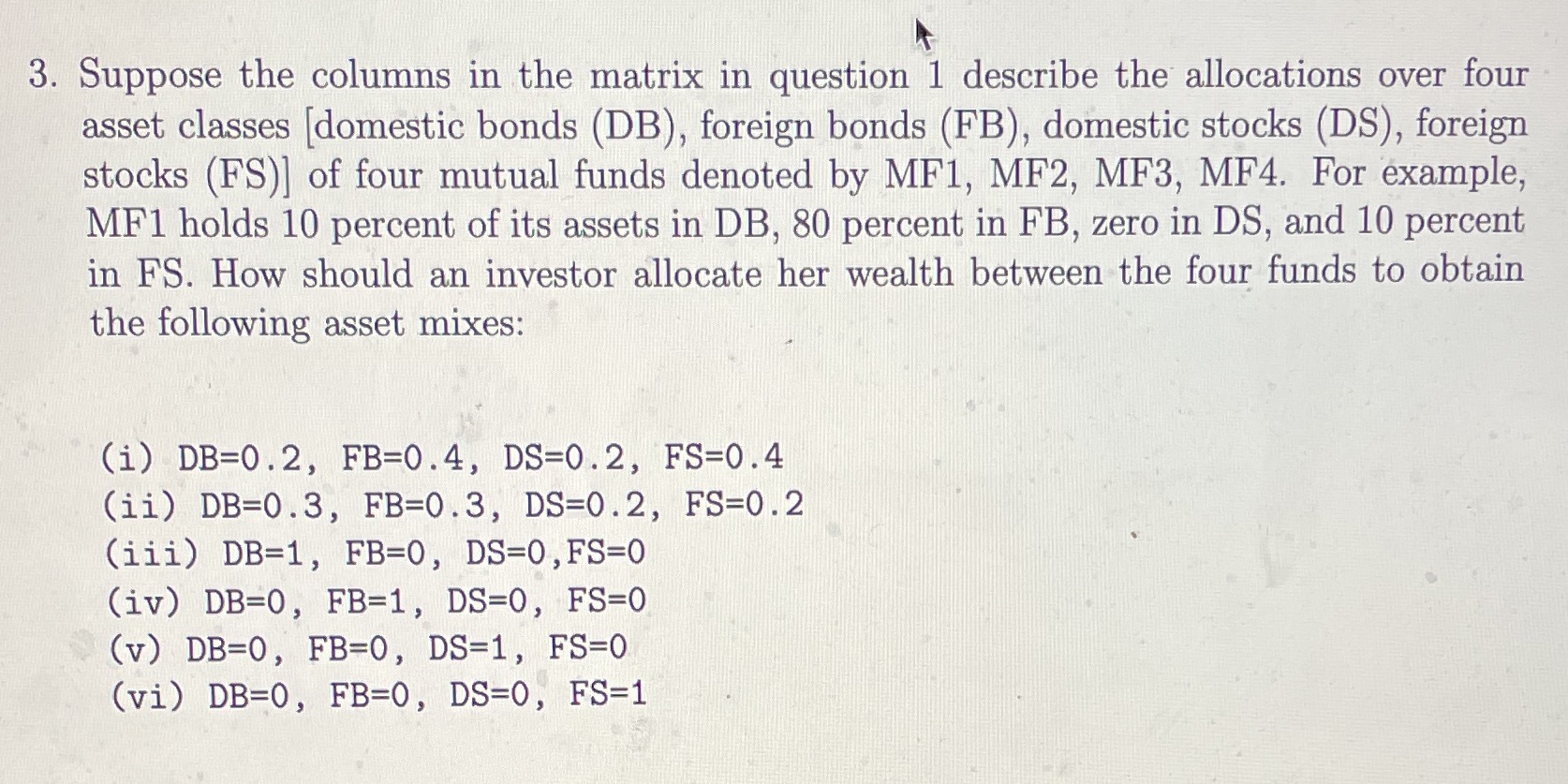

3. Suppose the columns in the matrix in question 1 describe the allocations over four asset classes [domestic bonds (DB), foreign bonds (FB), domestic stocks (DS), foreign stocks (FS)] of four mutual funds denoted by MF1, MF2, MF3, MF4. For example, MF1 holds 10 percent of its assets in DB, 80 percent in FB, zero in DS, and 10 percent in FS. How should an investor allocate her wealth between the four funds to obtain the following asset mixes: (i) DB=0.2, FB=0.4, DS=0.2, FS=0.4 (ii) DB=0.3, FB=0.3, DS=0.2, FS=0.2 (iii) DB-1, FB=0, DS=0, FS=0 (iv) DB=0, FB=1, DS=0, FS=0 (v) DB-0, FB=0, DS-1, FS=0 (vi) DB-0, FB=0, DS=0, FS=1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To obtain the desired asset mixes we need to allocate the investors wealth across the four mutual fu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started