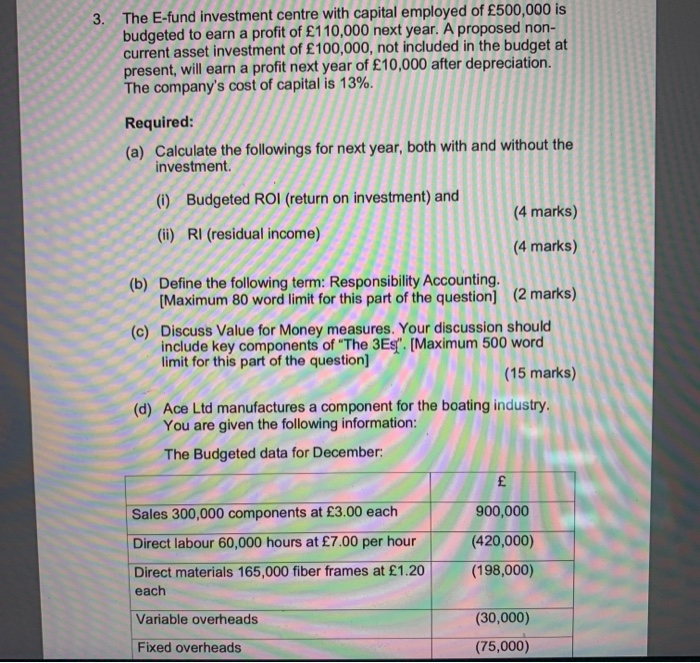

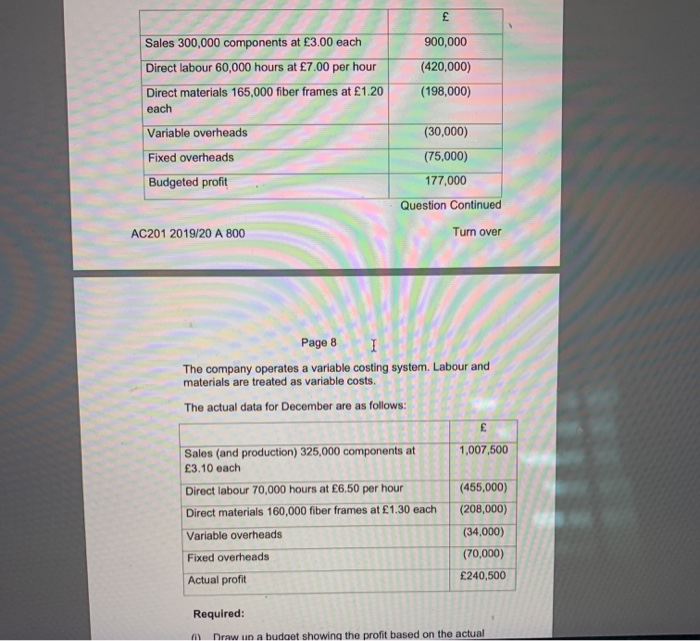

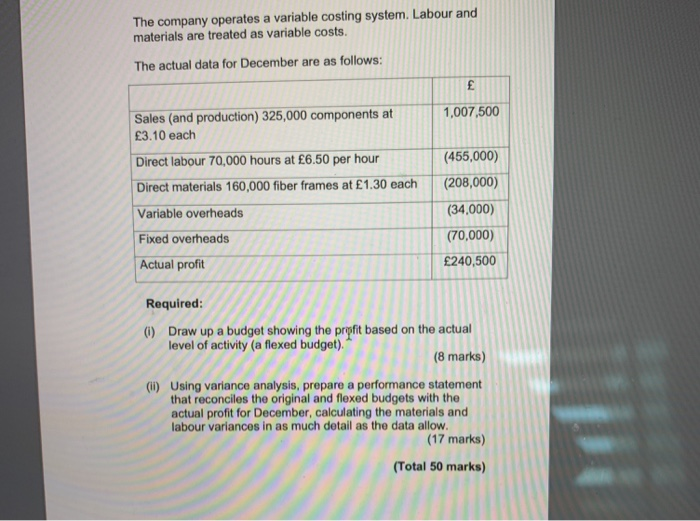

3 The E-fund investment centre with capital employed of 500,000 is budgeted to earn a profit of 110,000 next year. A proposed non- current asset investment of 100,000, not included in the budget at present, will earn a profit next year of 10,000 after depreciation. The company's cost of capital is 13%. Required: (a) Calculate the followings for next year, both with and without the investment (1) Budgeted ROI (return on investment) and (ii) RI (residual income) (4 marks) (4 marks) (b) Define the following term: Responsibility Accounting. [Maximum 80 word limit for this part of the question) (2 marks) (c) Discuss Value for Money measures. Your discussion should include key components of "The 3Est". [Maximum 500 word limit for this part of the question) (15 marks) (d) Ace Ltd manufactures a component for the boating industry. You are given the following information: The Budgeted data for December Sales 300,000 components at 3.00 each Direct labour 60,000 hours at 7.00 per hour Direct materials 165,000 fiber frames at 1.20 each Variable overheads Fixed overheads 900,000 (420,000) (198,000) (30,000) (75,000) Sales 300,000 components at 3.00 each Direct labour 60,000 hours at 7.00 per hour Direct materials 165,000 fiber frames at 1.20 each Variable overheads 900,000 (420,000) (198,000) (30,000) Fixed overheads Budgeted profit (75,000) 177,000 Question Continued AC201 2019/20 A 800 Turn over Page 8 The company operates a variable costing system. Labour and materials are treated as variable costs. The actual data for December are as follows: . 1,007,500 Sales (and production) 325,000 components at 3.10 each Direct labour 70,000 hours at 6,50 per hour Direct materials 160,000 fiber frames at 1.30 each Variable overheads Fixed overheads Actual profit (455,000) (208,000) (34.000) (70,000) 240,500 Required: f) Draw un a budaet showing the profit based on the actual The company operates a variable costing system. Labour and materials are treated as variable costs. The actual data for December are as follows: (455,000) Sales (and production) 325,000 components at 3.10 each Direct labour 70,000 hours at 6.50 per hour Direct materials 160,000 fiber frames at 1.30 each Variable overheads Fixed overheads Actual profit (208,000) (34,000) (70,000) 240,500 Required: (0) Draw up a budget showing the propfit based on the actual level of activity (a flexed budget). (8 marks) (W) Using variance analysis, prepare a performance statement that reconciles the original and flexed budgets with the actual profit for December, calculating the materials and Tabour variances in as much detail as the data allow. (17 marks) (Total 50 marks)